Mandatory taxation embedded into smart contract, the government doesn’t know what happens, it just gets its cut automatically. (smart contracts are always public by default right, so seems enforceable)

Would ethics be an acceptable answer? Would droves of people really lie on their tax declaration to save at most a couple of thousand bucks?

I’d think the same people that try to get out of taxes in an illegal way these days would do the same if the govenment couldn’t find out thier income.

A possibility is the tax offic using inversed burden of proof; they send you a four million tax bill, and it is up to you to proof you really own less.

Of course, an alternative is consumption based taxation, possibly progressive. A TVA of 30% or 40% would probably cover a lot of government expenses without need for income tax.

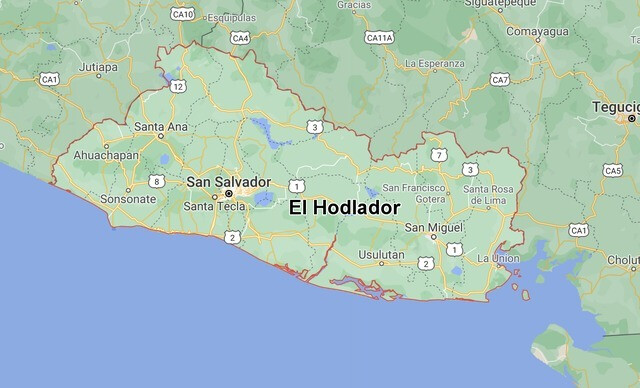

El Salvador will pass a bill next week to be the first country to recognize bitcoin as a legal tender. Economic game theory will be strong with this one if it works.

Also, Square announced the launch of an open-source renewable energy mining project

Future of Bitcoin is bright.

Wanna-be dictator of a small central american banana republic (that as of now doesn’t even have a currency of its own) announces to make Bitcoin legal tender?

Wake me up when it’s Iceland or Estonia at least.

Why you sleep during the day?

![]()

Your open-mindedness is astonishing, to say the least. “they are poor and small, who cares”.

Actually, the fact that you call them a banana republic is funny, could the petrodollars/US politics have something to do with that  ?

?

Anyway, Paraguay is expected to be next, give them a few days/weeks. Paraguay has a better football team, maybe you will appreciate that.

Have you ever been there? How is he a wanna-be dictator?

Edit: After reading the Wikipedia article about Nayib Bukele you seem to have a point.

Why are you downplaying this? Salvador has over 6 million inhabitants and a GDP larger than Iceland and Estonia combined. I was expecting that if any country embraces Bitcoin, it will be a bottom-up initiative, with people de facto using Bitcoin because they don’t trust their local currency. But here it’s the government that wants to try it. It’s a risky attempt, but since Salvador does not have its own currency and only uses dollar, and they do not replace the dollar, but simply supplementing it with BTC, then it looks like the perfect place to give it a try.

I’m not convinced if BTC is capable of being used as currency. I’m also wondering if powerful people in other countries will allow it. If one country embraces BTC, it increases the chance that more countries will follow. So there could be some resistance. I would not be surprised if we soon discover that there was a coup, or this president supports terrorism or drug smuggling and has to be taken down.

This president doesn’t seem to shy away from using the military to push his wishes through; if his adversaries would do the same, I doubt BC has anything to do with it.

https://www.nytimes.com/2020/05/05/world/americas/el-salvador-nayib-bukele.html

It’s paywalled. I found this instead:

I’m sure I’m not really up to date with Salvadorean politics, I didn’t say he’s a good guy or that everything he does is right. It’s definitely a fascinating story to a bystander. He wins popular election, breaks so many rules, yet the people still support him. I wonder how BTC fits into this picture. Maybe he doesn’t want to use the USD anymore, because they’re printing too much of it and Salvador is getting none of it?

As far as I know, they don’t have a relevant oil producing economy.

Not according to World Bank:

| population (07/2021 estimate) | GDP nominal (mln USD), 2019 | GDP per capita (USD), 2019 | |

|---|---|---|---|

| El Salvador | 6,528,135 | 27,022.64 | 4,187.30 |

| Estonia | 1,220,042 | 31,471.10 | 23,717.80 |

| Iceland | 354,234 | 24,188.04 | 67,084.10 |

I have got nothing personal against El Salvador. But here’s the thing: With a per-capita GDP of less than 400 USD/month more than half of the population “unbanked”, it’s macroeconomically just pretty irrelevant - let alone a blueprint for more developed societies - of which Iceland and Estonia are both at the forefront of digitalisation.

PS: Also, every article about this refers to this Jack Mallers guy that we’ve touched upon before. And as I’ve said before, I’m not impressed of that guy. He rathers weirds me out in a way. To me, it seems like a publicity stunt that will quickly fizzle.

Indeed, I just heard that 70% of the population does not have a bank account. But someone will probably say that crypto will enable more people to access to financial services…

- It seems to be about remittances from abroad and helping the unbanked:

"El Salvador… depends heavily on remittances sent by Salvadorians from abroad. Around a quarter of the country’s citizens live in the US, and in 2020 they sent home more than $6 billion in remittances … making up more than 20% of the GDP. …a big chunk of those 6 billion dollars is lost to intermediaries. By using Bitcoin, the amount received by more than a million low income families will increase in the equivalent of billions of dollars every year.

Bukele also said that Bitcoin will help increase financial inclusion in El Salvador, where 70% of the population does not have a bank account and relies on the informal economy. “Financial inclusion is not only a moral imperative, but also a way to grow the country’s economy, providing access to credit, savings, investment and secure transactions,”

- I can see why BTC makes sense for El Salvador in the short term but even crypto experts seems to question its competitive advantage vs. other monies in the long term:

“…some crypto experts have criticised the move saying that El Salvador could have looked at crypto options that would work better as a currency than Bitcoin, whose three transactions-per-second processing rate is seen as too slow compared to other virtual tenders such as Bitcoin Cash or Monero.”

OK, so they’re pretty comparable in nominal terms. On PPP basis Salvador comes out on top. 6.5 million is 0.1% of World population, which is a nice start.

The bill was passed this morning!

I know I am a fan boy but I truly believe the historical importance of what is happening is huge. They could have created their own digital currency, but no, they went with bitcoin.

Also a point that some may be missing, but the implementation of the bitcoin wallets will be immediately on lightning (thank you Jack Mallers) , this is a massive step forward for this technology and to make bitcoin a currency.

I was not expecting country adoption this cycle and yet, in just 6 months we had:

- institutional adoption

- new ATH in price and user adoption for both layers 1&2

- country adoption

- miners going out of China (eg El Salvador will mine with geothermal energy)

- soon: Taproot activation

Truly mind blowing.

Next 6 month could be fun

Too bad I’m out of cash, won’t sell VT to buy crypto  .

.

By the way, since many btc owners are HODLers, who try not to look at the price, I guess the most coins being traded come from short-term speculators. There was some chart to demonstrate it.

What I wonder is, how does velocity of money influence the price of BTC? What would happen if the number of possible transactions increased significantly? Would this have any effect on the price?

Oh, and the nominal GDP of Salvador is $27 billion, compared to the market cap of BTC, that’s just a few percent. That is actually incredible, that BTC has become so big, that its market cap dwarfs the GDP of many countries.

No problem: You have enough TSLA to sell, don’t you?