The easier would be to buy VT (Vanguard Total World Stock ETF) with IB

is there any conflicting issue with regard to

?

Segregation is required in UK as well AFAIK

IB’s money is supposed to be segregated from clients’ money and securities, so that the firm’s creditors wouldn’t be able to reach clients’ assets.

Indeed, if IB goes bankrupt, ETFs are segregated under your name. But for cash, situation is a bit less clear: cash is considered as “invested” - not kept in a vault (as ETF).

Like a lot of US brokers, IB is a member of SIPC: cash is insured up to USD 500k.

For us, what matters is the limit of FSCS insurance for IB UK: 85.000 GBP.

It’s even lower than that, cash for investment purposes should be covered by FSCS only up to 50’000 GBP.

SIPC covers cash up to 250k USD, but there’s the big question whether the cash is in US - if it’s not specifically on the books of US based IB subsidiary, SIPC does not cover it

Better keep cash in your swiss bank

Yes but as a swiss resident you’re only dealing with IB UK, who is not a member of SIPC

Hedgehog is right.

For more info have a look a t: https://ibkr.info/node/2016 under Customer Protection and https://ibkr.info/node/2012

Schwab is also handling Swiss clients through Schwaab UK.

Have someone an exemple of a US based broker who offers SIPC to their european customers?

As mentionned by Hedgehog in another post: the Swiss proctection (esisuisse) doesn’t cover securities.However, in Switzerland, the stocks are registered under your name and can not be liquidated. Don’t know if it’s the same in UK and US.For IB, based on this “Client money is ring-fenced in separate bank accounts which are held in trust on behalf of the clients”. Securities seem to be under IB name.

Have a look at: https://www.esisuisse.ch/en/faq?set_language=en under “Are securities in securities accounts protected or preferential?”

That’s what I read on another forum. That in Europe the stocks are owned by the client, so you should not worry about your broker going bankrupt. Whereas in USA they are owned by the broker, so you need this SIPC protection. If this would be the case, then I guess this is one benefit of holding your stocks with a Swiss broker?

For me this sentence from IB is not clear “Client money is ring-fenced in separate bank accounts which are held in trust on behalf of the clients” The term behalf dosn’t mean under client’s name or does it ?

I just got again the confirmation from IB, the custodian for IB UK is IB LLC and hence it’s the SIPC which applies.

In a typical IB style:

If the client reads the contract they would see the language that IB UK uses IB LLC as carrying broker. Also on their daily statement, under footnote, it says the assets of IB UK clients are carried by IB LLC.

Note the only variation is for products carried by IB UK, which are all CFDs, UK metals, and some European index options.

Using the term “on behalf” seems to imply that it is not in the name of the client.

Guys,

in case someone is interested: following ETFs were added to ICTax (Kursliste) upon my request.

-

Vanguard Mid-Cap Value ETF (VOE)

-

Vanguard Mid-Cap ETF (VO)

-

Vanguard Mega Cap Growth ETF (MGK)

-

Vanguard Large-Cap ETF (VV)

-

Vanguard Value ETF (VTV)

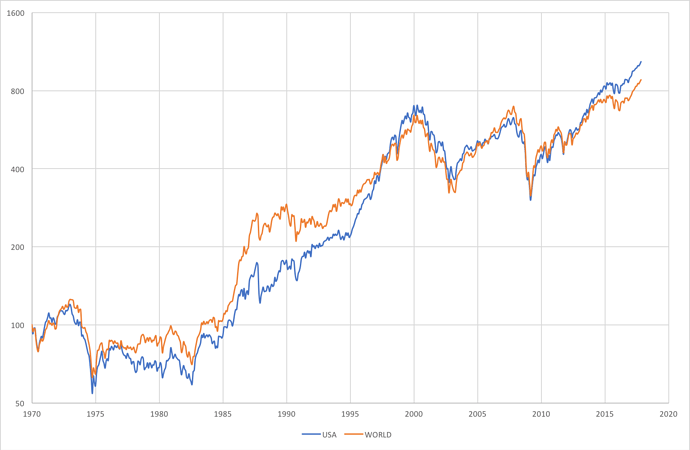

Hey guys I’ve been playing with excel and I just wanted to share a chart I prepared. I took the data from MSCI: net total return of MSCI World and MSCI USA. Then I applied monthly inflation stats from BLS.

When looking at the whole period from 1970, MSCI USA has had a 5% real return. If you skip the 70s, the return bumps up to 7%. The chart is scaled logarithmically (base 2). Exponential growth in such a scale looks like a straight line. If you’re looking for deviations from the trend, then year 2000 was a real peak of the bubble.

Thanks for the chart, Have you apply worldwide inflation or U.S inflation ?

I was using the US CPI from BLS (Bureau of Labor Statistics). My understanding was that if the index is expressed in USD, then in order to convert the USD nominal value to real value, we would use the US CPI.

I don’t know if using global inflation would make much sense, but it’s a good question.

This is the stock portfolio which I am aiming for at the moment (then there’s some cash, 2nd/3rd pillars, and a house ):

45% EUR large cap IMAE

15% EUR small cap DX2J

30% US large cap (http://www.etf.com/VOO)

10% US small cap (http://www.etf.com/VIOO)

To be honest, I am not very sure about it, so your comments are very very appreciated.

Goal is buy and hold to grow the capital and hopefully retire before the standard >65.

I am looking to have a large sum invested in EUR, as I will be living on this part of the world, that is why I have picked the european funds (though they contain also stuff in GBP and CHF), but they have rather high costs (up to 0.4%) and I am looking for alternatives.

Hello,

I’m studying to implement a similar portfolio that the original Mr MP one (MP’s 3 fund portfolio) but I already have a doubt about the first selected instrument for 55% allocation, the Vanguard Total WORLD stock ETF (correct me if I got it wrong but should be ISIN US9220427424, right?): I can see it’s not really following any obvious index… the S&P500 for instance not at all… so in my view it’s quite under-performing and that increasingly since years… is that known? is there some reason why this would be anyway still better than for instance the other VANGUARD S&P 500 ETF (US9229083632) ?? It’s cheaper than this last one? It’s more trusted?

Maybe I missed something here…

Thanks in advance,

tent

What do you mean, it’s following FTSE All-World, one of the most obvious to follow.

Since a couple of years the USA is outperforming the rest of the World. That is known. The future years - that’s the unknown. ![]()

Ok yes you’re right, I mean the S&P500 clearly outperforms the world but you guys would still stay on the more diversified because on the long run it could even out with the advantage of being more safe? Maybe I’m starting to grasp it…

thanks!