OK I think I finally “cracked it” (for Basel, BalTax), so I am sharing my approach here - for validation. ![]()

How I did it was:

- Find ISIN of the US ETF (e.g. VTI)

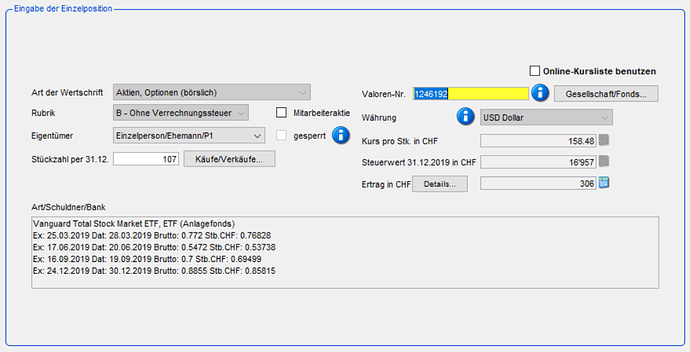

- Use ICTax to find Valor Nr. (e.g. 1 246 192)

- In BalTax, add new entry and first use Valor Nr. with search function, to get my values automatically calculated based on No of holdings

- Screenshot Step [3] and cancel that entry - because it classifies it automatically as “B - Ohne VSt.”, which is wrong, we need “DA-1”

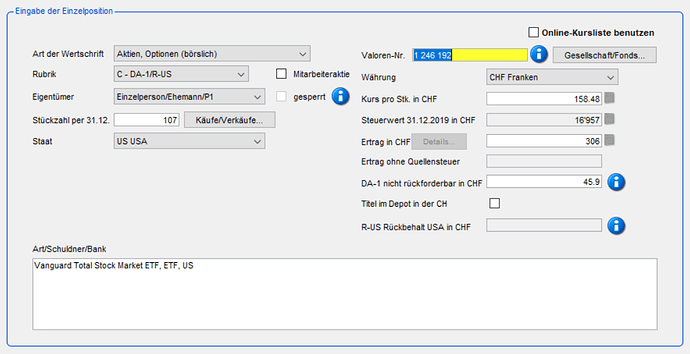

- Add new entry - without using the search function, but fill in all things manually based on [3], classify as “DA-1”, set US as country (I also filled in the value in CHF immediately rather than using the calculator to add in USD) & Save, as in [5]

Outcome in the generated final PDF report:

- Antrag auf pauschale Steueranrechnung (DA-1) - now has an entry

- Antrag auf Rückerstattung des zusätzlichen Steuerrückbehaltes USA - empty

Does that approach and outcome look correct?

Thanks!

[3]

[5]