I hold VTI, VEU, VWO and VSS atm. I have fixed ratios between the funds. I underweigh VTI with 35% atm as I feel uncomfortable with the historically very high multiples. This probably is not perfectly mustachian.

If you choose the correct ratio from the start, you will not have to rebalance. By buying 56% VTI and 44% VXUS, you basically replicate the VT, so it will, within a margin of error, stay the same.

And a market weighted ratio is not a guarantee of best long-term return. It just has a nice feature of auto-rebalancing itself so the maintenance costs are low. If you went 100% USA 5 years ago, you would have made a much better return than with VT. It’s hard to say what will do better. If your allocation is not exactly market weighted, you slightly overweigh some market, so you place a bet on that market, that it will do better than the rest.

But what is the correct ratio?

I think when VT launched, the US part was 49% (I could be wrong, but lets assume it’s true)

So I would have invested 49% VTI and 51% VXUS, now in hindsight, this would have done worse than going with VT.

My assumtion is for the exUS percentage in VT to increase, this exUS part has to do better that the US part. Is this somewhat true, or completely wrong?

The correct ratio is the current ratio.

Look, it’s like this. Imagine you start with US being worth 100 and exUS as well 100. So the ratio is 50:50. Now US goes up to 150, while exUS stays at 100. The ratio is now 60:40. But this ratio has changed for both the VT and the individual ETFs. You don’t need to rebalance anything, because your US ETF is now worth 150. I mean… how else can I explain this that you understand?

I see what you mean now, thanks for that!

I was too focused on how to divide my monthly investment amount, but didn’t consider the actual stache growing accordingly

Indeed, I’m also not so happy with that, but the only alternative for one stop shop MSCI World Small Caps is the iShares MSCI World Small Cap UCITS ETF which has a TER of of 0.35%, and is not traded on SIX in CHF and also has securities lending.

Were I investing on IB, I’d probably go with a mix of VSS + VTWO for small caps, but well … I’m not.

Lets say that you are investing every month with a certain desired portfolio value.

Month 1:

Desired portfolio value: 8,000 CHF

Then, as per current weight in VT, I would buy 56% of VTI , i.e. 4,480 CHF and the rest (44%) allocated to VXUS.

Month 2:

Desired portfolio value is 16,000 CHF

In month 2, the weight of US in VT is 54% and ex-US is 46%

Which means that out of your target portfolio value of 16,000 CHF, VTI should be 8,640 CHF and the rest (46%) should be VXUS (as per the weightings in VT in month 2).

Then, in month 2, I would take the current portfolio market value on the day of investment, look at the target desired portfolio value keeping 16,000 CHF in mind and then accordingly purchase the VTI and VXUS units (taking into account transaction fees) such that the total holding of VTI becomes 8,640 CHF and the rest goes to VXUS, i.e. 7,360 CHF.

Is this the right way to go about doing your monthly purchases, or am I overly complicating things?

Would appreciate any feedback or criticism. Thanks!

You should always buy according to the current ratio. It just so happens, that once you calculate the number of shares you should buy, it should stay roughly the same.

Let’s say that one share of VTI costs 200 and one share of VXUS costs 100. Their market share is 50/50 and you want to spend 2000. So you buy 5 shares of VTI and 10 shares of VXUS. In future, if you buy the same number of shares, you should more or less keep the correct ratio. I say more or less, because of dividends, for example.

You only need to rebalance if you wish to keep a fixed ratio, e.g. 50/50.

Thanks a lot guys for spending the time to write the answer and the great explanations.

Based on your comment above I am finally of the opinion to focus on VWRL in CHF unhedged as a « hassle free » solution. I really would like to make it as easy as possible for me to manage. Sorry again for these basic questions but a few area remain a little unclear to me despite having read this forum a lot.

1- what should be the decision criteria between VWRL and VR? I understand VT includes also some small caps and therefore Glinda portfolio is well thought through since the first 2 ETFs would tend to reciprocicate VT. What are your views on that? Is VWRL+small caps better than VT alone from a tax perspective (or the difficulty of doing tax declaration) ? I kind of like this portfolio and selling my VUSA to invest for world small caps and mirror VR that way seem also tempting.

2- not sure I full grasped your answer regarding VUSA (CHF). Is there a tax difference with VWRL despite the fact that they are both hosted in IE ? From which perspective is it harder to handle or not as nice VWRL ? Apologies if I misunderstood you.

3- i liked your explanations about rebalancing. However… it may still be a little unclear to me. Let’s take Glinda’s example again. Let’s say you have 100kCHF invested as follows on day 1 of investment (70k/20k/10k). I see that rebalancing is ensuring on day 2 of investment that you keep the same % split for the 3 values either by selling the performing ones or adding some money to the lower performing ones. Am I right ?

Sure, do it. It’s definitely not a bad choice if you don’t want to learn about investing in US ETFs.

Well I would say the criteria would be based on your domicile. If you are planning to be domiciled in Switzerland for years to come, then it’s fine to use the US ETFs. The Irish ETFs are meant for people domiciled in a country without a favourable deal with the US, or maybe for people who use a broker without cheap exchange of currency to USD.

Well, US funds are better than the Irish funds from a tax perspective (for Swiss residents). So VT is better than any combination of the Irish funds.

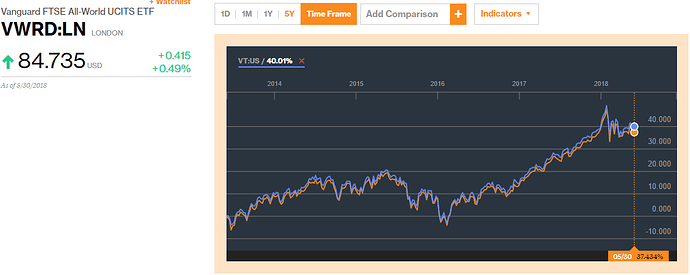

Also, the small caps don’t really make a big difference. The have a really small total market cap plus their return curve mimics the large and medium caps. Here’s a demonstration:

If you go for VWRL instead of VT, you will probably lose (per year) around 0.3% on tax, 0.2% on other hidden things, so maybe 0.5% in total.

What I mean is, if your money is stuck with a Swiss broker (CT, Swissquote, PF), you don’t necessarily have to close your account. You could buy VFEM (Emerging markets) or VEUR (Developed Europe) instead. If you own VUSA, then Vanguard has to pay 15% withholding tax to the USA for the dividend, which is 2% of the portfolio. This means that 0.3% of the portfolio is lost. If you, however, own VOO, you can get a refund from the Swiss tax office. If your portfolio is worth 100’000, that’s like 300 CHF extra money each year. sure, in the first year it takes a lot of time to understand it and learn it, but in the following year it should cost you maybe 10 minutes of your time.

And if you invest in VFEM or VEUR, there is no easy tax to reclaim, so theoretically no potential loss.

Yes, if you want to keep a fixed ratio of A and B (let’s say 50% / 50%), then if A is outperforming B, then you will need to sell some A and buy some B to bring it back to 50%. However, this does not apply to replicating VT, because there the ratio between US and exUS is NOT fixed! So once you replicate the fund, it should roughly keep the right proportions.

If you look at longer term returns, the Small caps do better than all world.

Look at MSCI Small Caps here

https://www.msci.com/documents/10199/a67b0d43-0289-4bce-8499-0c102eaa8399

and MSCI World here

https://www.msci.com/documents/10199/178e6643-6ae6-47b9-82be-e1fc565ededb

These graphs trace back to 2003. This is also the reason my portfolio is overweight on Small Caps.

Basically, Small caps offered the same returns as MSCI Emerging Markets but without the crazy volatility. VWRL follows the FTSE Index, so includes 10% of EM.

VFEM (in CHF on SIX) may be a good option to add more weight to EM.

Another option would be the new XMME Xtrackers MSCI Emerging Markets UCITS ETF 1C which also trades on SIX in CHF, has a TER of 0.20% and apparently slightly better returns than VFEM. In this scenario, I would take the CBMWOR ComStage MSCI World TRN UCITS ETF as base, as it also trades on SIX in CHF and has a TER of 0.20%. Then adjust the proportion of MSCI World to MSCI EM as required.

Indeed they do. You don’t even need to supply the second link, because it’s already visible on the first chart. The ACWI IMI is the all country world investable markets index. That covers like 99% of all publicly traded stock. So it also includes small caps. What I meant to say is that Small Caps has a market cap of 6 billion USD, whereas ACWI IMI has 53 billion. So small caps have a share of only 10% of ACWI IMI or VT, plus they give a return that looks like an amplified version of the large and medium caps. This means that in the end the difference between VT and VWRL is very small.

But of course, if you decide to overweigh small caps, like you did (20% instead of 10%), then it’s a different story.

That’s true, it looks impressive. But if you look at what happened to small caps in 2008, you will see they dropped down to the level of ACWI. I’m curious to see what will happen to them during the next big crisis. I dare say they will get hit by it in a greater way than large caps. You get nice growth during bull market, but also big drops during bear.

You don’t need to get crazy at digits and rebalance every month, you can simply adjust ratios every 3/6 months buying more (or less) shares of one of the two ETFs

Thanks @Bojack I think your last paragraph provided a key pointer.

If one wants to maintain a pre-defined fixed portfolio weight, say for e.g. VTI 50%, VXUS 40% and BND 10%, then it is required to do rebalancing every month when the fixed sum investment is made (taking into account existing market value). Maybe the term “fixed sum investment” wouldn’t be appropriate as one is essentially then doing dollar value averaging to keep the pre-defined weight same (?).

If one wants to simply replicate VT, then the important thing is to get the starting ratio correct in the initial gross investment (for e.g. VTI 56% and VXUS 44%) and then the portfolio will rebalance on its own (?).

I guess this is what it boils down to. I am still a bit confused on how the monthly investments will work out. For e.g. after the initial ratio is set and one wants to invest a fixed amount (say 8,000 CHF) every month, does one just buy 4,000 CHF worth of VTI and 4,000 CHF worth of VXUS?

Please excuse me if this query sounds overly simplistic. I am really interested in learning these core basics from the wealth of experience and knowledge here. Thanks!

required? no, I think not. My 6-fund-world-portfolio is free floating since the beginning of the year as i am currently saving cash for later expenses, instead of investing it. after 6 months, the largest deviations are VXF (USexSP500) with +0.74% and VWO (EmMa) with -0.79% from the intended allocation.

If you invest your money every month, you will hardly see such deviation.

you should have a rock solid, strong reasoning to not just buy VT. I don’t see one, but that doesn’t mean there is none. TERs for example, but that’s quit minor in thos low-TER regions

i made a google sheet to answer this question. make yourself a copy, put in the tickers and allocation you want and play with it. it tells you exactly where to put your money each month.

And I very much agree with what you wrote here. I should add that the very popular SMIM seems to correlate very well with the MSCI EMU Small Cap Index, so there could be some painful moments there as well.

https://www.msci.com/documents/10199/51473645-5d10-4e45-bf60-c51cff530f69

you should have a rock solid, strong reasoning to not just buy VT. I don’t see one, but that doesn’t mean there is none

@Joey has linked to a very nice post by @lupo:

In short lower costs and better diversification but let me copy & past the answer given by the famous boglehead Taylor Larimore in this post . Usually lower Fund/ETF Expense Ratios: Total Stock Market (VTSAX & VT) = .05%; Total International (VTIAX & VXUS) = .11%; Total World (VTWSX = .21%; VT = 0.11%). Lower Turnover (hidden cost): Total Stock Market = 4.0%; Total International = 3.1%; Total World = 14.8% Tax Efficiency (5 years): Total Stock Market =.56; Total International = 1.09; Total W…

Who in turn linked to a post by Taylor Larimore:

https://www.bogleheads.org/forum/viewtopic.php?t=88005#p1263932

To recap, avantages of VTI+VXUS vs VT:

- lower TER

- lower turnover

- deeper market penetration (some 2’000 stocks more)

- flexibity (ability to overweigh or underweigh USA)

You know, maybe in the end all these sum up to something like 0.2% difference. So for portfolios under 100k it’s just pennies. But for larger portfolios I would say it makes sense. It definitely makes more sense for Americans, because they are better off being able to overweigh USA.

0.2% difference over 20 years investing are seldom pennies - accrued interest is working against the investor

With such low values as 0.1% or 0.2% you can forget about compounding.

0.1% off an initial 100’000 CHF gives 100 CHF every year, 2000 over 20 years. And compounded its 2019

We are talking about pennies here. Let’s not get distracted from the main points: saving money and investing it! This makes a huge difference compared to choosing Irish or American ETFs, or not rebalancing, or other “first world problems”

We are talking about pennies here

When not aware of the power of compounded interest, I would be more humble giving advice.

Let’s assume an investment of

100’000 without further savings/investments

200 is the price per year of TER 0.2% difference for this sum.

Historically, a return of 8% was realistical for investing in shares. The return (200) is invested annually.

This gives 475’900 in total after 20 years.

Without the 200 we have 466’000.

The difference is 9900 in Francs.

This equals 990’000 in Franc-Pennies (Rappen).

This is, of course, without cost but also without further investing.

Please correct me, should I have made a mistake.