Hello Everybody!

Because some of you were quite curious about my investing strategy and asked me for more details, I decided to create a new topic on that subject. I know that it is not a very mustachian-low-fees-etf-investing spirit, but I hope you will find it as interesting as I do.

In the literature this strategy has several names : the most usual are “Net Nets”, or also “Net Current Asset Value”, and it has been created and popularized by Benjamin Graham, the finance professor of Warren Buffet at Columbia university.

The Net Net strategy is a “Value” Strategy, which means that we always try to find out a conservative valuation of a company, and to buy it at a great discount. Hence the famous saying “I try to buy a dollar for 50 cents…”

Disclaimer : In this topic, we will talk about financial reports and documents. Although I will try to explain the main steps, if you are not at ease with these reports I strongly advise to subscribe to this free lesson on Coursera :

It should lay the basics and it will be very useful in your investing journey.

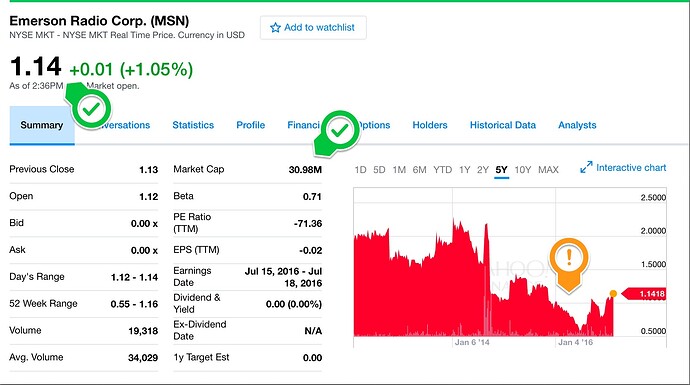

So, as I said, we will try to find a VERY conservative estimation of a valuation of a company. But in order to be more understandable, let us look at an example. Let’s go on Yahoo Finance, and look up the information about the Emerson Radio Corporation (Symbol : MSN).

http://finance.yahoo.com/quote/MSN/financials?p=MSN

What can we see? The stock price evolution has not been very great in the last years, to say the least. The stock is currently quoting at 1,14 USD, and has a market capitalization of 30,98 million USD. So this gives us an approximate number of shares of (30.98/1,14) = 27,17 millions of shares. (Note : In reality it is more close to 27,13 millions).

This leads us to the first important notion : What is a share? For a value investor, a share is really a portion of the whole company, so if you own a share of MSN, you will be the owner of 1/27M of its assets, 1/27M of its debt and so on.

So we should really try to find out what are worth these assets and debts!

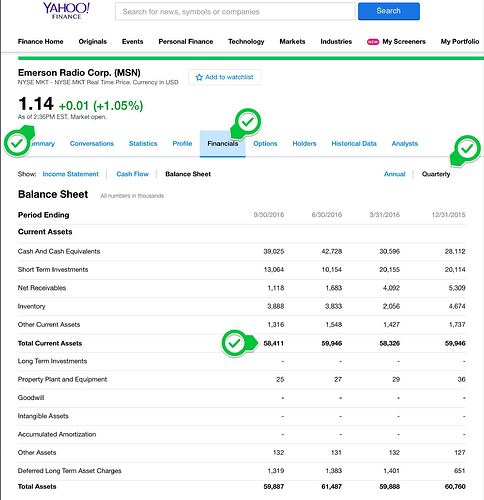

If you click on the “Financials” tab, then on “Balance Sheet”, and select the quarterly data (more up to date), you should see the following :

So at this point we should explain the most useful words :

-

Current assets are assets that can be exchanged easily for cash within 1 year. That would include :

-Cash(of course)

-Clients debt (often called “Receivable”)

-Short Term investments

-Inventory -

Long term assets are those you would not expect to exchange easily for cash within one year, for instance :

-Real estate and factories

-Machinery

-Patents -

Current Liabilities are liabilities that the company will have to pay within one year, for instance :

-Short term debt

-Employees wages

-Provisions for taxes -

Long term Liabilities are liabilities that the company will have to pay on the long term :

-Mostly long term debt

Now that the most important concepts are explained, let us go back to our strategy. What would be a very conservative estimation of MSN? Well, Benjamin Graham proposed the Net Net valuation, which is the following :

Imagine that the company goes bankrupt now. It ceases all activities. It pays the entirety of its debts. Its real estate and factories, and all of its long term assets are in such a bad condition that nobody wants to buy it.

Pretty pessimist, isn’t it?

So what would be the valuation of MSN in that case? As we said, the long term assets are worth 0, which gives us only the current assets, worth 58,411 millions USD. But we also have to pay the entirety of the debts of the company (total liabilities), so we should also subtract 2,546 millions USD. Which gives us a pretty pessimist value of 55,865 millions USD. This is what we call the “Net Net” value of the company, or the net current asset value (for “current asset value net of all debts”).

Now, remember that we have 27,13 millions shares on the market.

So in the case exposed above, the valuation of a share would be 55,865/27,17 = 2,06 USD per share.

But, wait! Haven’t we said that today the price of one share is 1,14 USD? That means that even if the very very bad situation described above was real, the shares of MSN are selling at near 50% of their value. That’s a huge discount!

It means that if the market realizes that it does not value MSN shares correctly, the stock will go up significantly! For the story, I bought this stock when it was selling at 0,67 USD.

But why is it currently so low? Well to be honest, this company is far to be a great company. In the near past it had repetitive losses, and investors got very pessimistic about it. So pessimistic that they sold in excess their shares, putting the valuation of the stock way below where it should be.

Now the next question is : how do I know it will recover, and when?

Well I don’t. I just have the intuition that if I bought 1 dollar worth asset for 50 cents, something good might happen. But i never know when. In my past experience, the recovery can happen quite quickly or very slowly. That’s why when I invest in such a stock, i have a 5 years horizon, and i diversify my portfolio. I try to have at least 15-20 Net Net stocks, and from time to time, one of them wakes up with a nice 50-100% while the others stay quiet. For instance, I bought GRVY at 4,32 USD in July 2016 and sold when it skyrocketed to 15 USD in November, but i also bought RBCN and so far the stock did not do anything, except going a little bit lower… That is why it is important to diversify among at least 15-20 stocks.

Historically, this strategy has been quite prolific. In his book Deep Value , Tobias Carlisle says that it returned 28% annually since the times of Benjamin Graham. This is surely very (too much) optimistic and I could not verify it, but so far I stand at +23% for 2016.

Another belgian value investing club, Les Daubasses, are using a similar strategy and claim average annual returns of 33% annually (with excellent years as well as years of underperformance).

So what is exactly the critera for buying a Net Net stock?

The most used one is :

Buy if stock price < 67% * (Current Assets - Total Liabilities).

If you want to be even more conservative, a criteria I like, especially when I don’t know many about the company(ex : Japanese market), is :

Buy if stock price < 67% * (Cash +0.9*Receivables +0.5 * Inventory - Total Liabilities). It assumes that the company won’t be able to sell half of its inventory and will not recover all the money its client are owing to the company.

Is this criteria Sufficient?

No! Even if you find companies meeting these criterias, there are companies i filter out directly :

-Companies from continental China : unfortunately, many investors suffered great losses with them because they use to cheat with their reports in the past. Note I said “continental” China, so i keep companies from Taiwan, Hong Kong and Macau.

-Companies that don’t sell anything so far : this is usually the case of a lot of bio-pharma companies. If they don’t sell anything, you can imagine the rate at which they will burn their current assets!

-Companies who had issues recently with integrity of their financial reporting. If a company announces that it will reexamine its results for past years, avoid it like the plague. You need trust in the reports for this strategy.

Last question : it seems to be a very manual process. What if you don’t want to lose a lot of time while looking through all these reports?

Well, at least for the US markets i have good news : if you know a little bit how to code a simple program, there are existing tools that should make your task easier :

-First, you can find the list of all the stocks listed on the US markets (NYSE, NASDAQ, AMEX)in excel sheets here :

http://www.nasdaq.com/screening/company-list.aspx

-Then, Yahoo Finance has an API which will give you, for each stock, at least its price, market cap and number of shares. Here is how you could use it :

-Finally, and this is the most beautiful, the SEC (Security Exchange Commission, the police of US markets), also has an API where you can query all the financial reports in a XML or JSON format. This is very powerful! Here is the documentation :

http://developer.edgar-online.com/docs

So with these three resources, you should be able to develop a tool that scans every stock and apply the net net criteria to know if you should buy it, automatically and in less than five minutes.

For other markets, it is unfortunately not as easy. The best I can advice is to look for a stock screener that will preselect stocks with a criteria close enough to our strategy, which will allow us to refine manually the results afterwards. Personally I like this one, which has a one month free trial period and has already the net net criteria :

Well, that is all for today, I hope you enjoyed this post!

And of course, obvious legal disclaimer : What i exposed is just my strategy and I am not advising you to do the same. I explain what I do and why I do it, and not why you should do it. I shall not be responsible nor liable for any money you would lose after reading this post.

I find that calculating the real return is not so easy.

I find that calculating the real return is not so easy.