Excellent, thanks. I love how shareholder-friendly Switzerland is: no capital gain taxes and deductible management fees ![]()

Btw, do you guys indicate every single stock trade for the whole year when fillig out your taxes?

Seems very tedious ![]()

Nope, basically I have a line “IB cash” where I show interests and “IB Depot US” where I indicate the dividend for obtained over the year (I have only VTI and VXUS) in CHF as indicated on the IB report (which I attash).

Worked in Zurich, trying it out now in Aargau.

Excellent, thanks.

One last question: How can I verify in the Zurich tax form if the 15% withholding tax will be refunded to me?

There are two options:

-beantragte ausl. Quellensteuer (Anrechnung)

-Steuerrückbehalt USA

I don’t know which option will give me the refund?

The first one is for the actual withholding tax. The second one is additional withholding done by Swiss brokers, not relevant with a foreign broker such as IBKR.

Very much appreciated, thanks ![]()

![]()

A post was merged into an existing topic: Final tax bill timing

However, if you have relatively high deductions or a relatively low effective income tax rate, the maximum DA-1 return may be lower than the 15% of the gross dividend, in which case you get less back. The reason is that effectively the US taxed you more than Switzerland and Switzerland will never return more than what you pay in Swiss taxes (for the DA-1 assets).

Thanks for this nice summary. It helped me a lot in understanding the whole topic.

I am wondering if it then actually pays off to declare the management fee in your tax declaration for those, where the management fee is a significant (50%) part of the foreign dividends from which it is then deducted.

You should usually not be worse off with the wealth management deduction even if this results in a lower DA-1 tax credit. At least based on the idea behind this calculation, the tax savings from the deduction should never be smaller than the reduction in DA-1 tax credit, especially if you also have non-DA-1 assets.

That said, there might be corner cases where the deduction results in a disadvantage because of the way deductions are distributed across DA-1 and other assets (and because the reference tax rate used for DA-1 may not match your actual tax rate). If you want to be sure, you’ll have to do the full calculation yourself for both cases. It’s unfortunate that (at least in ZH) the official tax software doesn’t already calculate that.

I would expect these cases to be insignificant (if they exist at all), as long as you don’t fall below the CHF 100 minimum, but I can’t be sure. You could ignore it until you get a DA-1 tax credit that is significantly lower than the 15% or what you expect and then calculate whether it would be better to adjust the deductions for the following tax year.

Not in Switzerland. You will be taxed on the imputed dividends.

Only if the benefit of the (difference in) wealth deduction is smaller than the 3% of your US dividends, and the lower deduction actually results in a 15% refund. We’d need more numbers to calculate this.

Hello everyone,

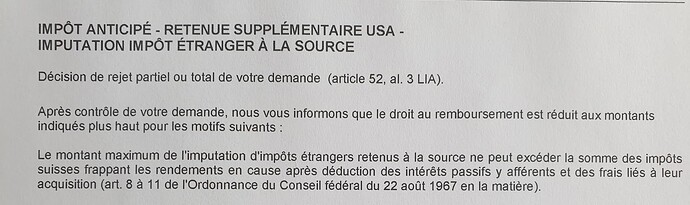

As I just received the decision of the tax administration in Vaud, it seems that VT dividend taxes refund are being discarded completely with this reason:

If I understand correctly, and if this is well related to what you all are describing, this is can arise if my “management cost” (code 490 I suppose) is too high compared to the claimed amount, is this correct?

Thanks!

Uncertainty of US WHT refund in the long term (especially after retirement) is one reason why I’m shifting a part of VT into VEVE+VFEM.

Isn’t owning the US domiciled ETF always the optimal strategy? With an US ETF you get’ll between 0 - 15% of the dividends back through DA-1. With IE domiciled ETF you always loose 15% as they’re paid by the fund.

This is based on the explained from here: Nonresident alien investors and Ireland domiciled ETFs - Bogleheads

Am I missing something?

You lose any L1 withholding tax of ex-US holdings inside VT. In any case, they are simply unrecoverable.

They are like ~11% (only on the ex-us dividend part). So without DA-1, you‘ll lose 62% US x 0% (L1) x 15% (L2) + 38% ex-US x11% (L1) x 15% (L2).

A double whammy on ex-US holdings.

For US stocks, US-domiciled ETFs are indeed always optimal (at least when ignoring estate tax and assuming a decent broker). In the worst case (no DA-1 refund), they will match IE-domiciled ETFs.

For non-US stocks, it’s roughly the other way round. In the best case (full DA-1 refund) US-domiciled ETFs will approximately match IE-domiciled ETFs. In the worst case (no DA-1 refund), IE-domiciled ETFs will be better for non-US stocks.

The above assumes that the ETFs are otherwise identical (same index with same tracking difference).

For an all-world ETF, it will obviously be a mix. Due to the large US part in all-world ETFs, the outcome will be closer to the US stock case. However, with a sufficiently low taxable income, which is possible during early retirement, IE-domiciled ETFs can be better (and if it’s roughly the same, I prefer paying taxes to Switzerland to paying taxes to the US).

Out if curiosity, do we have some data on those ~11%?

Yes, I’m sure. Not all withholding taxes are refundable, especially when multiple countries are involved.

The 15% US WHT are not refundable for Swiss residents (outside special pension funds). The US keeps that no matter what. Via DA-1 you can get a Swiss tax credit for those 15% US WHT to eliminate double taxation. However, as the only goal is to avoid double taxation, the DA-1 credit is capped at the Swiss tax amount (for these dividends)¹.

If your Swiss tax rate is e.g. 10%, you will still pay 15% taxes on US dividends to the US but Switzerland effectively won’t tax you on that amount, thus avoiding double taxation. If your Swiss tax rate is 20%, you end up paying 15% taxes on US dividends to the US and 5% to Switzerland, so 20% in total.

This is based on the double taxation agreement between Switzerland and the US, which defines the treaty rates, e.g., how much the US is allowed to tax Swiss residents on US dividends. That treaty rate is 15%.

¹ The details of the calculation are a bit more complicated, as already discussed, but that’s the basic idea.

That‘s pretty much fund dependent. You can look into the yearly report and calculate the withholding taxes paid, compared to dividends received.

Dr.PI made an overview of some of the tax treaties existing for different domiciles and consequences for CH investors here:

Dataset 1: withholding taxes on dividends received from stocks from different countries for funds with different domiciles. Data are both “theoretical” and extracted from yearly reports of various ETFs. Unfortunately LU ETFs do not report gross dividends and withholding taxes separately. Red: expensive taxes Green: potential tax savings Yellow: data as extracted from annual report which I don’t understand completely. Could be one-off effects in particular funds. [wht1]

I calculated the wht for different funds I use and they ranged from 9-13%

Thanks, thats interesting. Based on his data, there even quite some countries & regions where US based etfs are still more edficient (Germany, Canada, Japan, Emerging Markets, etc).

So if you focus on ex US, then an IE based fund might be better, but not necessarely is.