We just had the discussion today about Zoom in our office, their value might go up. It’s not just meetings but also teaching and virtual classes that might go on Zoom.

I will rebalance back to shares and buy more in about 3-4 weeks not earlier. With drastic measures like in China it takes one month to be in control. Italy has taken them now, so it will take now about 2-3 weeks. Everything in Switzerland origined from Italy. But there might be another “outbreak” occuring in France or Austria. The big cities in the US are not affected yet, and they will be for sure. This is for sure not over yet and then 1st quarter results will be reported and as someone else already mentioned many badly operated companies will use Corona as excuse. I already hear now excuses, “oh we could not deliver in time because of Corona…”

Nice expression: “The bond market is scaring the raccoons out of the air ducts like crazy right now. Investors seeking shelter and betting on aggressive policy cuts have driven the hottest bond rally in years, if not ever,” said Neil Wilson, the chief market analyst at Markets.com.

For those who are wondering why I started investing into ETF bonds, it’s because I came across dual momentum portfolio strategy.

https://www.quantopian.com/posts/accelerating-dual-momentum-150-year-backtest

But I am taking this with a grain of salt, I would never follow this strategy with the whole portfolio, it simply is not possible in my view, it’s too good to be true. And I don’t trust all these backtesting.

Corona is not more aggresive than the normal influenza! You need to differenitate, younger people are less affected by Corona, you just get a running nose, some coughing, therefore you stay mobile and spread it. This is different for influenza. On the other hand for older people Corona is much more dangerous. I don’t worry for myself, the problem is that if too many people are infected at the same time our healthcare system collapses. This means also people start dying because they don’t get treatment anymore they would usually get. Every measure that is taken aims at slowing down the spreading not stopping it, because than the healthcare system can cope with it. One should show solidarity towards the elderly people. I am not visiting my parents anymore and I try to not get close to any old person that I see.

I’ve read about Dual Momentum. Can you share your numbers ?

This thread should have been forked multiple times already, but now it’s too late. This mess is so big and so tall, we cannot pick it up. There’s no way at all.

Well, it’s a shame for the ones who didn’t follow from the start. I for one, read all the posts and enjoyed it, but it would be a challenge to read it all from beginning. We wrote a small book here ![]() I think forking makes no sense for the reason that we already had threads for most of these side discussions, it’s all just a reiteration and brainstorming caused by corona and the recent mini crash.

I think forking makes no sense for the reason that we already had threads for most of these side discussions, it’s all just a reiteration and brainstorming caused by corona and the recent mini crash.

In the end it’s all just noise that you can just ignore. The only thing I learned from this correction is that 100% stocks is the right asset allocation for me and I don’t mind losing 15% of my assets in 2 weeks.

Let it be how it is. It will be a cool lecture in a few months from now ![]()

Almost in same boat. My only regret is that I don’t have more cash to throw in!

That’s what I thought as well in the beginning. But once my portfolio approached 150k I became much more anxious about possible downturns. I guess it’s even more true for bigger portfolios (like @MrRIP’s case).

Who? Me?

I’m fine, I just avoid thinking that today my portfolio is down by 13k.

The strategy I use is to focus on the fact that yesterday it was down 15k.

That’s simple!

Btw, anyone offering a shoulder where to cry?

Yeah well, how big is your portfolio relative to your annual savings? In my case that’s 4x. That is, I would need to work 4 years to rebuild it all if it went lost. At this point, a 25% drop would feel like 1 year of your work was wasted. One really has to develop a thick skin and right mindset to handle this.

How big is it then? Is his Retirement still in progress or already achieved? Edit: OK I checked. 350K in stocks of his 1.2M net worth. That’s not such a high proportion, or? He has huge deposits in cash and bonds. He’ll be alright ![]()

I read about it, did some backtesting myself with portfoliovisualizer using different ETFs. You can basically monthly run the script on portfoliovisualizer to get the asset you should be invested. My conclusion is that I probably will never put my whole portfolio on that strategy. Often you would do sell and buys for no reason (like monthly changes). You might miss some of the big returns. You will tweak the numbers on ETF, monthly returns (I use something like 1,3,5 monthly average) so long until you beat the index, but that does not mean you will do it in future. I consider the 150 years backtesting as bullshit because we do not have the same economy (you notice that because the algorithm will result im much more transactions after 1990, 2000, 2010, so you would reallocate very often). Therefore I am just using TLT instead of going into cash for times like now, but I don‘t do a full reallocation of the whole portfolio.

I get it, but it will only get worse with time. I invested 27k (1.3x annual savings rate), so it’s not a big deal for me. Portfolio went down -3.5k, which I’m able to save in 2 months. In 10 years I will have ~350k (assuming 7%/year and my savings rate stays the same). So a 25% drop would destroy almost 4.5 years of saving, a 50% drop would mean 9 years of saving gone. It will only get tougher. Someday I’ll reach a point where daily volatility will be in the ballpark of my annual savingsrate!

Just a bit of caution from an older guy: the number of shares in the market fluctuates over the cycle. In the growth phase, buybacks are on buyers’ side. But in a recession, it goes in the reverse: if companies are already fully loaded with debt (as it is the case now), they’ll get new money not from the bond market, but from the stock market by flooding it with new shares at discounted prices. It’s good for them because it’s fresh cash they don’t need to reimburse later. But for you, dear shareholder, it’s a different story…

If you are looking for examples, you don’t need to look further than some Swiss blue chips…

Well , this is true but I would rather say some former Swiss blue chips. The three big of the SMI are not in this situation today.

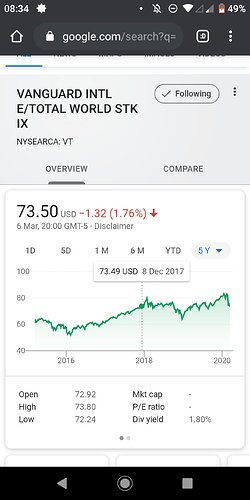

By the way, looking back more broadly, I think there’s another reason not to panic. No need of panic because of previous optimism, and no need to panic because of current pessimism. Current price of VT is on the level of end of 2017, if we average out, these 2+ years, the market is going sideways.

I could now ask - is it justified and rational that after almost 2.5 years of global economic development, the stocks valuations are in the same place?