Normally I go to Account/Account Management Home, and on the page that opens, Reports/Activity/Statements

thank you for the hint.

It seems like this option is deactivated in paper trading ( can ayone confirm?)

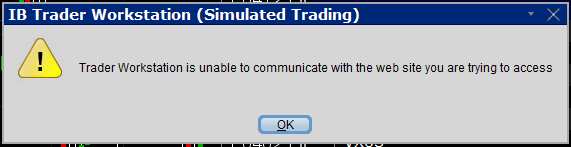

since i try this error message comes up instead of the

account management home window

I don’t know if this works for paper trading accounts, but you can also try to log in to the website directly: https://gdcdyn.interactivebrokers.com/sso/Login

that was the golden hint, thank you!

perfect reporting they have^^

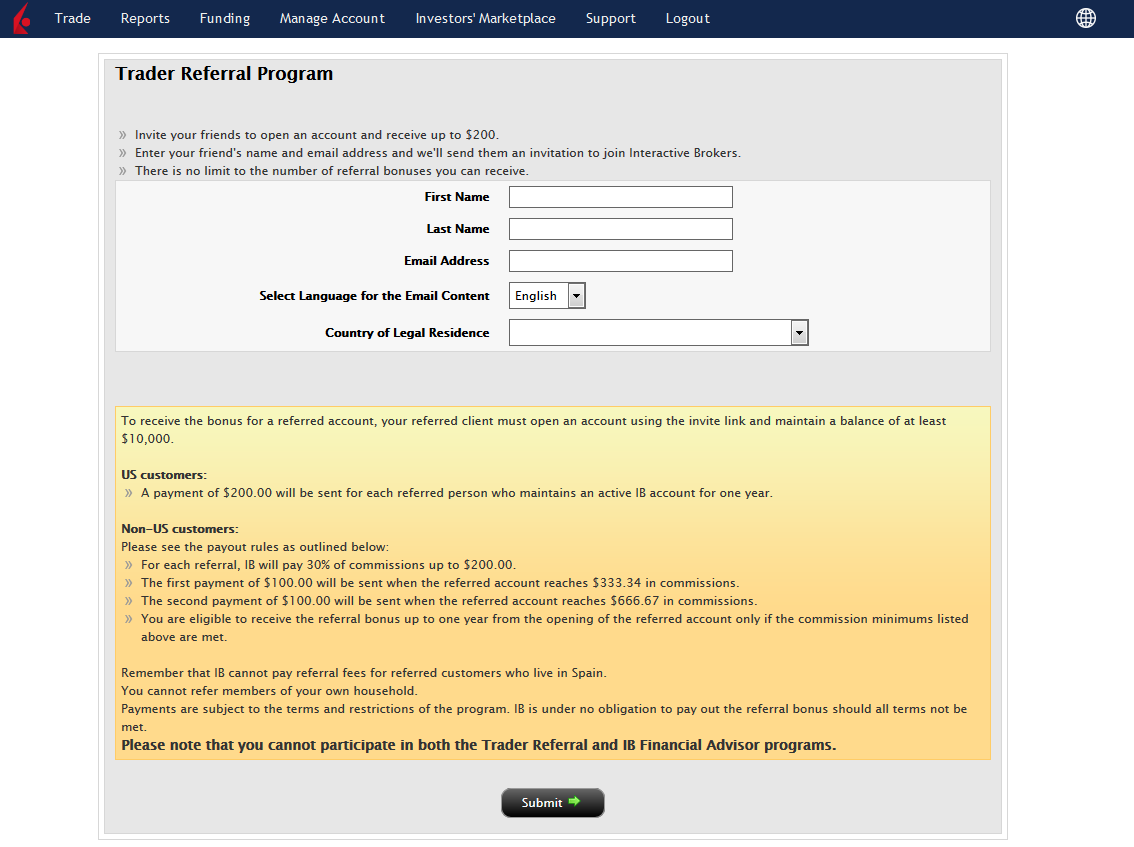

I just found IB offers referrals of up to 200 US. so if someone is inclined to open an account there, maybe i can refer you! just pm me ![]()

wohooooo the first CHF 100 will be paid after you generated $333 worth of commissions. hm when is that hapening? during your third year at IB, considering chf 120 yearly costs ![]()

or maybe even never, if the “idle fee” does not count ![]()

ah and it is limited to the first year. so, goodbye, referrals ![]()

so I finally swiched, my IB account is up and running. I am looking forward to implement my new portfolio, and pay zero commissios! but 120CHF/y idling fee until my depot is worth 100k… should be done within 1-2 years with the current cash flow.

If you have any questions on swiching, maybe i can help!

If you are below 25 the idling fee is just 3$ per month (36$ per year) this is like 2 trades at Saxo/IB and if everything keeps on track I am going to hit 100k way before I hit 25.

Overall the conditions are very good, interestingly the commissions for SPCHMA are really high at IB (20$ per trade) so I might be looking for a more favorable CH ETF at some point.

It’s not for just this ETF, it’s a european thing - trading on european exchanges in general is batshit expensive. For CH, IB is charging 0.08-0.1% or so, not fixed $20.

Why home bias anyway?

That is a good question since I am probably not retiring in Switzerland but with just VT my portfolio would feel a bit too lazy. I do not know but this is a question for another thread, I do not want to hijack this one.

One more thing that makes me wonder about IB: in their Messaging support, the answers to my questions get answered by Lisa, not like a customer support person but plainly Lisa. Even when I ask them for who i should enter in the “contact person” field on the CT securities transfer form, they say “Lisa - Transfer Desk”. Feels a bit odd to me. anybody having the same experience? It’s up to now the first thing that I would not consider “professional” with IB.

Best,

-nugget

Well I never tried their messaging support, but however I already phoned their support team twice.

They were very effective and professional, so from this point of view I would not worry more than needed about IB Professionalism.

It might be that Lisa is simply the code name for support team

Yes that is what i thought ![]() I just wonder that they use this name also in B2B relation

I just wonder that they use this name also in B2B relation

I’ve only ever chatted with the support team, and it was usually a different person but it seems to depend a lot on the kind of issue you have. When I was asking about transferring shares, I always ended up talking to the same two people.

It’s not too weird that they ask you to put Lisa as the contact, she’s probably the one handling your case and it’s easier if she does the whole thing rather than have to keep switching between different support people.

so finally my funds arrived at IB after transferring them from CT. there were three days when neither of them showed the assets - that was scary!

but now im on to my final portfolio!

thanks to all who helped out by providing key information!

If you’re trading VT, remember to buy it when NYSE ARCA is open (there’s a time zone shift). It’s open from 9:30-16:00 ET. That is 15:30-22:00 CET (Zurich).

It cost me lots of nerves in the beginning when I tried to trade on weekends or in the mornings during the week.

Really good point, I did the same mistake. Don’t forget to check bank holidays which are not the same as in Europe

yes, i want to make sure to trade in these hours.

what time is good for usd-chf conversion, 15:30-16:00?^^

i dont’t get it, why whould you want to trade during these times? weekday evening for ARCA trades

also a good one!

I also got a friendly (really!) call from CT, they asked why i swiched and if i could confirm the arrival of the ETFs in my new depot.

From experience Forex works all the time. [quote=“nugget, post:37, topic:355”]

i dont’t get it, why whould you want to trade during these times? weekday evening for ARCA trades

[/quote]

Because during the week I’m busy most of the day and usually in the evenings. It was just a rookie mistake.

Hey all,

i recieved advertisemen from IB about their Stock Yield Enhancement Program, which, as far as i understood, means lending my own shares to short sellers at IB, yielding in some interest payment for me.

To me it sounds like “hey, add another risk to your portfolio for some additional yield”. A priori i dont like it and i won’t go into it - but i wanted to hear some other people’s opinions about it. does anyone have experience?

Unless you hold heavily shorted stocks (which should make you think twice about them), you’ll get paid pennies for most stocks, not making it worth your while. You lose sipc protection on loaned out shares, there are additional risks, potential tax complications.