Ah yes, my mistake. I missed the “per person”. Interesting that premiums are cheaper in your area.

I have the Salt Unlimited for 29 plus a second SIM card for 10 and a Huawei Mi-Fi router. Watch TV through Zattoo. During the day the speeds are good, 2-3 MB/s, in the evening it drops to 400 KB/s (I guess people are using it more).

My friend has 1 Gbps for 59 CHF. I would take such a deal, but unfortunately in my building for this money I would only get 50 Mbps, so I decided it’s not worth it.

Thanks Bojack, That seems like a good deal. I will look into this. Would be very happy to cancel my internet subscription.

I’d suggest you to check some smaller Provider rather than go to 3g/4g internet at home. There are cheap offers starting at 29 or even 24 if I remember correctly.

January Update

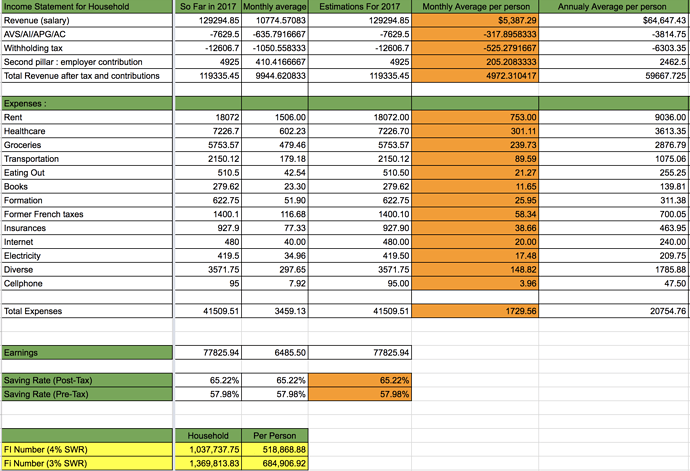

So I made the accounting for the whole year 2017 :

Lo and behold, the household spent 41’509 CHF this year, without counting taxes. This makes 20’754 CHF per person. Obviously, housing represents almost 50% of the spendings. Then, we have healthcare and groceries, around 15% each. The “Diverse” category takes up almost 10% of expenses, so I’ll have to make more categories this year to monitor what it entails!

We managed to save 77’825 CHF, which feels good ![]()

This, plus a very good stock market year, means that our net worth is now 216’335 CHF as of the first of January!

The expected FIRE date is thus September 2025. We’ll see!

Switching subjects, as some of you may have seen in another thread, I am currently working on a side project of a Stock Screener web application. Feel free to give some feedbacks if you have some ![]()

So, almost 6 months passed since my last update so i thought I would do a semi-annual debriefing

- I became a dad in March. This is obviously the biggest change I had in my lifestyle since a very long time

It takes time to adapt, but this is definitely a lot of happiness (and a lot of exhaustion as well as a young parent, but it is worth it).

It takes time to adapt, but this is definitely a lot of happiness (and a lot of exhaustion as well as a young parent, but it is worth it). - As expected and explained by other members on the forum, having a child does not change much to finances in term of expenses in the first years. I can confirm that as well!

- The Julianek family Net Worth is now 276’799 CHF, up 60k in six months since the beginning of the year.

- It is becoming increasingly difficult to find cheap assets and undervalued companies. For this reason, I have 35% of my portfolio waiting in cash. Some may say that it carries a lot of opportunity cost, but when I run the numbers:

- Since January 1st, the S&P500 is up 3%

- My invested portfolio returned 10% over the same period

- Therefore, my whole portfolio returned 6.5%, so more than twice the S&P500 for 35% less exposure. Fair deal.

The uninvested cash is mainly waiting for assets to become cheaper. I do not know when it will come, but I apply the lesson “Be fearful when others are greedy and greedy when others are fearful”.

As usual, here is a list of the books I enjoyed reading. I really think that knowledge compounds like money. It does not show at first, but if i can go to bed each day a little less stupid, I’ll take that.

-

From Third World to First , by Lee Kuan Yew. LKY is known to have built the modern Singapore from scratch in 40 years, transforming an area of hopeless land into one of the most successful countries ever. It is very interesting to read what was his mindset and how he managed to do it. What is even more interesting is the culture shock inside the book for a Westerner

-

I re-read the three first books from Nassim Taleb. Paradoxically, The Black Swan is the one I least enjoyed. Fooled by randomness and Antifragile are much much better! But anyway, Taleb’s concepts of asymetry and fragility are really worth it (i.e, you should not focus on being right, you should focus on what happens when you are wrong…)

-

Thinking, fast and slow by Daniel Kahneman. It is surprising that it took me so much time to start this one. There are so much articles about Kahneman’s concept that I thought I knew a lot of what is in the book. Boy, was I wrong. I would have wasted less time by reading the book first! For anybody interested in finding out how irrational and manipulable we are, this is really one of the references.

-

Understanding Michael Porter, J. Margretta : A good book to understand how a company builds a competitive advantage.

-

and finally, I took the time to read the Berkshire Hathaway letters to Shareholders by W. Buffett from 1962 to 2017. It contains more nuggets about investing than any modern book of economics!

The Target is still to retire in 2025 with around 1’300’000 CHF for the household. But lately i am not so sure about what to do afterwards. The initial plan was to have a small farm in Poland, but I am losing the enthusiasm for farming. At some point I thought about staying in Switzerland or going back in Alsace (France) to be close to family but the high taxes in France require a much bigger stash. Another option we considered was to emulate the guys from Millenial Revolution and to go traveling non-stop for several years before settling down.

Well the good thing is that we have 7 years to figure this out and this is kind of a first world problem

Does this include dividends? If yes, what is your approximate Grenzsteuersatz?

I saw your post in the portfolio thread about the stocks you picked but I think it’s a value strategy and taxation should not be neglected.

As you said i use principally a value strategy (= finding undervalued stocks) and thus most of my gains come from capital gains. Statistically, dividends constitute only 6% of my portfolio returns: for instance if my portfolio returned 100k CHF, then only 6k CHF were dividends.

So It is even less impacted by taxation than indexing for instance.

You are right, I should calculate my Grenzsteuersatz and take it into consideration, but I think it is gonna be impacted in a very minor way by my returns.

Congratulations!

It will be interesting if you track the difference in costs for having a child.

Also, who are the Milleinal Revolution’s people?

FI people from Canada who has spent the last two years visiting the world

Sure, so far it is not really expensive ![]()

- 100CHF/ month for healthcare insurance

- We paid 50 CHF for a set of second hand baby clothes

- We paid 50 CHF as well for second hand cloth diapers as well. The baby is growing fast, so maybe we will have to buy another set at upper size

- We bought as well a second hand “Milk pump” to stimulate milk production because we only breastfeed the baby. the pump was around 30CHF second hand.

- We got all the furniture (baby bed, stroller,…) for free because people were getting rid of them

- There was as well a “baby trager”. I don’t remember the price but it was no more than 30 CHF

- There was diaper changing station as well that we got for 40 CHF

-Add in sets of baby books and toys (usually veeery cheap on second hand market) - There were as well some one off small items (tissues, baby bedsheet and so on) but you get the picture : usually with a small dose of patience you can get anything you are looking for on the secondary market for very small amount of money.

Plus, the canton gives us 200 CHF per month for the baby. So far it balances out quite nicely!

It’s even more impressive if you compare it to YTD of VT: -0.12%. The real test of performance though requires at least a decade IMHO. Shorter than that I still won’t put my faith in your net nets. ![]()

PS. As always I love your books recommendations. Thanks a lot. I already read Taleb and Kahneman, but not the others (especially LKY book seems interesting - I’m generally interested in microstates, like Singapore or Hong Kong). I need to open my own journal thread and publish my numbers and books that I’ve read. Compounding of reading is even more powerful than compounding of the interest - it’s a really good investment!

9 posts were split to a new topic: What about Childcare?

Oh yes the LKY book is great! In particular, one key aspect for me was the culture difference between west and east. In the western world we have broadly three distinct socio-economic ways of thinking : socialists, conservatives and libertarians. In the East, one of the main school of thoughts is confucianism (where the primary focus is the wellbeing of your family and society), and it is interesting to see how LKY picked several items from each school of thought to unite them in a society that works.

One other key take-away is when he states that democracy is not the cause of progress but its result; and that, in order for democracy to work in a society, you first need a cohesive society and a prosperous middle-class (as an illustration of this, see for instance the various recent failures each time western countries tried to impose “democracy” in other countries…)

17 posts were split to a new topic: About Democracy and rights

For those interested in Value Investing, I cannot recommend enough the work of Sanjay Bakshi, a professor - and practitioner - vastly influenced by Charlie Munger and Buffett:

- His website with an overview of his lectures

- His blog

- and his interview in Farnam Street’s Podcast about Mental Models and thinking

I noticed a lot of people talked about their Investment policy statement lately. Since my investment style tend to differ a lot from other members, I thought it would be a good exercise to layout my investment philosophy. of course, it may be amended with future experiences.

Julianek’s Investment Policy Statement:

„Take a simple idea and take it very seriously.“ Charlie Munger

I decided to apply the idea of compound interest with utmost seriousness.

My goal as an investor is to compound my wealth at the highest rate possible. A compounding machine has three components:

- Seed Capital: How much money I put in the machine initially

- The amount of time during which the machine is compounding.

- The rate of return at which I compound this seed capital

Part 1) Seed Capital

I will continuously save between 65% and 70% of the money I am earning through my job, until I become financially independent (saved up 30 times annual expenses), which I expect to happen in approximately 7 years (give or take 2 years depending on market conditions). After which I may stop working (or at least stop exchanging my time against money when considering an occupation).

Part 2) Time horizon

This one is easy: Being currently 32 years old, I expect to let my compounding machine run at least 30 or 40 years, hopefully much more depending on my health.

A nice tool when we have a long term horizon is the rule of 72, which gives you the amount of time needed to double your money by compounding.

- If you compound your money at 7% per year, it will double in 10 years

- If you compound at 10%/year, the capital double in 7 years

- At 15%, your money has doubled in 5 years

- At 20%, a doubling occurs every 3.8 years

- And at 26%, it only takes 3 years to double your money

It is all about the number of doubles occurring in your time horizon. With a 10 years horizon, there won’t be that many doubles, even compounding at 26% (there would be only 3.33 doublings in this case).

But with a 30 years runway, the number of doublings can be huge! Between 3 and 10 doublings using above rates (and 2^10 is a very sweet number where your money has been multiplied by 1’000…)

Part 3) Rate of return

This is the part where I actually invest the money.

- The most fundamental principle is how I should think about stocks. It is not a piece of paper whose price bounces around in a funny way, but a share of ownership of a business. It ensues from this that I must think as a business owner and always ask myself: „Is this a good business? At which price would I be happy to own this business? At what price is it currently selling for?“

- The second concept is how to think about market fluctuations: although markets are often efficient, they are not always efficient , and this matter a lot for my returns. Markets have regularly episodes of manic-depression or excessive euphoria, from which I should take advantage, provided that I know the value of the businesses I am concerned with.

Imagine I have a small farm, that is yielding 50k CHF per year on average. Imagine on the other side of the street there is a neighbor, who has exactly the same fair as I do. On top of that, this neighbor comes everyday to my door, and tells me at which price he would buy my farm, or at which he would sell me his, with no obligation from my part. Most of the time the price quoted would be roughly in line with the 50k CHF yielded by the farm. But in some occasions, the price would be way off: - At 10kCHF, I would for sure buy his farm, this is a no-brainer

- At 5 million CHF, I would sell him my farm, again a no-brainer

- But most of the time when the price is in line, I would just go on farming without acknowledging him. The market is here to serve me and not the other way around.

3a) Buying

- I believe choosing what not to invest in is as important for results (or even more important) than choosing what to invest in.

- Therefore, I am not interested in buying a stock unless there is a high probability that I will double my money in two or three years.

- The above rule is very unreasonable on purpose and forces me to invest only in no-brainer situations. In investing, I am not rewarded for complexity or the elegance of my thesis. I could decipher a very complex business and only earns 5%/year, in which I have no interest whatsoever. I only consider situations where it is obvious that there is good money to be made.

- Those situations can often be described as „Heads, I win, Tails, I don’t lose much“, with little downside and big upside.

So far, I have classified these occasions in five categories:

- Wonderful businesses, with a bullet-proof competitive advantage and strong tailwind, that can be run by idiots (and often have been ran by idiots). If I can buy them at a good price, they will compound at a high rate for a very long time. Example: Credit Rating Agencies. if their behavior during the subprime crisis (equivalent to selling poison to customer) did not suffice to kill their business, nothing will kill the business, and its economics are wonderful. Every bond issuer has to go to rating agencies to have its credit-worthiness rated, otherwise the cost of its debt will be much more expensive. The agencies operate in a de facto oligopoly which reinforces network effects: everybody goes to Standard & Poor’s or Moody’s, so to be taken seriously you have to be rated by them. When a company or a government issues debt (let’s say $1 billion), the agency will charge 10 bps (or $1 million) to rate the debt, while its only costs are a computer and an analyst that it can afford to pay at a good salary, let’s say $200’000. A wonderful business indeed. Looking forward to buying at the next market downturn.

- Wonderful businesses with good competitive advantage, good tail winds, but that cannot afford to be ran by idiots. (the difference with 1. is that because of this they cannot become a „buy for life“ decision). These are often business achieving very high returns with either:

a) Razor-thin margins compensated by a high turnover (ex: COSTCO)

b) A lot of float that has to be wisely invested (ex: Berkshire, Markel)

c) all the advantage comes from the capital allocation of the manager (ex: Teledyne with Henry Singleton) - Situations with Low risk but High uncertainty : markets hate uncertainty and usually punish really hard businesses that are not predictable. Those businesses are trading usually at depressed multiples (even sometimes at P/E of 1), and if I can find a situation with a good downside protection (for instance with the assets on the balance sheet), then buying at depressed earnings result on average in very good returns. This is the quintessence of „Heads I win (=>if the business continues earning some money, buying at P/E=1 or 2 is very good for the returns), Tails I do not lose much(=> If the business stops making money, I am protected on the downside with the liquidation value)“

- Special situations and especially Spinoffs. Spinoffs have statistically over performed the market by at least 10% annually over the last 30 years, and it has been confirmed by various studies. No additional comments, other than strongly suggesting to read Joel Greenblatt’s book on the subject.

- Other situations with little downside and big upside. Example : Net nets, where you are buying cheap assets at a steep discount and statistically tend to close the gap between price and Net Current Asset Value. My position on Net Net stocks has returned on average 28%/year, but such occasions have become practically inexistent on the market since last year.

-

The circle of competence is very important. If I am not able to understand how a company is making money, which factors are driving its earnings, where its competitive advantage comes from and how this advantage is likely to endure in the future, I should automatically pass to the next opportunity.

-

One last point : such occasions are usually found in smaller stocks. It is easier to go from a market cap of $100 million to $1billion (a lot of companies did it) rather than from $100 billion to $1trillion (very few did it) or from $1trillion to $10 trillion (no company ever did it).

3b) Selling

This one is easier. I will sell when:

- A company has reached its potential and it is not obvious that it will keep compounding at a high rate

- The reasons for which I bought the company are not valid anymore

- I made a mistake in my appreciation of the business, which makes my investment thesis void

- I found another opportunity with much more potential and I am already fully invested.

Thanks to @1000000CHF I have finally read James Clear’s book Atomic Habits. It is fantastic!

The book provides a comprehensive set of rules and advices that help us changing our behavior and instill new habits/break bad habits.

I had read before The Power of Habits by Charles Duhigg, but had found it impractical although interesting from a theoretical point of view. Here it is the opposite: think practical and implement

Hi Julianek,

I’ve been reading this forum for a few months now and also the jurnal section. A lot of great information and advice, I learned a lot from the posts here.

I’m trying to run a salary calculator simulation on https://www.lohncomputer.ch/en/your-result/

However, if I input 10774 chf per month for a married couple with no children, not church members living in Zurich they estimate net income 8285, that’s a far cry from 9944 I see on your table even if I add the employers P2 contribution.

Can you shed some light on how you reached those numbers, please?

If we earn say 130k between myself and my wife on a B permit, how much would that be Net, assuming we will live somewhere in the canton of Zurich most likely close to the German border.

We are planning to relocate there from Dublin and I am trying to compare overall cost of living & purchase power.

Thank you,

Regards,

Vlad

A lot more than in Dublin in any case.

Only US beats Switzerland in compensation

Hi Vlad,

Yes you got me on this one: in our situation in 2017 I earned most of our income (around 120k gross) while my wife did various small jobs and tasks (at some point she had up to 3 employers) for around 500 - 1000 CHF / month. So although I may have correctly recorded all the AVS/First pillar and witholding tax for my salary, in the case of my wife her salary usually arrived waaaay before the many payslips; So in her case I may not have recorded all the social contributions. But the Net income is accurate in any case. The above exercice’s purpose was more to track our daily expenses after net salary.

Anyway, if you want to have a more precise idea of how much you will take home in your pocket, I advise you to follow the simulator, the picture may be more accurate than our special situation