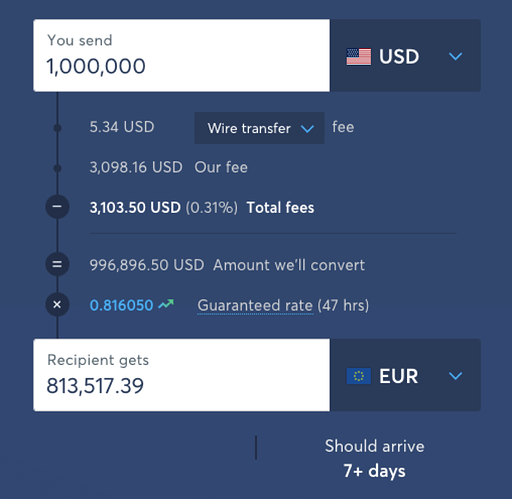

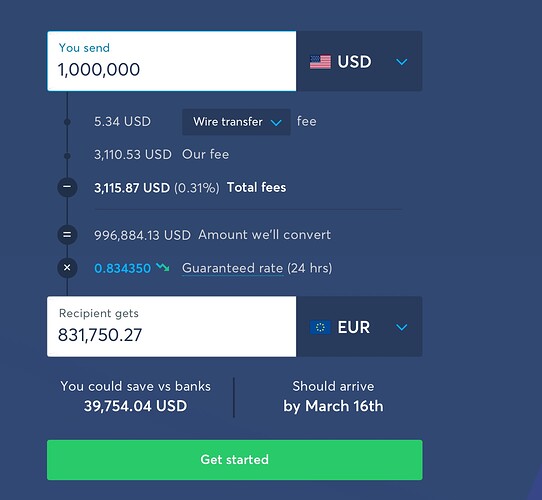

Yup, smells very bad:

The claim:

If I wanted to send $1,000 from Chicago, USA to Berlin, Germany, Strike is able to take my US dollars and deliver them to the intended Berlin resident in Euros instantly and at no cost.

And it’s possible, because:

Strike then automatically converts my $1,000 to bitcoins ready for use in its infrastructure using its real-time automated risk management and trading infrastructure.

Sure, because processing digital operations doesn’t require energy and energy is free.

Strike then moves the bitcoins across the Atlantic Ocean where it arrives in one of our many European infrastructure pieces in less than a second and for no cost.

Sure, because the Bitcoins were physically located in Chicago and are not a decentralized asset that’s not located in a single specific location.

Strike then takes the bitcoins and automatically converts them back into Euros using its real-time automated risk management and trading infrastructure.

And that still either doesn’t require energy, or uses free energy, or that energy cost is gifted by Strike because Strike is a charity that not only doesn’t expect to make a profit but is willing to register a loss in order to process our business.

Also:

Real physical value escrowed thousands of miles, in real time, and using USD and EUR at the user’s convenience

Neither fiat nor bitcoin are real physical value, unless the claim is that the actual paper notes were teleported across the sea instead of other bills being issued, to which we give the same value because we have faith in their issuer, or just digital data, because money is fungible.

This smells like wishful thinking and scam, I’d not touch it with a 10 foot pole.