Hi everyone,

My wife will likely receive a gift from her parents, in EUR currency.

I checked if there are possible taxes to be paid, and it seems this is not the case (majority of Cantons, if parents donate to children without need to pay sort of tax).

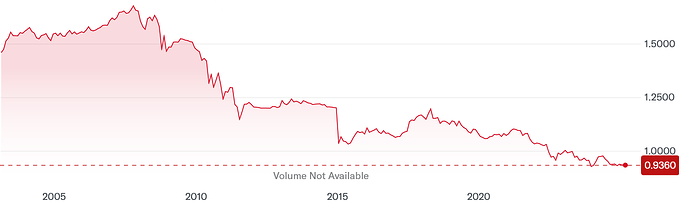

The main question we have, if about the convertion itself: at this moment, selling EUR to purchase CHF is not favorable, therefore wondering if we should keep the currency and after the bank transfer, to invest the amount directly in EUR (not even sure if that’s possible).

Keeping the amount sleeping into a EUR bank account with a near-to-zero interest rate, is obviously a no-go.

My wife is concerned about the convertion rate which is not favorable in this scenario.

Another option she was thinking about was to ask her parents to keep the amount on their bank account and select a possible investment solution, in case (theoritical) in the future she might want to use this amount for a (little) real estate investement abroad.

Since this is just theoritical and in case of a transfer, the topic of the convertion rate will be always there (favorable and not favorable thus), I tend to suggest the option to receive the amount and check the possibilities.

What would you suggest?

THank you in advance

Best,

Cap