@wapiti, @ParaStachian : With these tables, someone who retires with a 1,5 million CHF net worth will have to pay almost 3kCHF of AVS per year. Compared to the 60CHF he could withdraw with the 4% rule, that would make 5% of his budget! Totally non-negligible.

@Grog : Sorry but I disagree. I still think the 4% rule is flawed in Switzerland, and also in the US. Let us try to find pro and counterarguments in a constructive way. I will suppose that most of the community invest in a indexing way.

Good points for Switzerland :

- Taxation. I made a mistake in my first post, and a very big advantage of Switzerland is that capital gains on the stock market are not taxed. They are in the US. Depending on your investing style, that can be a really great advantage. On the less bright side, we just saw that 5% of your budget will go in the AVS contribution.

-Bad for Switzerland :

If you decide to index the Swiss market :

As I said already, the Swiss market has been les dynamic than the US one, hence less returns. I cannot find older historical data, I would be interested if someone can provide them.

If you decide to index the US market instead of the swiss market :

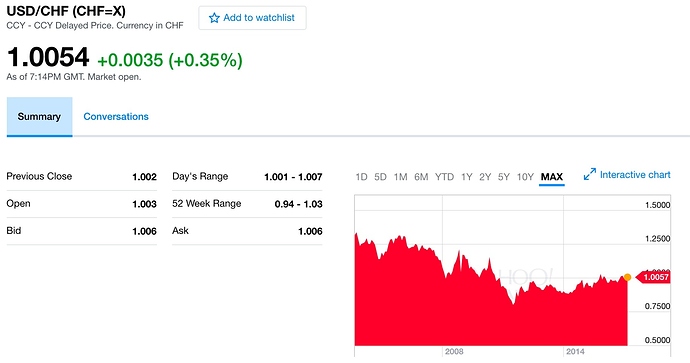

Well the dollar has been continually losing value against the franc. 30% in 20 years… That makes 1.3% of relative loss per year. Of course past returns are not the same as future returns, but still, with the available data, a swiss investor would have earned much less returns than his american fellows.

-Regarding cheap healthcare insurances : I don’t know about you, but although I agree that currently in Switzerland healthcare a insurances are relatively cheap, it seems that the premiums have been constantly raising in the last few years. Between 2016 and 2017, the cheapest insurance available for me made a 10% jump in its premiums. At this rate, cheap healthcare won’t be cheap for long.

-Neutral points : Social Security. As I said in the AVS topic, it really depends in how much you contribute. I saw in your presentation post that you plan to retire at age 50, so I guess you will have contributed around 30 years, which is a lot, so you will have a substantial retirement rent from AVS. For other people like me, my contributions won’t be much more than 10 years, so the rent from social security is much less substantial…

Points that are independent of USA/Switzerland :

-As pointed several times in the topic and in Nugget’s link, the 4% SWR only guarantees that after 25 years, i still have some money left. With the trinity study criteria, if you have 50 CHF on your bank account after 25 years it is a success. So if I retire around 40 :

-I expect to live much longer than 40+25 = 65 years.

-Since I did not contribute a lot to AVS, if i only have 50 CHF when i’ll be 65 i am screwed.

-Good luck to find someone willing to hire you if there is a tail event when you are 55/60.

Plus, on the qualitative side : early retirement at a young age means that you will be able to do what you would like to do if money was not a decisional factor. It would be very crushing for the soul to go back to unwanted work (and it is not a supposition : Charlie Munger explained perfectly the “deprival super reaction tendency”, which is one of the cognitive biases we are subject to. See for instance his speech on the 25 factors of human misjudgment or this page : Latticework of Mental Models: Deprival Super Reaction Tendency | Safal Niveshak).

I am very open to counter arguments, but the points listed in my post make me think that overall, the 4% rule is still flawed. On the contrary, I would be very glad if you’d show me where I could be wrong