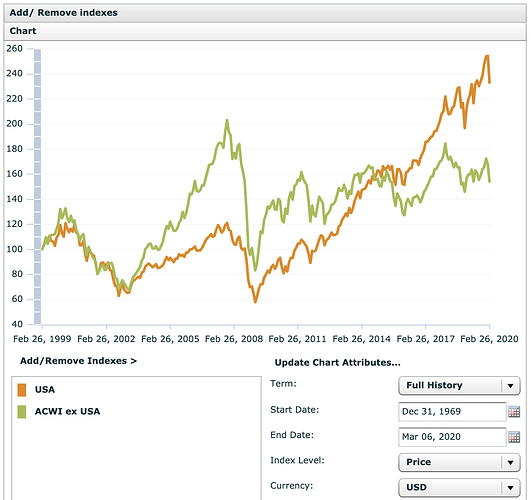

And if you look only at VXUS, its price is under $50, which was the price at inception in 2011. The growth since then has been mostly fuelled by the US. VTI went from $50 to $150. Wrap your head around it. The rest of the Worlds stock has been stagnant for the last decade, only US has been growing.

I could now ask: is it justified and rational that after 4 years of global economic development - at a yearly average growth rate for world GDP of approximately 3.5% (world bank, IMF, wikipedia) - the stock valuations are now 27% higher?

Yeah… and it is not a coincidence the those chips are smaller, or less blue ![]() .

.

Well you are comparing situations at two different phases of the cycle.

Here a price comparison of USA vs WORLD ex USA. The rest of the World has been doing great until 2008 and it hasn’t recovered since. Now it’s the USA that’s ahead. You think it’s gonna continue distancing the other countries for decades to come?

Difficult to predict. It depends on the lenders capacity (and “risk appetite”) to roll-over current debts, and lend even more.

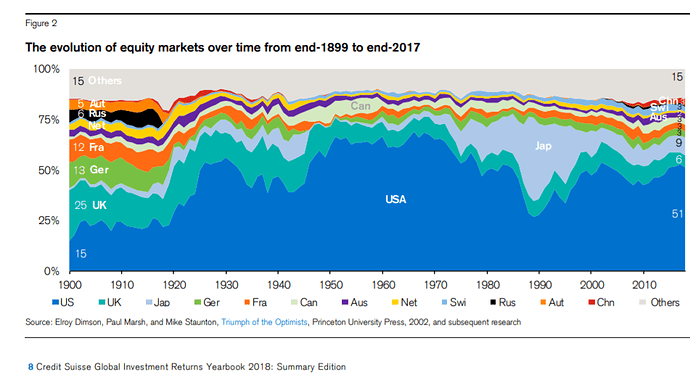

Right now the US share in world stock market is 55%. Anyone knows how big it was in 2007? Probably much smaller.

Edit: I found it. Check out this thread:

https://www.bogleheads.org/forum/viewtopic.php?t=272909

The good news is that others have also thought about this exact topic in the past. None other than Buffett wrote about it here in 1999. The bad news is that you won’t be pleased with what he observed:

So to answer your question, the same happens over way bigger periods of time. Like it or not, 2.5 years is still considered “Short term”.

Yeah, but 70s was very unusual period of very high inflation. It ended with the Business Week declaring death of equities on the front page - just before one of the biggest bulls in the history. In any case, I agree that market moving sideways in 3 years in normal. But I think it’s also normal to grow 15% a year. That’s why the historical average is 8%.

Yes, all majors index are on long terms support but buying now is like trying to catch a knife.

There are many who won’t agree with this statement. Either because they believe on long term it will average out, or because they believe it’s actually temporary sale. I myself am agnostic as I don’t have a crystal ball.

Yes I can understand but If you rush into a position now you are trying to time the market and saying yourself buying the dip works quite well in the previous dips and will works too. (until it’s won’t). Just want to point out that the psychology change in the previous months. Also the cute rate of 0.5 from the FED was the high of the week which is the first time the market react this negatively to this announcement.

If you follow Strictly your strategy of buying XX amount each XX (interval) fine. coutinue like this and follow strictly.

But the question on the subject of this thread was obviously trying to time the market. So my answer is simple. be careful as we don’t have any fucking idea how deep market will go and the goal is clearly not to find the lows of this move but protect your capital.

Well that was a good sign of the mess that the US is currently. At what point does a rate cute help fighting a pandemic? I could understand it once we’re in the recovery phase, but it’s not an economic solution that was need right now…

If you google for charts of “credit card debt usa”, “leveraged loans usa”, “corporate debt usa”, “margin debt”, “junk bonds”, etc. you can understand that the Fed would like to avoid any uptick in defaults. Plus, there is this liquidity shortage issue that has begun in last September, when the virus was still with bats / snakes / in a secret lab (depending on the theory…). So the rate cut is perhaps not only about this virus story…

A great video for math nerds about logistic curve by 3blue1brown. And an important takeaway: if people take it seriously, we will escape exponential growth soon. If they ignore it, it can get real bad. So I guess people saying there is nothing to worry about can be an example of a self-defeating prophecy.

Kuwait and the Arabs countries 10% down… biggest one-day fall sell-off in 15 years. Tomorrow we are going to laugh… ![]()

How much % due to Covid-19 and how much % due to the bickering OPEC+ which resulted in, wait for it, not a reduction of oil output to come more in line with usage to stabilise the oil price, but an increase by big producers to show it to the others? ![]()

![]()

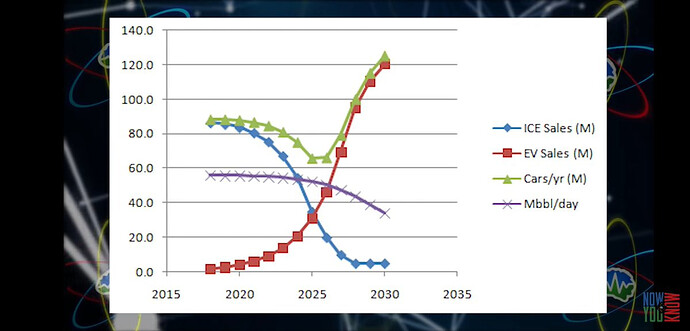

Not wanting to start yet another side topic within this thread, but I heard oil producing countries are in for a tough decade. Check out this chart. It shows a prediction of the transition from ICE to EV sales. If it really plays out like this, then 42% of oil demand (light vehicles) could slowly vanish. This will result in oversupply of oil, then in a drop in price. This will in turn cause countries which rely on oil income to up their production to make up for the lost income. I can’t wait to witness this ![]()

As financial experts say in such situations: “It’s not yet time to panic”.

(Translation: “If you want to panic, please wait that I panic first!” ![]() )

)

They’re very much aware of it, hence Aramco and the vision fund. Unclear whether the timing will work out for them tho.

it’s going to get worse before it gates better, I brace for some tough weeks ahead