Have someone experience really long time to load the account management web interface ? (old one and beta one ) Because it takes more than 20 sec to load any page on this interface.

yes, i observed that the account management site takes above average loading times.

Dear all,

to check the withdrawing from my IB account i looked o the functionality. I found it, but to my surprise the following displayed:

Being a good mustachian, i have only few idling swiss francs in my account. however i seem not allowed to withdraw them or a fraction of it.

Does anybody know about? there is no margin involved.

That is a good question. Have you tried asking the support chat? They are pretty competent, maybe you need to add like an approved account or something. It does kind of look like a measure to prevent someone just logging in and transferring everything to a numbered account in north-Korea or something. Or maybe it is just a minimum.

yes, i did send a ticket. and i posted it here for sharing my experience.

that could make sense.

however i also saw the option “withdrawal to third party account”. i didn’t dig here …

ofc I’ll share what comes out of this. Anybody so far discharged cash from IB?

I do it almost every month (I use the functionality to convert to EUR cheaply and transfer to my EUR account abroad). No problems so far.

I’ve done it as well, no problems and no extra fees. Could your cash balance be the result of a transaction that hasn’t settled yet?

hey all, IB customer support answered

this applies since i just transferred my monthly savings. so they have a 3 day lock-in of funds whenever you transfer some. i guess i dont mind to much, but i definately don’t like it either.

Heyall,

i have another question after a few months with IB.

I expected to pay CHF 10 per month (since my stash is still <100k), but i can’t find it anywhere. clearly i don’t spend that much in commissions, so what’s up? does anybody have a bill or statement, showing the monthly fee?

thanks!

first 3 months are free. If you already trade for more than 10.-, you will pay no fee

Here is another bit of information that fits into multiple threads on this forum…

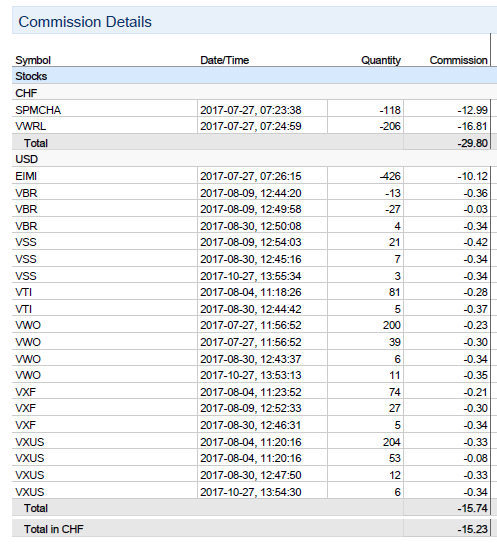

after 3 months of monthly rebalancing by adding funds with my new IB portfolio, i can present commissions paid so far. commissions dominated by selling my former CH & IE- based funds that i transferred ti IB from my former broker (SPMCAH, VWRL & EIMI). the vanguard trades average out slightly below $0.30 per trade, where the volumina ranged between $100 and $10’000. amazingly low cost! howevers, soon i’ll be charged chf 10 per month ![]() which in turn are over- compensated if i wanted to do the same monthly funds adding with Corner Trader

which in turn are over- compensated if i wanted to do the same monthly funds adding with Corner Trader ![]() gogo, $100’000 should be rachable by end of 2019!

gogo, $100’000 should be rachable by end of 2019!

@nugget I have VUSA by Corner Trader. How can I transfer it to IB? As soon as I transfer, I guess I should sell it and buy VT or VTI, right? Btw, I would not like to close CT. I also hold VEUR there. Does it make sense to keep it? What else could I hold at CT, so that they don’t close my account?

Also, @hedgehog said that for some potential hypothetical tax reasons (which I don’t fully understand), it would be better to split VT into VTI and VXUS (I would not like to go so much into detail to split VXUS into VEA + VWO). How big is the risk and should I really make this split?

after you opened an account, they have an asset transfer formular. CT has it, too. you need to file each broker’s formular, and then they will take care of it.

transferring assets and closing down the account are two separate, independent actions. They don’t close it without you asking for it.

this depends only on your wishes for your asset allocation.

Dear all,

hope you are doing well during christmas period!

when attempting my monthly rebalancing for December today, i encountered a yet unseen problem, and I dont have a clue:

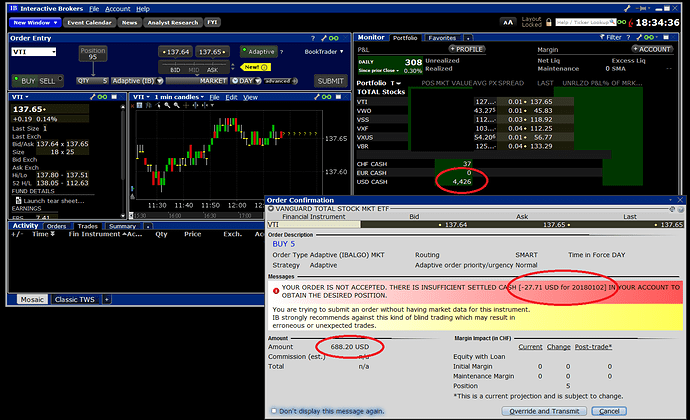

trying to purchase a few shares of VTI with some dollars I just converted from CHF, IB tells me I could not place this order because there was insufficient cash:

clearly, I have enough USD in my account.

Anybody saw this before?

btw this is a non-margin account, and there are no open orders whatsoever. Restarting the client did not resolve it.

Thanks for any contribution!

[edit]

quick as IB people are, i got a reply from customer support within half an hour:

FX conversion orders settle at the end of the day two business day’s after the execution. This account will have settled USD cash of 4,425.53 on 1-3-2018.

Also any MKT order add 5 % to the order amount at the Credit Check step. Always use a Limit order type when using the remaining funds in the account. Your order to Buy 5 shares of VTI which is trading art 137.60 USD at this time requires 688.25 USD settled cash. A MKT order will add 5 % to that as there is no certainty at what price a MKT order will actually execute. So the same 5 share order is Credit Checked as needing 722.67 USD.

this is interesting, since my activity statement clearly indicates that in the last months i always purchased my ETF shares only minutes after the FX conversion. Anyone saw this before?

thanks for your reples!

As mentioned by IB, you should use “limit” instead of “market”. “Market” can be really risky.

However, I don’t understand the answer. Does this mean you need to wait two business days before placing an order after a fx conversion ? I wonder if this requirement is due to the new year/new month time frame

I have also always placed my order just after the fx conversion.

Jeez, just convert to a margin account already and stop worrying about minor shit like that. Life’s too short

As @wapiti said it might have to do with new year ?

I’ve also always placed orders immediately after currency conversions and they’ve been executed instantly…

There is no catch? For the time between the purchase and the settlement of your fx trade, they are lending you money. They do this for free?

When you purchase stock, cash is settled after 2 or 3 business days during which they will not charge interest. If there’s bigger delay between the settlement date and when your cash arrives, I guess you’ll get charged a little - but at current interests it’s frankly not worth my time to think about it

Trading art… ![]()

What is IBALGO?