Oh man, I wish I had seen this before filing it manually. Next time. Thanks!

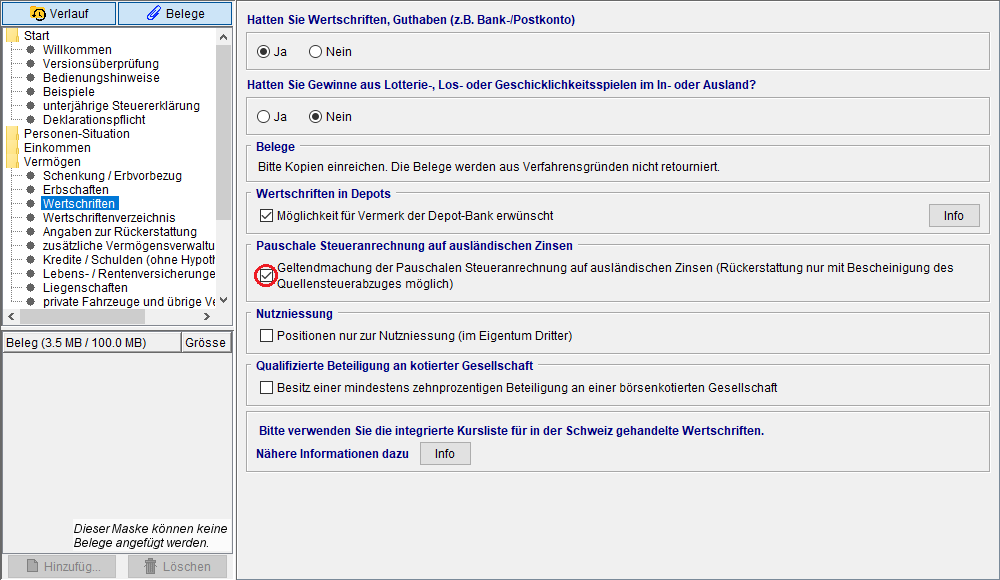

I click this box right?

Chose Aktien/shares and then enter it like that?

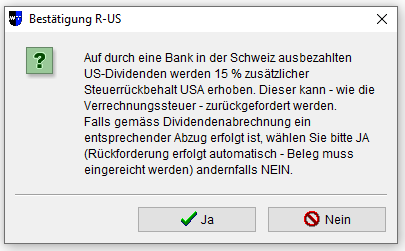

Then I chose NEIN/no so that the box “mit zusärtzlichem Steuerrückbehalt USA” won’t be selected. This way a DA-1 form is included in the tax declaration. If you chose JA/yes, then you’ll end up with a RUS form which is wrong?

DA-1 for US dividends from US brokers and RUS for US dividends from Swiss brokers?

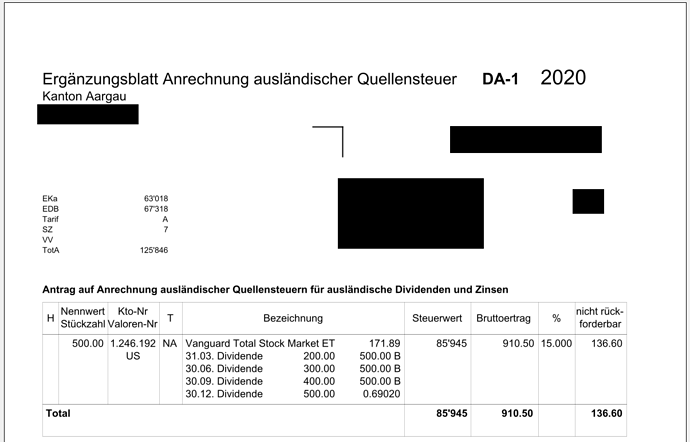

I got this at the end of my tax declaration (I increased the dividends for this example because otherwise I wouldn’t be above the required 100 CHF). So it actually works!

Yes, I checked mine, I did the same. Will handle in it today. Fingers crossed

Thank you for updating us in the future!

Thanks to this thread I managed to do it right this time. Everything in DA-1 showing now.

Is there anything special required from the IBKR output?

Actually, last year I did it for the first time all online (Zurich) and did not have to send anything separately for DA-1. Can someone confirm that I have done right? ![]()

How do you see if you got a refund?

Past years I got a letter in the mailbox 1-2 months after filing and soon after the money was in my account. Haven’t got anything yet for 2021, I only filed end of November but I suddenly got worried that I might have missed something.

So it’s not just a reduction in taxes but an actual seperate refund?

Yes, I receive money in my bank account a few months later.

it’s the 15% tax that the US withheld on your dividends

I know but I assumed that they will just subtract it from the taxes that you need to pay. An actual refund on your account sounds great, so you know if it worked.

Actually, the DA-1 refund takes a couple of weeks. The processing of the tax declaration takes about a year. (ZH)

Yes, since tax year 2020 there is no need to separately print and send DA-1 anymore, if you use ZHprivateTax online. I filed my taxes in February and got the DA-1 refund in June.

With CHF 427 in dividends I can’t get a refund on my CHF 64 in lost dividends as it’s below CHF 100. Too bad.

At least those CHF 64 are subtracted from my income, so I save CHF 16 on taxes lol.

Nearly the opposite in TI ![]()

Can confirm. I submitted my tax return early March and still haven’t received any letter from the ZH tax office

Mileage may vary whether the canton’s tax office or the gemeinde controls your declaration. The easy cases are done by the gemeinde, but as soon as you have more than a job, a house and a couple of bank accounts, it gets moved to the canton

I had the impression the biggest difference was between tax at source vs. not (at least in Zürich).

On tax at source, it took 9 months - 1 year regularly. Now it takes a couple of months.

If anything my taxes are (slightly) more complex now.

You can avoid those automatic fillings by a workaround.

Search for a post of mine with an example and screenshots in the other Tax return topic.

If I find time later I will link it here.

Edit: found it pretty quickly, here for reference: