Anyone knows the exact calculation for the DA-1 Refund?

I got it back this week and noticed they paid me less since they calculated some kind of expenses before calculating the final amount.

They deduct ‘Kosten für die Verwaltung des beweglichen Privatvermögens’ (and interest on debt) from the gross dividends because you don’t pay taxes on that. This is done proportionally to your taxable net worth.

Let’s say you have invested CHF 100k in VT, have a VT gross dividend income of CHF 2000, have a taxable net worth of CHF 300k and have deducted CHF 600 for the management of your wealth. As your investment in VT is 1/3 of your taxable net worth, they will deduct CHF 200 (600/3) from the CHF 2000 VT dividends. This leaves CHF 1800 as taxable DA-1 earnings. Then they multiple this with your effective income tax rate, e.g. 20%. This results in a maximum DA-1 return of CHF 360. This is higher than 15% of CHF 2000, so in this example you get the whole CHF 300 back.

However, if you have relatively high deductions or a relatively low effective income tax rate, the maximum DA-1 return may be lower than the 15% of the gross dividend, in which case you get less back. The reason is that effectively the US taxed you more than Switzerland and Switzerland will never return more than what you pay in Swiss taxes (for the DA-1 assets).

(Foreign-Dividends - (Foreign-Assets/Total-Assets) * (Debt Interest + Cost)) * Tax rate

Thanks. I have to check all numbers carefully. At the moment it seems that the “Vermögenvervaltungskosten” that they use to calculate are bigger than what I’ve declared on my tax forms.

I can deduct more next year then

Why „US“ dividends?

Isn‘t there many other countries that have withholding taxes that can be refunded through DA-1 in the same way?

Yes you are right. Should be foreign dividends

Found this: Tax declaration guide (4/6): Wertschriften - mypersonalfinance.ch

The DA-1 form is most commonly used to recover US withholding tax. In theory, though, you could use it with other countries. The necessary condition is that a tax treaty between the foreign country and Switzerland exists. Find here a full list of applicable countries as of tax year 2019.

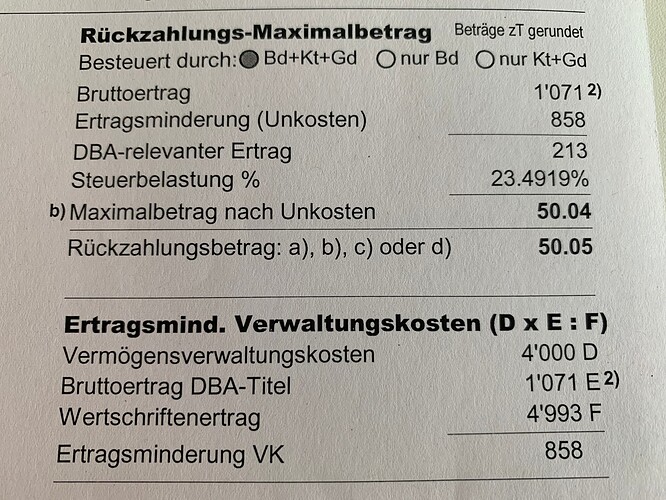

Hi guys. I got a letter from the tax office. I requested 161 CHF return, they awarded me with only 50 CHF.

Here’s the calculation logic:

This is my last year of DA-1 return, because I replaced my VT with TSLA, which so far pays no dividend.

But I don’t quite get this calculation. Up until now, I would always get my refund in full. In 2021, I earned 1071 CHF dividend, for which I payed 161 CHF withholding tax. Then they reduce the dividend by “Unkosten” of 858 CHF. Why?

The formula for Unkosten:

Dividend x Self-Management Cost / Securities Income.

1071 x 4000 / 4993 = 858

What is Securities Income again? (Edit: I checked, this is the sum of my IE-domiciled + US-domiciled dividends for 2021). Still don’t get why should this be deducted from my dividend. What’s the logic behind it?

You don’t pay taxes on deducted wealth management costs. So they essentially calculate how much taxes you pay relative to gross dividends. This is lower than the overall income tax rate as the latter is calculated relative to (income - deductions). If that reduced tax rate is below the 15%, you don’t get the full refund (as it’s only a double taxation relief).

The goal of the DxE:F formula is to determine the proportion of the wealth management costs that applies to DA-1 securities, i.e. VT in your case.

As per the beginning of this topic, they used a different formula in the past where they calculated the ratio based on asset value, not based on dividends. Having a large amount of non-dividend paying securities makes the new formula worse for you.

Thanks. That would explain what happened.

So I worked out the simplified formula for the refund to be:

refund = min(US_div * 15%, US_div * eff_tax_rate * (100% - mgmt_cost / (US_div + IE_div)))

In my case:

refund = min(1071 * 15%, 1071 * 23.49% * (100% - 4000 / 4993))

= min(161, 1071 * 23.49% * 19.89%)

= min(161, 50.04) = 50.04

I am mostly interested in the following bit:

100% - mgmt_cost / (US_div + IE_div)

So if your management costs (which are capped at 0.3% of your total portfolio) exceed your total dividend, you get no DA-1 refund, as this formula above goes into negative, right?

So let’s consider a typical case:

portfolio_value: 1'000'000 CHF

management_rate: 0.3%

management_cost: 3'000 CHF

dividend_rate: 2.00%

dividend_income: 20'000 CHF

reduction_rate : 3'000 CHF / 20'000 CHF = 15.00%

But in my case, the dividend income is very small (only 5’000), which makes the reduction super high. So I guess once TSLA starts paying dividend, I should get a smaller reduction? And the self-management cost is anyway capped at 6’000 CHF, so that means above a portfolio value of 2’000’000 CHF, it will stop growing, right?

I have to say, this formula is very convoluted, and I will surely forget how it all works in a week, or so. Now imagine someone new comes and asks “is it worth it to hold US-domiciled stock and get a DA-1 refund”? The only answer will be: it depends on 10 different factors. Whenever I deal with taxes, I just want to ![]()

(Small correction: 0.3%)

Yes, I assume that would be the case. And that makes sense, in my opinion. If your deductible management costs are higher than dividends, you don’t pay any Swiss income taxes on your dividends. This means that there is no double taxation and thus, also no basis for double taxation relief.

Yes, that seems correct to me.

I agree, it would be nice if it was simpler. However, it does make sense that Switzerland makes sure it doesn’t provide a refund for something that you don’t actually pay.

Uncertainty of US WHT refund in the long term (especially after retirement) is one reason why I’m shifting a part of VT into VEVE+VFEM.

Isn’t something like that happened in Germany a while ago and someone got caught getting millions of refunds for nothing?

Yes, I assume you mean CumEx-Files - Wikipedia

Not quite the same but it was indeed also a ‘refund’ of taxes that weren’t paid in the first place.

Thanks, I corrected my post.

Well, kind of. The portfolio management cost is a virtual cost, but it is something you have to do, regardless if you have income or not. But yeah, I guess it makes sense to compare that cost with your actual securities income. If long-term your costs and higher than your income, then you shouldn’t be investing (save for the cases where you make most money on capital gains).

What I did is I sold VT and put all in TSLA, and in my Swiss broker I hold VWRL. I wish there was an accumulating UCITS Total World ETF available, as I don’t like that I receive dividends in USD, which I then have to reconvert to CHF.

Since last week there is one: Most cost-efficient European ETF - #55 by leman

I hold both VT and VEVE/VFEM at IBKR, so I don’t really mind the USD dividends.

Is this formula still valid?

I have an apartment with 700k mortgage and a tax value of 360k, so negative wealth.

I have no idea how the tax office handles negative values.

As I understand it, the amount of debt is not directly relevant in the calculation. I.e, ‘Total-Assets’ should match ‘Total der Vermögenswerte’ before debt is deducted and thus, should always be positive. It’s called ‘Wert Total Aktiven’ in the DA-1 calculation in ZH.

Does anyone know how much you can deduct for wealth management?

It’s not the same in all cantons. In ZH you can deduct a flat fee of 0.3% of the tax value of all securities managed by a third party, up to a maximum of CHF 6’000. Proof is required for higher deductions.