I have to disagree with you. What is important is to stay liquid. We hear that many smaller Chinese companies report that they will go bankrupt in 1-2 months. So if you take out a quarter of income from a company, but it’s fixed costs remain, it will have to take a loan. If it doesn’t receive the loan, it will not be able to pay its debtors etc. This could trigger a snowball effect.

Not only in China: the worldwide corporate debt level has reached a $13 Trillon (source: OECD). So a quarter with large losses could be problematic to some companies. Some of them could just reverse their stock buybacks to raise more cash (this happened a lot beginning of the 2000’s), but of course it will reverse the upward pressure to the stock prices too…

Eurozone (STOXX 50, STOXX 600) bounced of the 200 Moving Average. The US is not quite there yet so use your dry powder sparingly ![]()

A rebound without central bank intervention?! Sounds surreal. Anyway I’ve sold my NDX puts this morning, just in case ![]() .

.

Update: now it’s clear, it’s not the Fed this time.

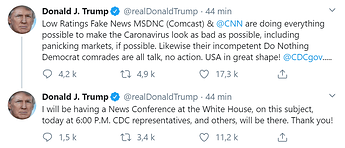

Donald Pump is back from India and will rescue the markets. Happy end!

Obvious answer to this thread’s question: no person nor algorithm knows when or where the bottom is.

But you all already knew that. And it is fun to discuss and speculate!

I don’t think we’ve seen the worst yet. If it is just the coronavirus, I am not worried and the world economy will rebound somewhat quickly once infections start dropping due to mitigation efforts/interventions/future immunisations/etc. However, if this coincides with central banks deciding to slow down their cash injection to the markers, then we could be in big trouble…

As for me, I am continuing to implement my policy of buying the same amount of VWRL every month + buying an extra amount that I can afford when it falls past -6%, -12%, -18% etc. from peak. So far we’ve only hit the -6% marker.

And what is a Caronavirus?

The Very Stable Genius is bigly creative.

Well then it is a balance sheet issue. But if a company is not able to have a balance sheet strong enough to bear one quarter of adversity, i’m not interested in being invested in this kind of company.

I guess that is one of the drawbacks of passive investing. You don’t get to choose what you don’t want to invest in.

Upside: simple to implement, good returns on the long term, no need to spend a long time on it

Downside: you get the good, the bad and the ugly, you have no idea what you invest in, nor what is the value of what you bought.

It would have if social media was around back then. But news were strongly controlled by powers during WWI and winning the war was topic nr. 1, and for sure also the war helped to keep certain industries going at the cost of the civilians life quality. Now it‘s different. Authorities can barely control news, not even China is able to keep secrets from the world (Uygurs camp, corona - they tried for sure to keep it silent for as long as possible) so panic can spread much faster.

I did the same for last couple of months - it’s crazy how emotional we are, even though we were theoretically well prepared to not follow our instincts in this matter. Today I looked at the VT 10 year chart and I realised - what a $@#! nonsense. Then I’ve logged in to IB and bought VT for 6k. The dip motivated me to break the vicious spiral of the bubble-fear.

So you bought for 6K just because you were afraid of being emotional ![]() ?

?

This is the exact opposite of the passive investing philosophy, we especially do not want to chose what to invest in, because we cannot know better than what market is pricing. Once we start choosing the expected returns go down.

To all those who think that “buying the dip” makes sense, I recommend to read this article by Michael Batnick (with data support by Nick Maggiulli):

https://theirrelevantinvestor.com/2020/02/24/what-happens-when-you-buy-the-dip/

Why should it?

Overchasing and overtrading might, maybe. But why should any choice of random stocks fare worse, have lower expected returns than passive investing, given that markets are supposedly efficient?

Sure you can!

-

The simple fact is, there are stocks that have hugely outperformed the standard indices

(AAPL, for instance, over the last 15 years) -

And their outperformance has been for very good and obvious reasons

(for starters, introducing the iPod and iPhone, in this example) -

And since these reasons have been very obvious, somebody can know and anticipate them

-

…and therefore establish a “mis-pricing” in the market and exploit that accordingly

Sure, it’s all very easy in hindsight. Yes, it takes lots of fantasy and conviction beforehand. And then the discipline to adhere and stick to the latter. But saying we can not or never be smarter than the general market is similar to the religious belief: “one should always accept one’s fate, as there’s nothing one can do or change about it”. A mere unfounded belief.

I guess you gave the answer yourself. Let me compliment with some facts based on data than “obvious reasons that you could easily anticipate the growth of AAPL”:

- Since 1926 looking at monthly returns of 25K distinct stocks that existed anytime in US, only 4% of them accounted 100% of the market growth. 60% of them had negative returns. (bessembinder study)

- 50% of the historic stock market increase came from only 86 top performing stocks

- 70% of stocks underperform the market in last 30 year period (JPM study)

- 40% or individual stocks dropped -70% and did NOT recover in the 30 year study (JPM study)

So what do we know, a) only few stocks drive the market returns, and b) those stocks keep changing all the time. So you need to be able to consistently find them. And make sure your assets do not get depleted by avoiding negative returning stocks. Can this be done?

Answer is yes, again let’s see the data:

85% active funds underperfomed S&P 500 , for 10 years (so 15% of them did it)

90% active funds underperformed S&P for 15 years (so 10% of them did it)

Buffet did it for 35 years.

Can YOU do it? I think sitting on your sofa in Switzerland thinking I can beat the market alone, while +90% of fund managers with excessive brain and computer power behind them cannot do it is a little arrogant. you might eventually do it, but I would not bet my money to it. Especially for a period more than 20 years with many bull and bear markets.

You presented a really strong argument, nice post! But regarding the funds, someone said they don’t make money from delivering returns, but from custody fee. So it’s in their interest to grow their capital base and not scare anybody off by taking some risky decisions. It would be nice to hear from someone who works at a big active to tell us how much are they really trying to beat the market.

What’s even more interesting is the fact that most of those who beat the market for 15 years aren’t in the group of 10 years. The winners are always changing. So betting on a previous winner will never work out.

And people investing in those funds fare even worse - because they get in and out at wrong times ![]()

I like the analysis.

But I don’t buy it yet. (The article, pun not intended ![]() )

)

Because nobody DCA-s every single day in the real world.

This to me is an “extremization” of DCA.

I wonder what the simulation would look like if it was periodized to e.g. buys on the 15th of each month, with e.g. doubling the buy (or whatever strategy people use) if the “dip is on” (but then the definition of the dip has to change too, as the daily -2% cannot be used).

Totally. I work for a major bank in Switzerland and a lot of the clients have a worse performance than the fund they actually invest in. Many are calling right now for selling their funds. They usually end up re-entering the market at a higher price.