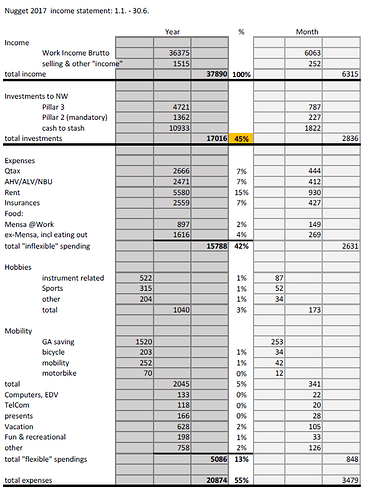

So, 30.6.2017 is done, here are my half year numbers:

I am still a PhD and will continue until well into 2018, so the big boost in salary has to wait unfortuanately ![]()

apart from that, looks like i could successfully boost my savings rate from 30% in 2016 to 45% in the first half of 2017!

whoop whoop!

the trend is clear: my inflexible spendings are almost exactly the same except for the insurances. this is due to the anticipated general increase in premiums towards 2017 for health insurances and that all my yearly premiums apply in the first half of the year.

for my variable spendings, i can proudly look on some optimizations! And to be clear on that: I am highly happy with the way I live my life, and regarding the Fun & recreational category: I was not three times happier about it last year ![]()

for those that want me to substract QTax/AHV/ALV/BU from the balance, this math trick would boost my savings rate to 52%^^

and to all who didn’t know me before, I am single around 30 with no kids and i live in a 6 person shared house in zurich, with fantastic ratio of price vs. living standard ![]()