August 2017 Update :

A lot has happened since June. Biggest news : We are expecting a baby! This made us reconsider a lot how we should structure the family finances. In particular, the FIRE project is not only mine, but the whole household’s from now on.

So Mrs Julianek is onboard as well now, even if this implies a lower average saving rate.

We decided it would not make any sense if one retires entirely while the spouse is still trimming in the rat race.

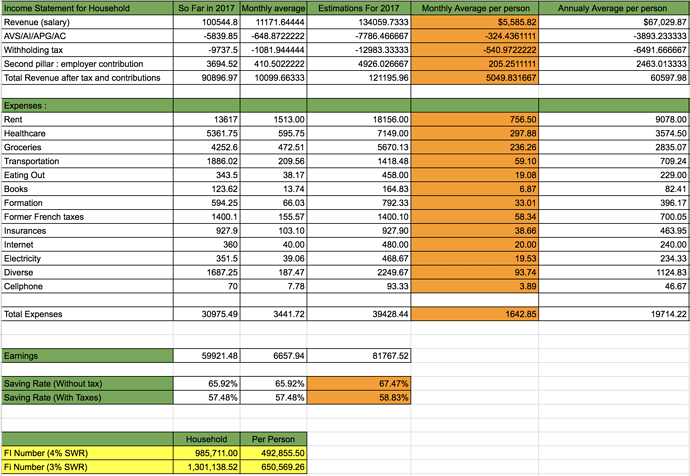

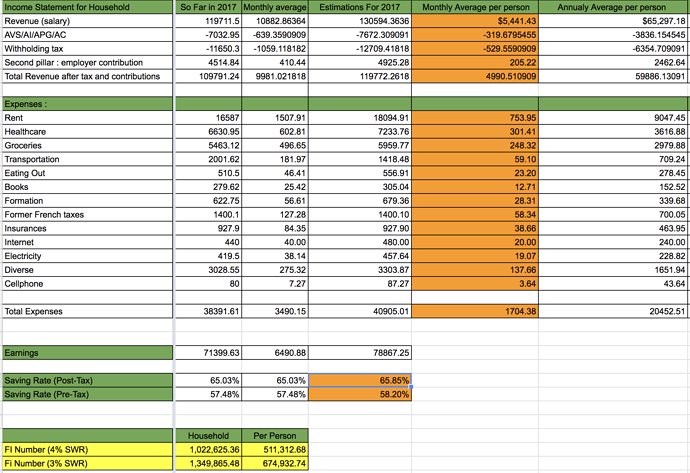

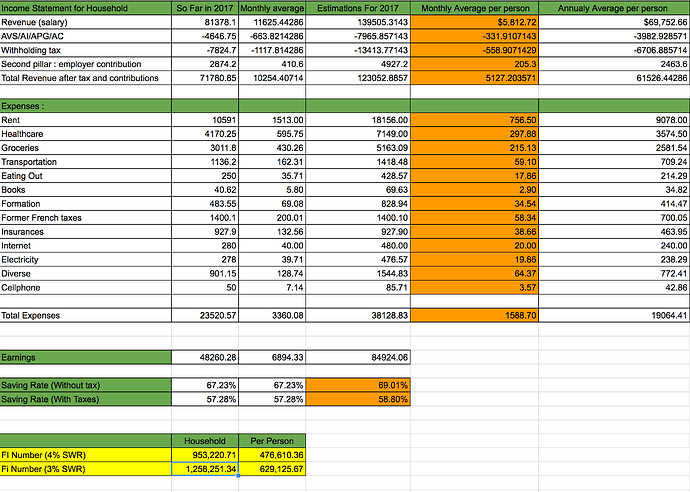

Thus we made a combined „Income Statement“ for 2017 so far :

A few remarks :

-We expect to spend on average 1564 CHF/month per person this year, which makes 37,5k CHF/year for the household. If we want to retire, that would require a Net worth between 938k CHF and 1,2 Million CHF, depending if the Safe Withdrawal Rate is 4% or 3%.

-This depends a lot from Taxes/Social contributions! As you can see, we pay currently more than 10k CHF of taxes and contributions per year. Our investment strategy relies so far on capital gains, on which we are not currently taxed.

We could expect to not be taxed anymore during FIRE. However, if the tax authorities consider that for some reason we are „professional investors“, then we will need to pay a lot more in taxes : we would need anywhere between 250k and 330k CHF more in net worth ![]()

Where things are likely to get better financially :

-Finally next year we won’t have to pay former French Taxes again! This should go away from our budget.

-I have a legacy healthcare insurance that is far from the cheapest option available : I will switch this year to the cheapest one.

-My wife has found a part time job as a music school teacher! This should allow for more revenue ![]() So far she was doing small jobs with kids, mainly in order to learn german.

So far she was doing small jobs with kids, mainly in order to learn german.

Where things are likely to get more difficult financially :

-Obviously, the baby ![]() . I have a hard time to estimate how much costs this will add, and we will have to adjust our budget next year. However, we are decided to not follow the consumer craze for baby related items : we already found a free second hand crib, and we plan to use cloth diapers and to breastfeed.

. I have a hard time to estimate how much costs this will add, and we will have to adjust our budget next year. However, we are decided to not follow the consumer craze for baby related items : we already found a free second hand crib, and we plan to use cloth diapers and to breastfeed.

Any suggestion to optimize further is welcome!

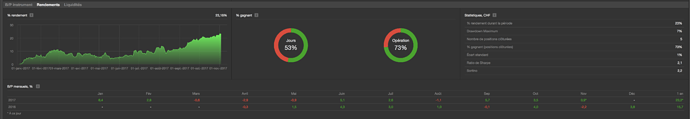

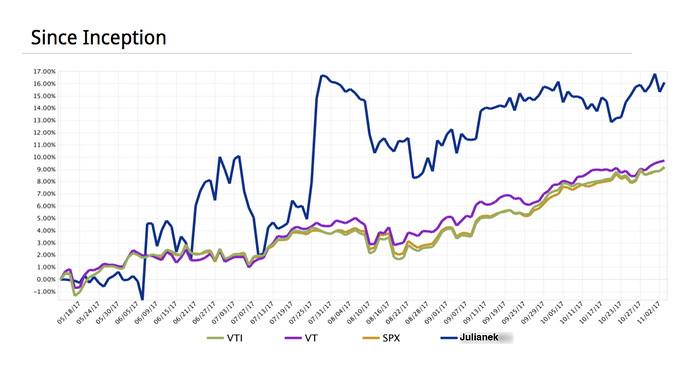

Net worth :

A good progression since last time, our net worth is now at 172 900 CHF!

Books read since last time :

-How to win friends and Influence People, by Dale Carnegie: the title is cringeworthy, but the content is great! I had seen this book recommended a lot in the past, but never bothered to read it. That was a mistake, there is lot of value in this book, especially for an introverted person like me.

-Influence, by Robert Cialdini : This is a marvelous book. Surely in my top 10 so far. Cialdini manages to explain all the main bugs in our brain and how sales people take advantage of it to make us comply to their requests. Brilliant.

-Pebbles of perception, by Laurence Endersen : how a few good choices make all the difference

-Margin of Safety, by Seth Klarman : a reference in value investing, and a lot of wisdom in this book!

-On the origin of Species, Charles Darwin

-Guns, Germs and Steel, by Jared Diamond : a very interesting inquiry into how humanity and civilisations evolved and why Europe managed to conquer the whole world.

-Sapiens, by Yuval Noah Harari : same as above, but covering a wider timeframe.

)

)