Did you activate it in neon app before? Or maybe you have to use it one time physically before adding to Google pay.

Adding to Google Pay worked for me after activating the card in the Neon app. Never put it into a ATM (but I should to change the PIN).

It turned out it was a problem on Google side, I was able to resolve it with the Google’s customer service. Apparently the card triggered some anti-fraud mechanisms ![]()

The support told me that I have to activate and use it at least once before adding it to my Google Pay.

Really disappointed from the global situation. They pretend to be a traveler card. I’m aboard for a few months and use the card on daily basis. I contacted them to postpone the change for me and they said it was not possible. That’s when they gave me the instruction to add it in Google Pay.

But now, I’m not able to take out money anymore and rely back to my UBS for that.

This is why I will probably keep my account with a real bank that don’t pull stuff like that from nowhere…

I added the new card in Google pay without ever using it (physically) before. I used it once online though, maybe that is enough or the support is wrong.

Hi guys, coming from a parallel where we’ve been forsaken by PostFinance as they’ve turned off their spend categorization engine lately.

thread Postfinance discontinues e-cockpit - #30 by user137

Can you please elaborate if the categorization feature in Neon is any good, maybe even with some screenshots?

My plan is to migrate our family finances to Neon (2 people) where I’d like to keep about 40 different categories of spend (in about main 10 buckets and 4 subcategories each). It would also be nice to be able to export this data either automatically or manually via customer service (once a year).

How long back is the data available?

Additional requirements which I think all work:

- redirect eBills and LSV contracts

- TWINT

- Saving the Mastercard into both our ApplePay Wallets so we can spend both off the same account

Any quirks so far?

Thanks in advance!

that card is admittedly for “powering green energies” and “offsetting your CO2 balance”, so that’s the offer. Your grandkids might live.

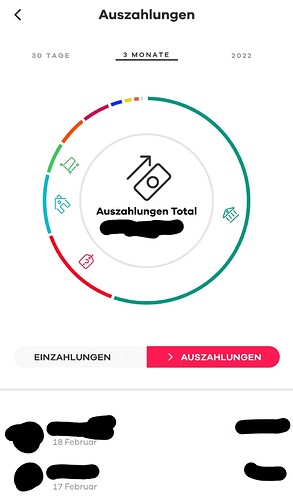

This is how it looks like, no way of creating your own categories, only those twelve to choose from. Most of the assigments work on their own, but you can move every transaction to another category. Hope this helps. ![]()

And bank statements can be exported as pdf and csv, but the categorisation is not included in the export.

Hey thanks a lot! it’s weak, but it’s free, I guess… where would you put Childcare here, for instance?

Does it auto-categorize if you, let’s say, buy petrol at a gas station?

And if I see it correctly, there is no option to choose your own months, just 30days-3m-YTD?

Does someone have experience with UBS on the same feature?

You can also select individual months (swipe left/right), and it is more interactive than the screenshots show: if you select one category in the top, it shows all corresponding transactions in the list below.

Buying petrol usually gets its right slot, just as buying something at Coop/Migros/Lidl, but I don’t think it is actually “smart” and learns from manual selection in the past (not sure about that though).

The predefined categories are somewhat useless, but I am also not really using the feature, as we are using a slightly hacky telegram bot together with IFTTT and google sheets. ![]()

With the last feature of spaces, I was planning to finally migrate from UBS to Neon.

But today, I found this post on Linkedin:

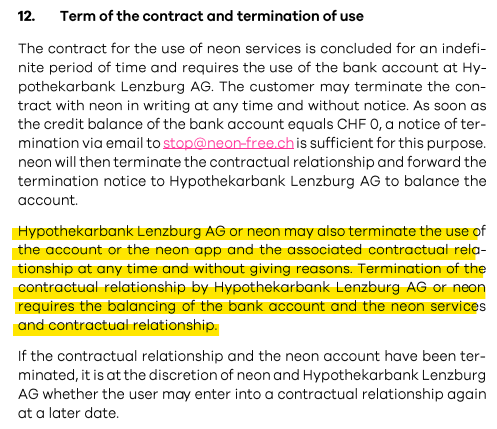

Do you know if that possible to happen with Neon as well ? Do they even have the right to do that ?

My plan was to migrate all my cash (50k), so I’m not going to take the risk that one day an algorithm decide to close it for whatever reason.

N26 is a hipster startup in Berlin which, personally, I wouldn’t touch with a ten-feet pole. It’s not the first time this company fucks up, and I’m not at all surprised to read the story you linked above.

Neon is backed by Hypothekarbank Lenzburg, and your funds should be safe up to 100k. From what I’ve seen so far, neon is doing pretty well. Can it also happen for neon? Yes, there’s always a possibility. Do they have the right to do it? Most probably not, but going to court takes ages.

I have different other accounts available if neon should, for whatever reason, freeze my account. 50k is a lot of money, and I wouldn’t be comfortable holding that much money in an app-only account.

Same thing happens to a high number of guys at Revolut.

If my cash is blocked, then I would rather choose to be in CH where I know the law (more or less ;D ).

But I think as well, that neon is relatively safe.

15.- per month. Thanks, but not interested…

Yes, probably for the most of us not interesting. But definitely much much cheaper than other cards with the same services.

Moreover, the biggest bummer would be, if the metal card gets sucked in the ATM abroad (I know that from Amex Platinum, but no clue about neon). The metal card of Amex is too smooth and hasn’t a very good grip in the machine.

Nevertheless, I hope a lot of guys are setting up the metal version to finance neon a bit ![]()

Yes, good point. Neon also states for several services (e.g. for travel insurance):

Check with your health and accident insurance first - if you’re not covered, the search, rescue and transport insurance comes into play.

Therefore, one should probably check what kind of insurances are already available. Personally I think, I am overinsured like a buch other people, but I am reducing it (or at least I intent to do it soon).

I red, that neon is in the making regarding the joint account. But this is also something I am looking forward to it. They just launched “Spaces” which works analoge to Zak; so there is no additional IBAN for a savings account, there is the same IBAN but virtually divided in various savings account. Please correct me, if I am wrong.

With the cashback cards you won’t have any insurances but again the topic: are they really needed? This is also why I will stay with the free version of Neon and do the fx things with it ![]()

For the same price I’d rather get Neon than revolut.