Yes, will come separately. Was additional 3 days for me.

Dear all, out of curiosity, did anyone received arelady the cashback from Cembra?

Thank you,

Don.

Yes, I did. It was credited directly to my account and reduced the next credit card bill accordingly.

Hello everybody, I just have a question.

I was already a client of Cembra (through Cumulus) and asked the new Certo One. I was expecting the initial credit of CHF 50.00, but nothing arrived. So I called them and they answered that this offer was only for new client. Didn’t see something mentioned on the website.

What do you think ? I think I’m gonna call them again, because it is not fair at all !

Thanks

I am a new client and did not receive it.

How do you activate it ?

Edit: Confirmation of the registration with the Cembra Money Bank done on October 5th

I was also with Cembra before with Cumulus and I received the credit. The promotion was however only ubtil 30.09. as far as I remember. Did you apply before that date?

It should be added automatically to your cashback, which is paid out every 3 months.

Hi,

There were two offers :

- the Certo “standard”, 1% cashback until end of September for Cumulus holders

- the Certo One, CHF 50.00 initial credit, but apparently only for new customers

I had Cembra before with cumulus, ao I was not a new customer and still got the bonus ![]()

Thanks, good to know, I guess I need to wait until the next statement in my case.

You should see it already in the app under the cashback section.

Coming back to this: I also received the cashback from the Certo card!

Cheers

Don

Wow… I really must have overlooked this thread, quite some worthwhile information.

Migros Cumulus looks to me like it may be the best (free) all-around card in the Swiss market. eBill, insurances, a very popular points program, no foreign currency fees (though a moderate spread), insurances. They even include two free ATM withdrawals abroad for your holidays.

Does it include the best travel insurance or the highest cashback rates? No. But it’s looks like the card I would most likely recommend to the “average” Swiss person. People who aren’t penny-pinchers, frugalists or nerdy optimisers - but just willing to look beyond their main bank for their first or second credit card.

Me personally, I’ll probably keep my cashback cards for 1% at the supermarkets and big chains - or only cancel so that I can get sign-up bonus again. Speaking of which…

This is currently available with a 100 CHF sign-up bonus for IKEA “family members” (free membership).

I agree.

For the vast majority of consumers who do a lot of online shopping from foreign stores and use their credit cards a lot for travel, the money saved on foreign transaction fees will likely far outweigh the cash back they could earn with other credit cards. Neon (and Wise, Revolut) are cheaper for foreign transactions because of the better exchange rates, but you don’t get the other benefits.

It is also worth noting that the Migros credit card is the only credit card I know of (anywhere in the world) which does not have a cash advance fee (for cash advances at Migros supermarket tills). I used the old Migros Cumulus credit card from Cembra for a long time, and this feature eliminated the need for a debit card, for my specific cash withdrawal needs.

I rarely shop at Migros because there are cheaper options, but the Cumulus vouchers were still as good as cash because if nothing else, I always needed municipal garbage bags/stickers.

The new Migros credit card has much better insurance perks than the last one.

If I needed a Swiss credit card and had to pick just one, it would be the Migros card. But you can always optimize by getting several credit cards, and using one for travel bookings, one for foreign transactions, etc. For now I’ve trimmed down to just the Wise card, because I find it easier to budget with a prepaid card.

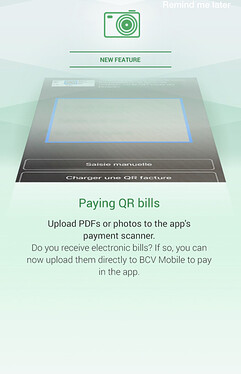

I was discussing this with a friend once and he forwarded me this screenshot a few days ago. So it seems it is now possible to pay a QR-bill by uploading its PDF in the mobile app of BCV.

NB: I am not a client of BCV myself, haven’t tested the feature.

Could you elaborate on this point? I’m not sure I understand what you mean (probably because of the language). What do you mean by cash advance? Does it mean the possibility of withdrawing cash at the Migros stores?

I have personally adopted the new Cumulus card since it became available and I am fully satisfied with it.

Big German direct banks used to issue VISA credit cards for free ATM withdrawals (most of them as charge cards with monthly debiting, but you could use them to rent things) as their “standard” or “primary” cards. Most did move to VISA debit recently - though the DKB VISA is an example that still stands.

It’s cash withdrawal, but since it’s a credit card the cash isn’t “there” yet, so it’s given in advance.

Got it! Thanks for the explanation !

A cash withdrawal (at Migros supermarkets, in this case). With regards to credit cards, the correct term for cash withdrawals is cash advances, since you are in fact getting a cash loan as opposed to withdrawing cash from an account.

With the Migros Cumulus credit card, you can effectively get a fee-free, interest-free cash loan for a term of up to one month. That is something I haven’t found on any other credit card (you generally pay a minimum of 5 or 10 francs/dollars/etc. per withdrawal with other cards). The advantage is that if you need some cash, you can just get it at Migros at no extra cost, and then have it all in your one credit card statement. Theoretically, you could even earn bits of interest on those free short-term loans, but that’s more of a curiosity than a useful plan.

A bit of feedback on Cembra Certo1 credit card.

I opened the account in October 2022 and just got the 50 chf credit in February 2023 without claiming it.

I am quiet happy with the setup.

My wife also use her card on the same account and we split 50/50 our spendings on this card every month.

It has eased our money talks as we have none now !