Doing exactly that lol. First I add it the wrong way (as Anlagefonds) to get all the values from EasyTax automatically. Then I add it as a share and enter all the values from my screenshot.

You just have to delete the last row. Maybe also the 1st row. Only put the values inside where you actually had the shares.

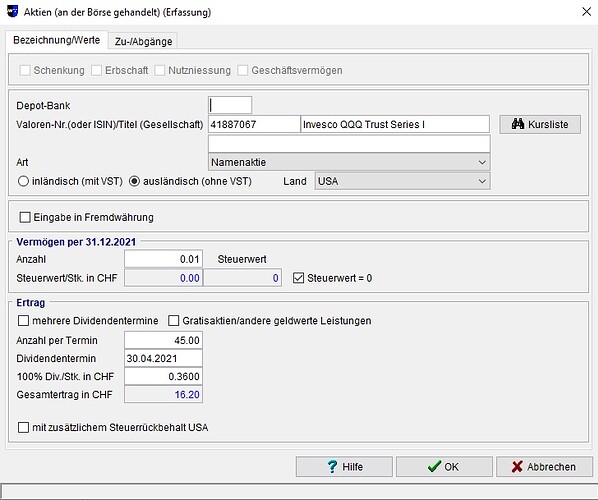

What’s also not perfect: You can’t have 0 shares at 31.12.2021 from which you received dividends lol. That’s why I put it at 0.01 and Steuerwert = 0.

The whole tax programm is a mess for investments.

First time I need to fill it out as last year I was a few bucks below the threshold.

I mainly don‘t understand how I declare how many shares I had at each dividend date. Anyone from Canton of Bern able to help?

Just put in your shares at the end of the year and put in the dividends yourself.

Say you had X shares of Nestle on 1.1, and 100 Nestle shares on 31.12, then spread your Nestle position over a few entries/lines:

X shares already owned at 1.1. 21 (no date to enter Kaufdatum)

Y shares bought on dd.mm.21

Z shares bought on dd.mm.21

where X+Y+Z =100

that way it’ll automatically “calculate” the dividends acc. to the number of shares you held on ex-dividend day.

of course a bit tedious solution for lots of trading…

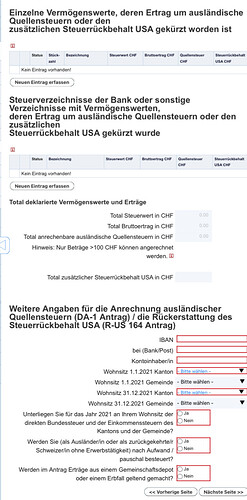

Anyone from Zurich here filing the DA-1?

Individual stocks, e.g. Nike are automatically moved into the DA-1 section using the online tool. However it appears impossible for any ETFs. Anyone have similar problems and need to do it manually?

Just read literally 10 posts above, please.

I believe the issue is that most ETF are missing the “(Q) With foreign withholding tax” label in the ICTax database at the moment. I see it only for VTI and VXUS among my ETFs, and those work when I try to look them up in the DA-1 form.

I’ve sent a request to fix the data for 9 other ETFs I own via the contact form today. We’ll see if it gets fixed.

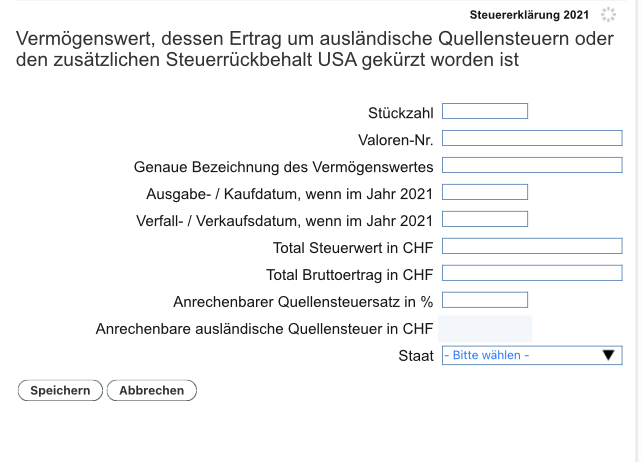

In the meantime I was bored and just filled in all the data manually ![]()

We probably should synchronize so as not to spam them ![]() I also asked them to add Q for VB and VEA today.

I also asked them to add Q for VB and VEA today.

Thanks! I will wait for a few days then. Even VT is missing which I need plus VYMI, VTV, VBR and VSS.

VT did work for me in ZH

Yes, VT had the (Q) added on the 25th: ICTax - Income & Capital Taxes

And it shows up in the “DA-1 Wertschriftenverzeichnis”? Because I will get a prompt saying that VT (ISIN: US9220427424) cannot be found. Can find it though in the normal section “Wertschriftenverzeichnis”

Yes, VT is found by ZHprivateTax with that ISIN in DA-1 since the 25th. “Wertschrift suchen” => Enter ISIN => “Suchen” and the dividends are correctly listed with the 15% US WHT. Just tried again with the demo version and it works there as well.

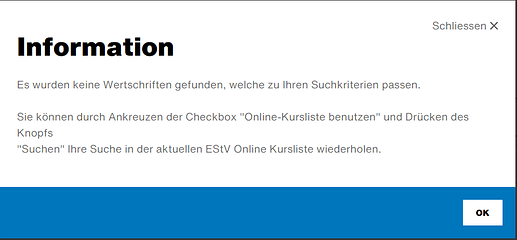

This is getting too annoying. It does work in the demo version for me, too but fails in the regular application. There I even receive the following notification. Anyone knows where this magic “Checkbox” is supposed to be!? ![]() I will probably gonna contact the technical service…

I will probably gonna contact the technical service…

They’re quick! I’ve already got a response this morning, and all my funds now have a Q, and they’ve added a missing fund that was established last year.

Btw. this is the form I’ve used: Contact the FTA

Hi,

By reading this thread, I calculated that I could clame 130chf back of tax.

I have found the pdf form for my canton (Geneva). It will be the first time for me to fill a complete tax declaration (named Taxation Ordinaire Ultérieure TOU).

I cannot use the GeTax software yet. I do not have an Tax Number ID.

Did you submit separately a PDF the first year or did you wait for your Tax ID ?

In Geneva, the DA-1 must be sent together with your tax return. The amount (if accepted) will be deducted from your final tax bill.