I agree with you on that, but your 2 statements were not clear.

First you said that the travel (health) insurance paired with your existing health insurance (which I also have) is the way to go.

Then in the second quote you stated you shouldn’t “mix” the two.

That’s why I got confused at what you are actually suggesting. ![]()

I see. I don’t consider worldwide coverage by krankenkasse as mixing travel insurance. I should have not used the word “travel” in that sentence. Basically, krankenkasse is covering all your emergency health needs regardless of location.

Travel insurance is for cancelling holidays, baggage loss, and other such things. I consider this to be not as reliable of an insurance as they come with a long list of exclusions. So definitely don’t recommend mixing medical insurance with it, unless you don’t have the option to go with krankenkasse.

Clear now.

I agree using “travel” was a bit confusing to me, more like “emergency/health-related stuff abroad”.

I have my travel cancellation insurance separately (with Axa).

And the luggage related stuff is I believe in my household package (with electronics and sports

equipment).

Some people get it via their (fancier) credit cards too.

I tried to calculate whether that makes sense (with extra fees etc.), but didn’t to me.

Complementary need read all carefully and compare. Some have very light coverage or very limited in time or pay you like 20.-/day but it’s nothing.

4 posts were split to a new topic: Help me choose health insurance model

I would like to revive this topic and ask for your help. I met recently with an Assura salesman and he tried to sell me some complimentary insurance. He presented me some scare stories of possible expensive treatments that are not under the obligatory insurance. I didn’t really trust his judgement so I would like to ask you.

Which complimentary insurance is it really worth having? Please keep in mind, that my mindset is the following: I only want to insure against huge expenses. I do not care if I suddenly have to pay 10k, I can afford it. The insurance company has to make money, so these premiums will of course make you pay more than you receive on average. It is tempting to think “oh I only pay 30 per month, and then when something happens, I will receive 10k”, but that’s not what I want to insure against.

So, again, what potential loopholes may there be in the mandatory insurance, that are worth mending? The guy suggested taking a halb-privat insurance and the worldwide insurance. He also said, with basic insurance you will have no say in who gets to make a surgery on you, for example it could be a beginner or someone with bad reputation. A complimentary insurance gives you this right. I have, however, no idea which doctor is good and which bad, I’m a foreigner with no contacts in healthcare system.

I only have the ones which include what directly benefits me, and which financially “pay off”.

Those are (for now) mostly preventative items, such as co-coverage of:

- gym membership

- dental hygiene

- massage/physio

Everything else was pretty irrelevant thus far, but there are things such as eyeglasses, vaccination, psychologist, etc.

The package costs me around 30-35 CHF/month, so nothing to lose sleep over.

Even the world wide insurance I understood that they would pay for all treatments according to the Swiss prices and only the excess is not covered. And iiuc besides the US there are not many countries with more expensive health care than Switzerland. The point with the no selection for doctors is true.

I personally have complimentary for my wife for free hospital selection (outside of home canton, which was specifically for the birth of our son appreciated when we went to Nidwalden instead of Zug and got a room for ourselves and the ability for me to stay there over night for 80.- Fr.). And for my son the dental insurance which can only be setup before 3 years old w/o any dental history.

I don’t have any complimentary insurance, I used to have the glasses covered however they only pay 100.- Fr. every 3 years or so and that was less than the insurance did cost.

But I also have a gym and massages for free at work… not like I could use them at this point.

PS: Was the guy called Charles/Charly by any chance?

I’ll be with Assura in 2021 and I took their “COMPLEMENTA EXTRA” which cover all I need :

- Dental hygiene

- Eyeglasses

- Other thing that I’ve never used in the past but could be usefull : massage, physio, psy, etc.

And I took the “MONDIA PLUS” as I was used to travel a lot and their insurance is quite interesting in comparison to Groupe Mutuel, and they cover worldwide with no limit.

However, it will truly depends on yourself and how much you are ok to pay for your health. A friend of mine was really happy to take his complementary insurance two years before he’s got a leucemia.

Someone on this thread that the health insurances pays 50% of the costs, the rest is paid by the confederation. This means that abroad they’d pay 50% of the same operation’s cost in switzerland. Still a lot apart for USA/Candata/Japan or something.

I’ve read about some super rare health problem that isn’t paid, but I think it’s like winning the lottery. Rare.

Leucemia for example isn’t rare, I suppose it’s fully paid by the basic health insurance.

The only thing that might be interesting is the choice of doctor. But at the end I think that it’s a lottery anyway. You can always have the old and experienced doctor that make a mistake since he’s used doing it and the young doctor that’s nervous and study your case to avoid making mistakes on his first operation.

Just to be clear what the options are:

- COMPLEMENTA EXTRA (12.80): a long list of stuff, like 100% transport costs up to 20’000 CHF, 50’000 CHF for essential medicine not covered by the basic insurance, glasses 100 CHF per year

- MONDIA PLUS (8.00): 100% coverage of abroad hospitalisation (not only USA, you never know how much which procedure costs in which country), rescue and transport back to Switzerland, return of costs due to cancelled holidays (accident)

- DENTA PLUS (22.80): up to 15’000 coverage of dental treatments (after 500 deductible), 80 CHF per year for removal of plaque (excluded from franchise)

- OPTIMA VARIA (44.00): halb-privat (two bed room), free choice of specialists

the denta is unclear to me…dental hygiene in it? with a deductible of 500chf??

So I spoke to the guy. DENTA PLUS means that you cover 500 of treatment yourself, and the rest is covered by the insurance. Moreover, starting from the 2nd year, you get a 80 CHF deduction (or voucher) for plaque removal. So if you go each year and it costs 100 CHF, you will only pay 20 CHF.

I think I will take the COMPLEMENTA EXTRA, MONDIA PLUS and DENTA PLUS. The reason is, I don’t want to be surprised when the bad day comes, and some stuff is not covered. Plus, I’m very wary of my teeth.

The OPTIMA VARIA is the most expensive one of the lot. The halb-privat / privat is just comfort, I guess I can live without it. And if I really cannot stand the big room, I can pay extra for the smaller room. But what I don’t get is this “free choice of specialists”. He said that you can get an unexperienced doctor and you can do nothing about it. I wouldn’t know which doctor is good or bad, so it seems to me like I pay a lot of money and in the end don’t know what I get for it.

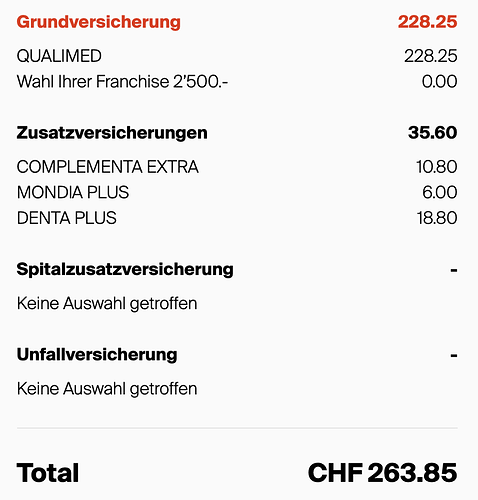

Here’s the total calculated cost for 2021:

Apparently, if you have a privat (or halb-privat) you will get more access to the senior doctors. It is really hard to judge the value of this. However, the level of care you get at the hospital has a huge impact on your overall health and recovery. The number of cases where your health deteriorates due to poor care can still be surprisingly high.

But, you can also pay for these solutions out of pocket.

I have never heard that before. Interesting point of view. Do you have anything to back that up? I personally cannot imagine sharing a room with 3 other sick people for multiple days. So, I always planned to pay out of pocket if and when it becomes necessary.

Personal experience says 1 person (not really sick, just pre/post surgery), and very on/off (out of 3 days the 2nd bed in my room was occupied for maybe 1 full day). But mileages vary, sure.

Says what? I don’t get your sentence.

Btw. in some cantons there are so few patients that you might be alone anyway. Well not in 2020 maybe ![]()

My partner had to go to hospital for 3 nights because of a wound that got infected and it was a pretty bad experience…

-

We missed the doctor the first night because no one could tell us when the doctor would come. After waiting for 7 hours, we decided to sit in the chairs on the floor for half an hour when my in-laws were visiting and informed the attending nurse about it. Guess what, the doctor came for her rounds at that time and just left without talking to us because my partner was not in the bed. The attending nurse was like “oh you missed her”… we were sitting literally 6 meters away from her. Of course, we just smiled and let it go because last thing you want to do is antagonize your carers.

-

The room was full the entire time with few changes of patients during the stay so you never really got used to your roommates. Many of them required attention in middle of the night which meant everyone else couldn’t sleep either.

-

In general, information was hard to come by and while everything mostly worked out well, you couldn’t help but get stressed because you often did not have a clue about what was going on.

I guess mileage can always vary but we will definitely try a private accommodation in the future. I think my biggest tip would be to take some nice gifts (chocolates, etc.) for the attending staff and give it to them in the beginning of your stay. It makes a huge difference how good the attending staff is. Maybe even more than which doctor has your case.

Sorry to hear about your case. Of course recent personal experience has a huge impact on the way we think. My approach so far is that you will probably only spend a few days in a hospital bed, at least until you’re very old. A halb-privat insurance costs some 600 chf extra per year. Is it worth it, or will you just push through it? The most important thing is to receive the best medical help, comfort has second priority. But I guess if you’re rich enough, it’s worth it.

Sorry if I wasn’t clear.

I just wanted to say that having 3 other people in the room is a bit of a generalization.

Which of course might be true in some cases, but not all - as it wasn’t in my personal experience, where I didn’t feel a need to have private hospitalization package.