Negative interest at IB begins with 100k CHF. At the moment, you pay 1.062% on the money over 100k.

We’ve recently had plenty of discussion about this on this (bit unaptly named) thread. ![]()

My personal recommendation still stands to go with what you are and feel comfortable with.

Yes, indeed the thread topic isn’t quite clear ![]() . My last questions posted here are also heading away from the thread’s initial purpose! So, I will stop asking new ones

. My last questions posted here are also heading away from the thread’s initial purpose! So, I will stop asking new ones ![]() Many thanks to all the lovely people here helping me in deciding upon our financial future!

Many thanks to all the lovely people here helping me in deciding upon our financial future!

Hello, I am new to investing (but not so new anymore either). I have a savings rate of 55% and it is likely to go up in the near future as I am in line for a promotion. I am very satisfied with my current lifestyle and that is what I aim for in retirement. So that part is all very well managed. Investing, however, is still on training wheels. I started investing circa 2 years ago and went from all cash on hand to the following situation as of today:

130K invested in ETF (VT/VTI/VXUS)

10K invested in stocks

38K invested in pillar 3A (VIAC, 80% Global)

20K voluntary buy in to pillar 2

180K cash in hand (I know…I feel like an idiot for not being bolder)

I am entering my 40s now and I hope to be bit bolder in the coming 10 years and ramp up my investing. This is my current monthly savings and investing strategy that I have been trying to stick to:

- 580 chf to VIAC

- 3000 chf to ETFs

- 2000 chf to bank account (doing nothing)…

I realize that point 3 is not ideal at all, but it has been tough going from 0 investment to the amount I have today. At this point, I feel comfortable with this formula. According to my calculations, I should be able to achieve FI in next 12-15 years with an annual ROI of 5.5%. I do make lump sump investments that go beyond 3000 chf monthly when there is a market crash like the coronavirus crash when I invested around 40K chf. Another thing that is forcing me to be bolder is the ever creeping negative interest rate threshold for holding cash in bank.

Maybe you should look arround for a good local bank with good interest rates. Bank bonds for 7-8 years at 1.25% or similar. That way the return of your risk free part will be a bit higher.

I have never heard of such a thing in Switzerland. Is this really possible? Mind you, I am a US citizen so the choices for investments and banks is rather lacking.

Hi fellas!

I’m a 29yo italian doctor, working in Romandie since 2017. As of now, I started investing and planning to do so - in parallel with some entrepreneurship ideas just not to lay all my eggs in the same basket - until early retirement.

My strategy is a very basic one :

- VIAC with max yearly deposit (probably switching to finpension soon) all invested in stocks

- Pillar 2 for the bonds or bonds-equivalent

- All-world portfolio on IB with 50% VTI / 40% VEA / 10% VWO .

Until now I’ve only be investing in VEA and VWO, and I’m waiting for the USA market CAPE ratio to fall below 30 (ideally <20) to invest the sum I’m keeping for VTI in my bank account.

Quick question on the way: do you think this is a good idea? Is it “too much” market-timing? Because AFAIK CAPE ratio points out quite reliably overvalued markets, and USA’s one is sky-high…

Cheers, ciao ciao!

Terrible idea. US might stay above 30 for a decade or more.

Higher valuations don’t implicate negative returns, just lower expected returns.

It’s probably worse than market timing. The higher valuations in the USA are related to growth which is plentiful in the US. Old world and old economy has basically stagnated for the last decade and it may just as well continue to stagnate for another one.

The current selloff related to US-elections and second wave of covid may actually be your best chance to jump all in.

Thank you all for the tips, I have to admit that, even if it’s been several months that I read almost everything that I can find - ERN, MP, here in the forum - there are still things somewhat obscure about FIRE.

I based my reasoning on the first 3-4 chapters of the Guide to SWR by BigERN, that I found incredibly nicely written and very “evidence based” (being a scientist I like very much).

So basically the idea is that, since the alternative of putting the right (in %) amount of money in US market with low expected returns is to keep them in my bank account with zero-expected returns, I might as well invest them and grab what I can…?

My current portfolio :

70% IWDA : (Degiro)

15% EMIM: (Degiro)

15 % VIAC

Any comments? The “best” option for the moment with <100k ?

Thanks

60% 80 Global

40% Suisse 100

Why not? I think I have a lot of US funds with Iwda and global 80. So I think it’s interesant to buy some extra in switzerland

But I’m opened to another ways to do if it’s better

I’ve been invested in the stock market for the last few years.

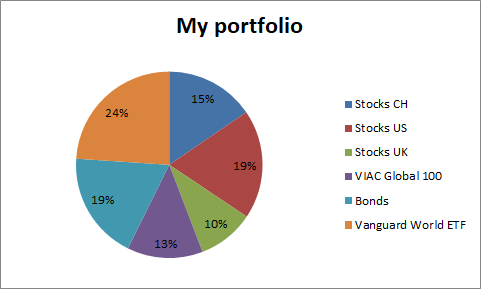

Only recently starting investing in VT and just moved to VIAC (Global 100 from February). The stocks are hand-picked (big corps and/or high div yield), going forward I might sell them and move more towards VT.

I’m aware it’s not well balanced in multiple aspects. What do you suggest going forward?

If you beat the market with your picks, keep on doing just that. Otherwise go passive.

The stocks I bought since June, so I wouldn’t know what to compare it with. I could compare it to the VT it that period? I don’t think I’ll beat the market long term and don’t plan on manual picking going forward. The question is when/if I sell the shares I have and what I base my decisions on

It’s definately possible to beat the market with individual picks or an active approach, but most people (including professional fund managers) wont.

If you do not want to manage your picks actively, just sell everything and go with a passive all world portfolio. Alternatively, if your picks from June contain some big winners, let them run for as long as they keep on winning and sell the losers ASAP.

Why so much UK?

What bonds are these?

That‘s just a big corp, that just happens to be from there. I consider bonds 2nd pillar and my member shares in a bank.

Quite a chunk risk, then…