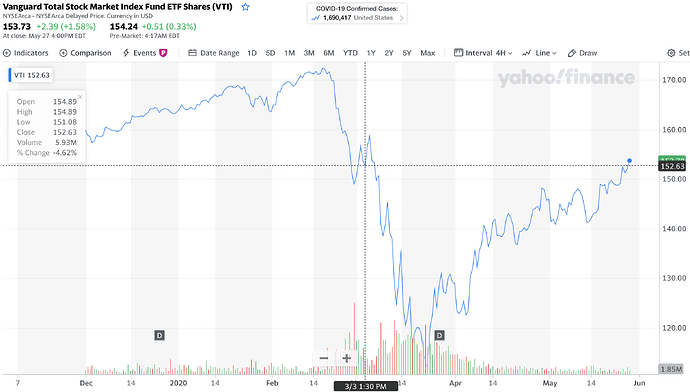

So it happened, VTI is above my purchase price, VXUS still has some loss to make up. It’s been a wild ride, and a much shorter one than I imagined. And of course the ride is not over and there are many bumps ahead. Buckle up… ![]()

Same reasoning here.

By the way, Dufry (DUFN) is also a travel pure-play but not a part of the STOXX 600Travel&Leisure subindex and seems to have missed out on that rally. Not a recommendation, but I reivested some TUI1 profits into Dufry (and Airbus).

Another recovery story playing out right now. I wouldn’t enter now, but I wish I thought about this earlier :-).

The stock lost 90% after Covid struck. I guess it’s pretty obvious people will be going to the movies again when this is over.

I have also been sitting on the sides with about 100K to invest. I did invest 10K in parts during these past few months but nothing since end of March.

This tells us that we know nothing about the market.

Now I am not sure when to start putting money back in… ![]()

How about today? ![]()

Yay, I get to participate in this thread! ![]()

The US seem more optimistic than Switzerland, the SPI/SMI is mostly going sideways:

Looks like investors on the swiss market have made their moves and are awaiting new information.

Shouldn’t you put together your plan to get back in at the same time you do your plan to get out ? If I were to get in and out of the market, I’d be using moving averages to decide when to get out or in. Right now, I’d be in but ready to get out if things start dropping again (don’t ask me why I have thought about it already).

Actually I never got out of the market. I just started investing this year. I had been saving to buy a place but not that plan is kinda put on hold so I have this pile of cash to invest…

Gotcha!

DCA, then? If you’re feeling very risk averse, you could wait for Q2 numbers to come out and then decide depending on how the market reacts. If it doesn’t go up or down right now, it could do so in autumn or next year… you could be locked out of the market for a long time if you don’t get in soonish.

I was in the same situation at the beginning of the year, and in a way still am, with still some reserves.

There are 2 choices basically. Lumpsum, right NOW, for which @Cortana would for example argue. Or DCA, as @Wolverine suggested.

For me DCA was the way in, since I would have waited for lower prices forever otherwise. I started too early, before the crisis really hit, but then I could average down with more purchases.

Or central banks are giving more support in US markets.

It’s not a really good sign: South Korea, Spain, Germany and France all show an increase in cases in the latest days…

Is is because we do more tests, or is it coming “back” ?

Spain just “resurrected” over 2’000 people two days ago so… who knows ![]()

Things are reopening, so at least some increase is not surprising.

So you are always sitting in cash for 6 months?

Didn’t know that. I guess the difference (to investing it as soon it’s available) is small enough to not care.

Well the idea was to DCA over the year but this sudden crash kinda shook my plans a bit

I’ll wait for Q2 results and then basically start DCAing till I exhaust my cash pile

I still believe the markets are artificially sustained by the FED’s QE policy and the party might only last till US elections in November

I don’t get what you were hoping for? Increasing prices till SP500 hits 4000 while you are DCA? This crash was ideal for your plan.

I know… but then the fear sets in for the first timers

but who is to say that the market will not crash 15-20% over next months if I go all in at the moment

There is the advantage of DCA. If you invest 10% of your funds today, you are effectively hedged for 10% against higher prices. And you are hedged for 90% of your funds against lower prices. Sure, if prices crash right after you invest (which happened several times for me) then in hindsight you would have been better of to wait. But then you get the chance to average down. And you have to hedge against both higher and lower prices. Otherwise you are just missing out.

The only scenario I am really afraid of is a 10 year or so bear market. That would be the only reason not to start investing. But we don’t know if that’s coming and by not investing there’s the risk to miss out on rising markets. There is risk either way.

A 10 year bear market would be the only reason to not invest?

This would be my dream scenario for investing!