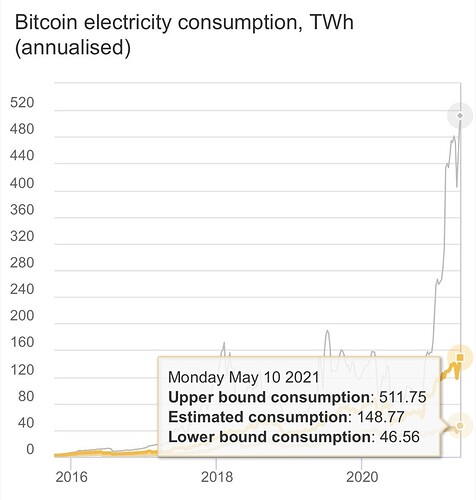

Well, seems like Tesla is rethinking Bitcoin. Apparently its energy consumption went up in the recent months by a lot. I also don’t think it’s sustainable for people to earn money by keeping their PCs on 24/7, it’s honestly absurd. I hope Proof of Stake wins.

Because you not know how BTC are mined.

BTC = professional mining no one use that at home at standard kwh price !

Professional use cheapest electricity due to overproduction because go in country without a lot of people using electricity actually so not used by anyone and sell at really low rate like 0.01$/kwh if not sell at this price this energy is just lost.

It’s the only way for win money with costly ASIC even when BTC isn’t overevalued and return to lower price. Miner are there for long time and refuse to use coal because know that price will increase in a near future. So all theories about BTC are just wrong. BTC help to consume cheapest energy where is just lost without them. Help too new electrified country to win some money during the transition. Elon know that but just not want lost money by selling car with a BTC who is shorted so write that. Elon is a scam and a lot will lost all their money invested really bad from him.

It would be interesting to find out whether a private miner (not a business) could deduct the cost of electricity from the income generated by mining. I can’t find anything clear on that, so I assume that would only work for a business.

Would be nice to have some reference about that. Most miners are in China where electricity is CO2 heavy.

At least in Zurich this is the case, see Steuerliche Behandlung von Kryptowährungen (Bitcoin etc.) | Kanton Zürich

Basically it’s counted as “selbstständige Erwerbstätigkeit” and therefore you can/have to list income/expenses for this. Electricity is considered expenses.

China change coal by nuclear (green) power. It’s due to price increase kwh price and miner will move.

Miner search green and unused cheapest power possible. Like use refinery methane actually burned for nothing but use this methane for produce power instead whatever the refinery is located.

BTC have huge price now it’s not an issue but when cost 3k/btc miner can’t sustain a huge kwh price and move.

Here, I corrected that for you:

Miners seek the cheapest electricity possible.

Stop bullshitting people they’d be seeking “green” power. If they were only remotely prioritising their environmental concerns or green considerations over their purely monetary business interests, they’d not be in the Bitcoin mining business in the first place.

If anything, crypto mining is just replacing out industrial and household demand at lower price points, thus increasing overall consumption. Even if renewables had lower costs than fossil fuels in electricity generation, mining just incentivises generation with non-renewables.

Yeah, so much that more than a third of China’s crypto mining is estimated to be taking in Xinjiang province. And floodings of coal plants there end up taking out a huge chunk of global mining power.

And who hasn’t heard about how green and renewable electricity production is in other top mining countries, such as Russia, Kazakhstan, Malaysia or Iran?!

Things are evolving quickly :

Greenidge says N.Y. bitcoin mining operation to be carbon-neutral by June 1

For context, this is in reaction to Private-equity firm revives zombie fossil-fuel power plant to mine bitcoin | Ars Technica

(they bought and restarted a coal/gas converted plant that was meant to be dismantled to mine bitcoin instead)

May be some use coal but it’s not the majority of miners and probably the most stupid miners.

Coal, Oil even uranium price increase day after day. Coal miner will shutdown mining and resell their ASIC to other green miner who can keep a low priced energy. Refinery methane isn’t green power but it’s better than partially burn this methane for nothing because refinery not need this power but miner yes.

Just stop to write bitcoin isn’t green or clean is just wrong. If we replace worthless fiat by BTC we can shutdown a lot of power plant resell building for other usage.

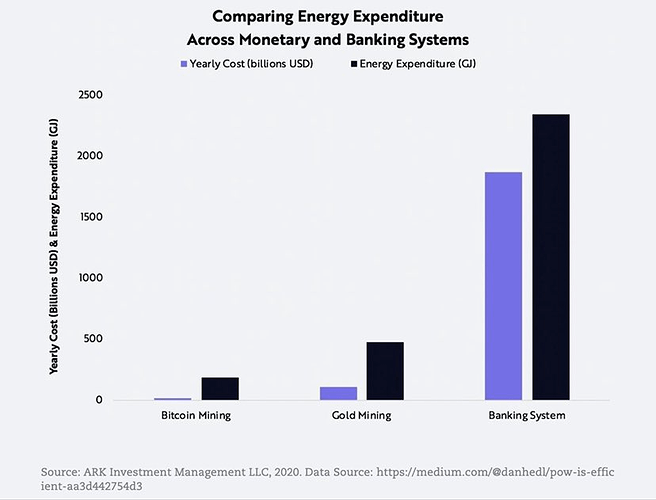

What? The current system is order of magnitude more energy efficient… How much transactions does bitcoin process vs. the payment and banking systems? (and the current financial system provides a lot more services than bitcoin does).

(the graph you had above compares apples to oranges, it’s basically the costs of retail branches and atms… for comparison it should compare visa + bank clearing since that’s most of the thing BTC can currently replicate)

Keep bullshitting yourself.

About half, probably a bit more of the world’s most of the world’s hashing capacity is in China.

A country that generates two thirds of its electricity from coal. In doing so, “China accounted for over half of all coal-powered electricity generation in the world”. And Bitcoin has been highest in provinces with cheap coal (and labour).

In China, they do shutdown because the government is taking active steps at curbing usage for crypto mining purposes.

A simple look at where most of it is mined makes it obvious it isn’t very green or clean.

So no, I won’t, until someone presents solid arguments and/r evidence that’s relevant today.

Anecdotal press clippings about company XY or gas flaring aren’t. Neither are the fairy tales about the future that ARK and other crypto Kool-Aid drinkers keep on fantasising about.

Yeah, these comparisons between crypto and banking system are suspicious. It’s hard to tell, what should be counted: front office, back office, banknote printing & distribution, payment terminals, ATMs? If there is only crypto, won’t we need credit cards, mortgage loans, collaterals, appraisals, safe deposit boxes etc?

The lack of efficiency could be fixed by writing better code, though. ETH 2.0 aims to solve this with sharding and what not.

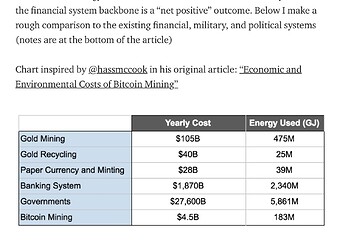

That graph is from an article on ARK’s web site. Their in-house “cryptoasset analyst” (whose Twitter ramblings we’ve had the pleasure with before) probably did a quick Google, took the first and most convenient table he could find and called it a day.

Because… let’s look at the “data source” they provide: Some guy’s blog post (well, ok, seems to be director of growth marketing at Kraken) on Medium. Indeed, the numbers seem to have been pulled directly from the table provided there:

And… that’s it, basically. There’s no details given, the figures are based on other research that’s only very briefly mentioned and linked to in the notes. ARK couldn’t even be arsed to quote the original “research” as the data source. Not that I am surprised.

So what underlying research is referenced in the notes then, as source for the energy consumption of the banking system? No problem, I’ll directly provide you link to the “initial research” here (page 20-22), provided by Hass McCook, self-proclaimed “Bitcoin Evangelist”

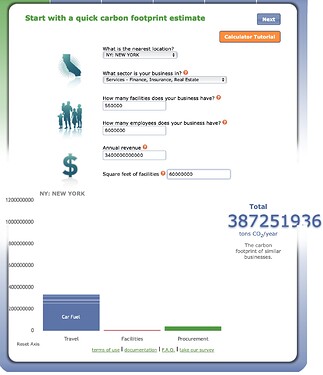

His initial assumptions in calculating the carbon footprint of the banking system (revenue, numbers of employees and branches, office/facility space per employee) indeed seem relatively reasonable. The author then proceeds to enter the data into the CoolClimate Network’s carbon footprint calculator provided by the respected University of California, Berkeley, to calculate an estimated carbon footprint for the banking system in terms of CO2.

And indeed, entering his numbers into the online calculator, I am ending up with very similar figures for carbon footprint of approximately or slightly below 400 million tonnes of CO2.

Now, here’s where it gets “funny” though:

-

The "initial research on which ARK’s graph is based does not actually calculate the energy expenditure for bank branches. He merely seems to apply the same ratio as the one between carbon footprint electricity generation with regards to ATMs (whose carbon footprint is pretty negligible). However, as we are going to see, the assumed carbon footprint for bank facilities doesn’t mainly depend on electricity.

-

Quote: “the governing factor of the model appears to be the amount of yearly revenue generated, as significant changes to number of employees and branches have little effect on the model output.”

Let that sink in: The carbon footprint of the banking system allegedly does not (according to the “research”) depend on the size of their operations!

If banks double their revenue, their carbon footprint would roughly double as well - and if they closed half of their branches, it would have only a small to negligible effect. So the assumptioon. -

So why is that? Well, of the 387 million tonnes of CO2 I am getting as a result, only 50 million are attributable to facilities (7 million) and procurement (43 million). 337 million - or 87% of the carbon footprint of the banking system is attributed to travel alone (air travel, public transit and commute):

And now the hashrate of China has fallen so less and less coal used until China go to Nuclear if they rectors not explode before…

Blockchain is a better system than banking system even if I never buy any bitcoin.

Next years will show us the future of money if banks and/or some country collapse due to huge amount of debts.

I was wondering what you guys are planning to mine with your GPUs when ETH will be proof of stake only? Looks like ETC is an alternative not too far from ETH from the profit aspect…

Also if anyone has older GPU cards to sell such as GTX 1060/1080/1660/2080/… for a reasonable price, please PM me. It should simply have at least 5GB of RAM.

Just a quick update on my mining. 5 months have passed now since I started.

Currently I have 0.515 ETH and 0.016 BTC, which is worth CHF 2’550. I spent around CHF 450 for electricity, which gives me a net yield of CHF 2’100 in 5 months, or CHF 420 per month.

Graphics card are still hard to get and all the new ones with LHR have 25-30% of the mining performance. So I’ll by able to sell the equippment for a profit once I stop mining in May/June 2022. I expect something around CHF 5’000 in return for that year including selling the GPU.

Nice figures  Interesting also to hear that there are still people mining BTC on GPUs… which mining software do you use for and on which pool for BTC if I may ask?

Interesting also to hear that there are still people mining BTC on GPUs… which mining software do you use for and on which pool for BTC if I may ask?

I’m mining ETH on the Ethermine pool with Gminer. I transfer everything to Coinbase and rebalance there with BTC so get 2/3 ETH 1/3 BTC exposure for diversification.

I see so you convert ETH to BTC. For what it’s worth I just read that PhoenixMiner is supposed to be the “best” software for mining ETH, but I can’t back that as I don’t have much experience yet.