Also worked for me for NEON

Thank you. As I have an account in Neon (not in Migros Bank) it’s more helpful information for me. So if I understand correctly you have received the full amount from IBKR UK, right? Was it recently?

I can’t see in the Neon app where exactly the money is coming from, but I’d assume it’s the same swiss entity from IB to which I send money to IB. It was a few weeks ago and I didn’t pay any fee at all.

When I sell CHF and buy EUR on IB, I can not immediately transfer the EUR to another bank account. I do have the balance under ‘Portfolio’ but when I go to ‘Transfer funds’ and I want to wire them to my EUR account, I only see the balance of a couple of Euros I had before buying EUR.

More than 24h after having bought the EUR they are still not available. I know I could take a margin loan but that’s not what I want. Does anyone know how long it takes for my EUR to become available?

Settling time is 2 days.

A post was merged into an existing topic: Buying and selling a security at different exchanges, change of listing

Hi,

I’m new and in the last weeks I read a lot on this site and forum. I opened now an Interactive Brokers account and transferd some CHF to it. On the justetf website I looked for ETFs I want to invest, but now I’m struggling to find the ETFs on IBKR. For example I want to search following ETF on IBKR:

Vanguard FTSE Developed World UCITS ETF Distributing (ISIN IE00BKX55T58 )

When I search after the ISIN number on IBKR I find a lot of different results:

VEVE STK@SMART

VDEV STK@SMART

VEVE STK@SMART

VEVE STK@SMART

VEVE STK@LSEETF

VEVE STK@EUIBSI

VDEV STK@LSEETF

VEVE STK@AEB

VEVE STK@FWB2

…and so on…

It looks like they are different exchange were I can buy the ETF, but I don’t find out for what this abbreviations stands…

So I tried to figure it out and opend some to see if it is written somewhere… for example:

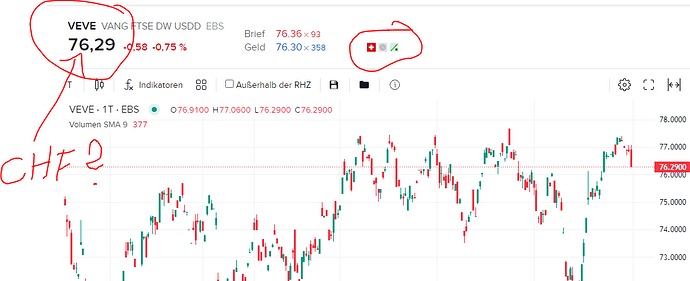

So here it says it costs 76.29 [apples or what currency?] First I assumed it has to be CHF, there is also the Swiss flag… but when I compare the price with the CHF price on justetf I get something completly different:

[Screenshot deleted, I can add only one Screenshot] → price in CHF on justetf is 91 CHF

So probably this is a compeltly stupid beginer question. But how can I find the same ETF I find on justetf webside on IBKR? And which exchange should I buy it?

Thanks!

What is the base currency of your account ?

I’ve set mine as CHF to ease my tax declaration at the end of the year.

My base currency is CHF.

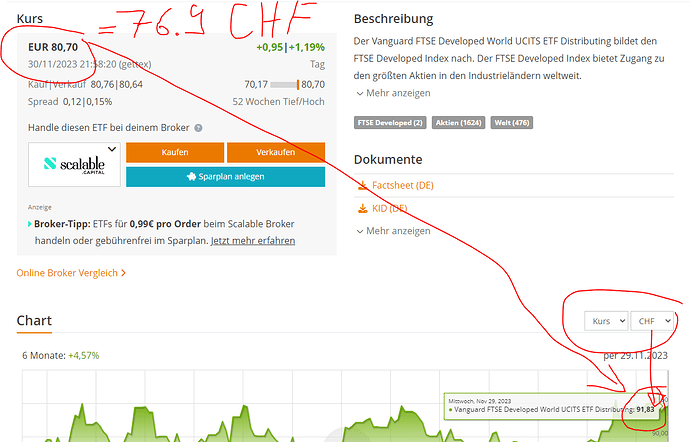

Okay maybe I don’t understand the justetf chart.

On the Chart I switched to “CHF” and it shows 91.83CHF but on the top it shows 80.70Euro and actually that are 76.9CHF → so is this a bug on justetf website or what I’m missing there?

All SMART are automatic routing orders in different currencies. So you can check them one by one and see which currency it is. Others are specific exchanges, you can safely ignore them.

If you open order form, limit order type, put some numbers, you will see in which currency your order volume is calculated.

The one you are showing is in CHF, EBS is SIX Swiss exchange.

Ah clear, thanks for the explanation. So I see clicking through the SMART until I have the EBS (swiss exchange) and then I can set directly my limit order in CHF.

I have two small questions about IBKR yearly reports.

-

How do i read the Interests Accruals table? I see “Interest accrued” of say 100chf and then “Accrual reversal” of 80chf. If I understand it correctly, the “Accrual reversal” is what I get. What is “interest accrued” then?

-

Change in dividend accruals. What is exactly? This is even funnier. I have a total of 0.01 usd which translates in 50CHF. The 0 USD means that I didn’t sell anything between two of the dividend dates (I don’t know exactly how they works). It translates to 50chf because between those two dates the FX changed. Did I get it right? Why is that important to know?

Accrual reversal is what has already been paid out of the total accrued interest.

Let’s say you get CHF 10 interest per month and we are now on the 15. November. Accrued interest will be CHF 105 (10 full months and one half month), and accrual reversal will be CHF 100 (10 months already paid out).

Thanks for your answer. It’s weird though, since I got the number from the yearly report. I suppose they “weren’t ready” to pay the rest before the end of the year so if I check the january report I should see the missing 20chf of my example (eg. Interest accrued = x, accrual reversal = x+20.

Hi all

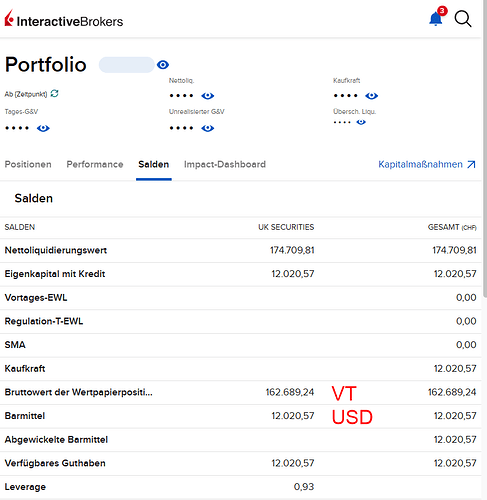

As of a recent discussion Is it worth waiting for dividends with regular investments? - Investing / Portfolios - Mustachian Post Community, I did not wait with sending money to IB until dividend date, but I did it today. I went to go change the currency from CHF to USD as I want to buy VT. I took a closer look to the “Portfolio” section in the webinterface:

Why does it say UK securities on top of that table? I know there is always a discussion if we are protected by SIPC (USA, $500’000) or FSCS (£85’000). Does anyone have a different view, when showing the “Portfolio” page? Does this “UK securities” mean anything?

As I understand, it means securities held in custody at IBKR UK = the subsidiary handling Swiss accounts.

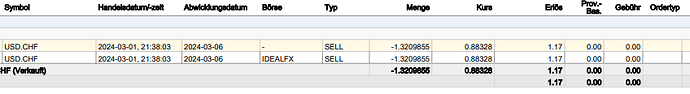

Hi all. Another question. I have an additional “small” account on IB for our child. I usually change FX on my “big” account, transfer some dollars to the “small” and buy one or two shares of VT on the “small” account. I did that at the end of last month. Now the remaining USDs on the “small” account were changed back to CHF.

No provision was charged. But I’m a bit confused. I did not initiate this. Anyone has in idea, why this happened? It has not happened before.

IB automatically converts cash of less than 5 USD in non-base currency to the base currency.

So change base currency?