I was intrigued by the title question. So I ran a small backtest.

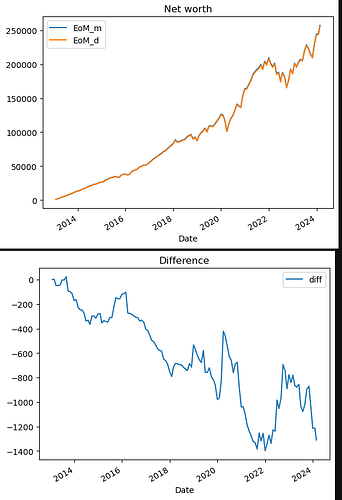

Result: no, it is not worth timing the dividends vs. naive monthly investing it by a tiny amount.

Assumptions:

- $1000 monthly budget

- only invest in VT

- time horizon: 2013+, where VT starts distributing quarterly

- $0.33 transaction fees (IB-style)

- 30% income tax applies to dividend distributions

- buy shares at End of Month. in case of the wait-for-dividends, only in case of a distribution within the month

_m is the naive monthly, _d the waiting for dividends

| A | Date | Close | feed | EoM_m | EoM_d | diff |

|---|---|---|---|---|---|---|

| 2410 | 2022-07-29 00:00:00-04:00 | 88.238220 | 1000 | 188138.655674 | 187085.197117 | -1053.458557 |

| 2433 | 2022-08-31 00:00:00-04:00 | 84.662292 | 1000 | 181514.447745 | 180547.141453 | -967.306291 |

| 2454 | 2022-09-30 00:00:00-04:00 | 76.594856 | 1000 | 165830.142229 | 165135.322705 | -694.819524 |

| 2475 | 2022-10-31 00:00:00-04:00 | 81.479149 | 1000 | 177404.305714 | 176660.973264 | -743.332450 |

| 2496 | 2022-11-30 00:00:00-05:00 | 88.227806 | 1000 | 193095.802496 | 192204.329587 | -891.472909 |

| 2517 | 2022-12-30 00:00:00-05:00 | 84.312820 | 1000 | 186506.644679 | 185729.628497 | -777.016182 |

| 2537 | 2023-01-31 00:00:00-05:00 | 90.759285 | 1000 | 201765.894238 | 200924.743411 | -841.150828 |

| 2556 | 2023-02-28 00:00:00-05:00 | 87.873535 | 1000 | 196350.542395 | 195570.322314 | -780.220081 |

| 2579 | 2023-03-31 00:00:00-04:00 | 90.378075 | 1000 | 203391.036615 | 202524.287270 | -866.749345 |

| 2598 | 2023-04-28 00:00:00-04:00 | 91.663734 | 1000 | 207283.441143 | 206404.165200 | -879.275943 |

| 2620 | 2023-05-31 00:00:00-04:00 | 90.554733 | 1000 | 205775.659521 | 204920.002602 | -855.656919 |

| 2641 | 2023-06-30 00:00:00-04:00 | 95.814117 | 1000 | 219758.410322 | 218719.893110 | -1038.517212 |

| 2661 | 2023-07-31 00:00:00-04:00 | 99.380714 | 1000 | 228936.287208 | 227858.867430 | -1077.419778 |

| 2684 | 2023-08-31 00:00:00-04:00 | 96.555099 | 1000 | 223428.566026 | 222410.814161 | -1017.751865 |

| 2704 | 2023-09-29 00:00:00-04:00 | 92.446899 | 1000 | 215579.499857 | 214684.115994 | -895.383863 |

| 2726 | 2023-10-31 00:00:00-04:00 | 89.748299 | 1000 | 210288.731464 | 209417.965008 | -870.766456 |

| 2747 | 2023-11-30 00:00:00-05:00 | 97.834183 | 1000 | 230233.627897 | 229193.387875 | -1040.240022 |

| 2767 | 2023-12-29 00:00:00-05:00 | 102.879997 | 1000 | 244425.426549 | 243211.384577 | -1214.041972 |

| 2788 | 2024-01-31 00:00:00-05:00 | 102.879997 | 1000 | 245425.096549 | 244211.384577 | -1213.711972 |

| 2804 | 2024-02-23 00:00:00-05:00 | 107.519997 | 1000 | 257491.165093 | 256180.343134 | -1310.821959 |

here the working example:

import yfinance as yf

import pandas as pd

import matplotlib.pyplot as plt

import seaborn as sns

import datetime

import numpy as np

pd.set_option('display.max_columns', None)

# Fetch historical data

vt = yf.Ticker('VT')

end_date = pd.Timestamp.now()

start_date = datetime.date(2013,1,1)

hist= vt.history(start=start_date.strftime('%Y-%m-%d'), end=end_date.strftime('%Y-%m-%d')).reset_index()

hist['yield'] = (hist["Dividends"]/hist["Open"])

# get End of Month data (will be used in purchasing & Net worth calculation)

df_EoM = hist.filter(hist['Date'].dt.to_period('M').drop_duplicates(keep='last').index, axis = 0)

# global parameters

div_tax = 0.3 # fraction of dividends you owe to the government. consider your marginal income tax rate

tansaction_fees = 0.33 # transaction fees. for IB, around 1/3rd of a $

# prepare the data. _m for the monthly staratedy, _d for waiting for dividends

df = hist.filter(hist['Date'].dt.to_period('M').drop_duplicates(keep='last').index, axis = 0)

df["cash_m"] = 0

df["distribution_m"] = 0

df["feed"] = 1000

df["shares_bought_m"]=0

df["shares_m"]=0

df["EoM_m"]=0

df["fees_m"]=0

shares_m = 0

cash_available_m = 0

df["cash_d"] = 0

df["distribution_d"] = 0

df["shares_bought_d"]=0

df["shares_d"]=0

df["EoM_d"]=0

df["fees_d"]=0

shares_d = 0

cash_available_d = 0

# let's go

for i, (idx, row) in enumerate(df.iterrows()):

year = row.Date.year

month = row.Date.month

price = df_EoM[(df_EoM.Date.dt.year == year) & (df_EoM.Date.dt.month == month) ].Close.values[0] # close price at the end of the month

div_yield = hist[(hist.Date.dt.year == year) & (hist.Date.dt.month == month) ].Dividends.sum()*(1-div_tax) # dividend yield of a month, minus tax

# first monthly investing

# collect cash

distribution_m = shares_m * div_yield

cash_available_m = cash_available_m + row.feed + distribution_m # available cash for purchase

# buy shares

shares_bought_m, cash_available_m = divmod(cash_available_m,price)

shares_m += shares_bought_m

cash_available_m -= tansaction_fees

# Net Worth End of Month

EoM_m = shares_m * price + cash_available_m

df.at[idx,"distribution_m"] = distribution_m

df.at[idx,"shares_bought_m"] = shares_bought_m

df.at[idx,"cash_m"] = cash_available_m

df.at[idx,"shares_m"] = shares_m

df.at[idx,"EoM_m"] = EoM_m

df.at[idx,"fees_m"] = tansaction_fees

# second the dividend cycle invest

# collect cash

distribution_d = shares_d * div_yield

cash_available_d = cash_available_d + row.feed + distribution_d # available cash for purchase

# buy shares

if div_yield > 0:

shares_bought_d, cash_available_d = divmod(cash_available_d,price)

shares_d += shares_bought_d

cash_available_d -= tansaction_fees

df.at[idx,"fees_d"] = tansaction_fees

else:

shares_bought_d = 0

# Net Worth End of Month

EoM_d = shares_d * price + cash_available_d

df.at[idx,"distribution_d"] = distribution_d

df.at[idx,"shares_bought_d"] = shares_bought_d

df.at[idx,"cash_d"] = cash_available_d

df.at[idx,"shares_d"] = shares_d

df.at[idx,"EoM_d"] = EoM_d

df["diff"] = (df.EoM_d-df.EoM_m)

df.plot(x="Date",y=["EoM_m","EoM_d"],title="Net worth")

df.plot(x="Date",y=["diff"],title='Difference')

keepcols = ['Date', 'Close',

'cash_m', 'distribution_m',

'feed', 'shares_bought_m', "fees_m", 'shares_m', 'EoM_m', 'cash_d',

'distribution_d', 'shares_bought_d', "fees_d", 'shares_d', 'EoM_d', 'diff']

df[keepcols].tail(20)

follow-up question:

- 2013-2024 is one of the strongest bull markets in history. would we have the same results in a sidways-or bear market?