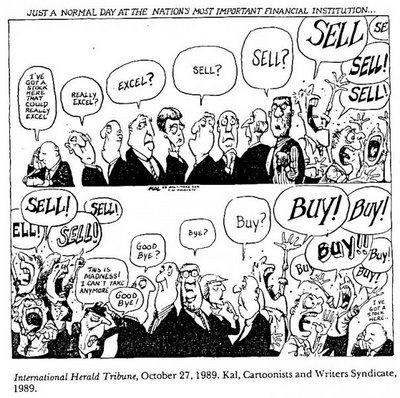

Mmmh… a bit scary. If they are too numerous, they will be right!

We have a very intelligent client (PhD etc.) who made a program and invested several years developing it with some friends. It was a stock and index analyzing tool that should predict when the ideal buying/selling time would be. They implemented a lot of factors and made a couple of backtests to be sure that it will work. Couple of weeks ago he called with the request to liquidate his whole custody account (total loss of -80%). So it didn’t really work out.

I think the truth is that we live in chaos and everything is random. Nobody can predict the future.

they dont’t have less expected returns. the expected return of the whole market is about identical to that of a random stock out of that index. What does change is the risk, it decreases with larger diversification. Another way to see it: for the same risk, an index fund has a superior expected return than a single stock.

now, the available products on the market cover everything from a single stock (one extreme) and VT (the other extreme). you could even expand that spectrum by considering leverage.

very true, and there will always be stocks that do so. the “obvious” reason is always “obvious” only in retrospect. nobody knows in advance. if it had been obvious that apple was so successful with their iphone, the stock price would have exploded on the announcement of it, rather than over the course of 15 years.

nobody claim this. but on average you won’t be smarter than the market if attempting to. The same way that on average you lose when going to the casino, despite there will always be some lucky few telling their story of their smart and couragous decisions.

Holy cow. Now it’s getting ridiculous in my place. Phones are running hot with selling orders, what the hell ![]()

There are many books that delve into the topic of market timing or “finding the next Google”. John Bogle and Gerd Kommer come to my mind as authors. There will always be somebody who outperforms the market, but they will not be able to do so consistently. And since we cannot consistently and reliably pick the winners, we are better off buying the entire market and just being happy earning the average market returns.

Still, I oftentimes can’t resist the urge to check the news and market prices and ask myself if “now is the right time”. Regarding the coronavirus outbreak I would expect that the worse is ahead of us. Thus I’m holding my fire and not buying right now. But I might be wrong: the outbreak could subside quicker than I expect, the markets could suffer less than I expect, etc etc.

Basically, the markets will always feel insecure.

They need money to buy more anti-virus masks.

Or repay their mortgage, leasing, margin debt, …

is there a vanguard ETF for FFP2 masks? BTFD

3M is producing lots of these masks:

https://www.google.com/amp/s/seekingalpha.com/amp/news/3546020-3m-climbs-on-mask-demand-in-latest-coronavirus-play

will apple take 3M over and start producing the iMask, 10x the price of a regular masks, and not made in China? it will need to hook to the wireless ear buds of course

Trading over the phone in 2020 you say? Have not heard a louder BUY signal in a long time ![]()

I’m still on the fence with regards to investing more. Man, once you stop, it’s a trap, because you see it go up and up and you think “this has to be the peak of the bubble, I can’t buy now”

Yeah that’s what happened to me a few years ago with Bitcoin. When a coin was worth 350 USD, I bought as I thought “this is the technology of tomorrow”. Even my master thesis was evolving around Ethereum back in the days when it was worth 0.10 USD.

Then BTC went up to 700 USD and I sold with a nice profit. Then it went up to 1000 USD… 1500 USD… I thought this is WAY too blown up. It’s a bubble. And refrained from buying because I refused to buy at a price I deemed too high. Well. We all know the rest of the story ![]() BTC is still worth almost 10k now…

BTC is still worth almost 10k now…

If you go to to a shareholder meeting, you’ll understand why ![]() (hint: the average age of the people…). A difference is that those trading over the phone are trading millions. A smartphone RobinHood trader has a few zeros less - and in part on a margin account… Better not being on the wrong side of the trade…

(hint: the average age of the people…). A difference is that those trading over the phone are trading millions. A smartphone RobinHood trader has a few zeros less - and in part on a margin account… Better not being on the wrong side of the trade…

100’000 traders with 1000$ each still have more than a big fish with a million ![]()

I bought BTC & ETH one month after the big crash to “buy the dip”. I invested 10’000 EUR. Today I’m at 6’000 EUR ![]()

PS. Today I’ve put in another 5k USD in VT. Looking forward to more lows.

Donald Pump will award you a medal !

With one million it is a small fish, you need 1000 times more to be a big fish.

By the way 59 answers within 48 hours I never expected so much interest for this thread. I must admit that the contributions are very interesting, sometime very educative, some other time very funny and well describing the diversity of opinions in such a situation. Congratulations to all contributors.