Hi,

anyone has any news about complementary health insurance? I’d like to switch but what I’ve seen on comparison sites isn’t enough for me to decide.

KPT seems a good deal, CSS is super messy with their health account while other seems to lack stuff or be expensive.

Glasses. I also would try one with the yearly checkup included. The gym membership is nice if the insurance doesn’t cost way more than the discount provided. Also “gym” in a broad sense, since I might use it for swimming. For example with CSS there is a difference between gym and swim. booh.

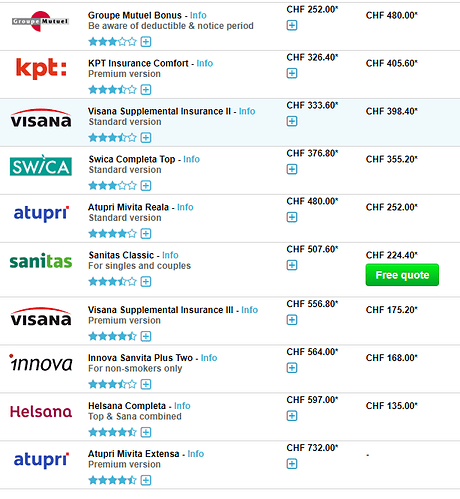

Have you tried the comparis calculator?

It has a search function for supplemental or basic+supplemental health insurance. Later on you can choose glasses as an option. Didn’t see an option for gyms.

In my case Swica was in the cheapest 3, and they are also well known for their gym-benefits. But you’d have to look deeper for which of their Zusatzversicherungen that applies.

(The word complementary might have confused some people because “Komplementärmedizin” is used to describe alternative medicine.)

Moneyland has a better comparison imho, but it still not enough for me.

Again CSS isn’t really well described there, maybe because they also hate their health account “scammish” offer.

I agree that there’s a lot of improvement potential with that comparison. This is actually one of the most difficult insurances to compare accurately because of the huge number of variables.

My personal recommendation is Swica (Completa Top, plus Completa Praeventa, plus Optima). I chose this setup for myself and my kids after much study. The main reason is that unlimited routine health checkups are covered 90% with no deductible at any doctor. By going in for routine checkups rather than citing specific issues, we avoid the deductibles. The 10% coinsurance is the same as we would pay for mandatory health insurance.

The coverage for glasses is 90% max 200 francs per 3 years. 50% max 100 francs per year for dental work. With Praeventa plus Optima we get up to 800 francs of gym memberships, swimming pool or thermal bath memberships, dance classes, etc. covered per year. 50% of braces/orthodontics are covered. All in all, we get a whole lot more out than we pay in.

Another plus is that the mandatory insurance deductible counts towards the supplemental insurance deductible (for the coverage which has a deductible).

The only catch is that they only let you take out supplemental insurance if you get mandatory insurance from them as well. Swica generally doesn’t have the lowest mandatory insurance premiums. Of course, you can cancel the mandatory insurance after a year and keep the supplemental insurance after.

Also, having all 3 insurances isn’t cheap. I pay 467.85 per year for me and 114.75 per year per child. But I take out around 1,200 francs per year per person just between the 800 gym/pool/etc. allowance and the dental and glasses allowances. Then there’s what we save on deductibles for checkups plus medicine coverage etc. So it’s a very good deal for us

I have Visana Ambulant II for 20.40.-/month.

Covers everything what I need. 200 gym, 90% on glasses every 3 years and couple of other things.

By the way there’s much more to it than just the current price. The thing with supplementals is that they can refuse to insure due to e.g. pre-existing conditions.

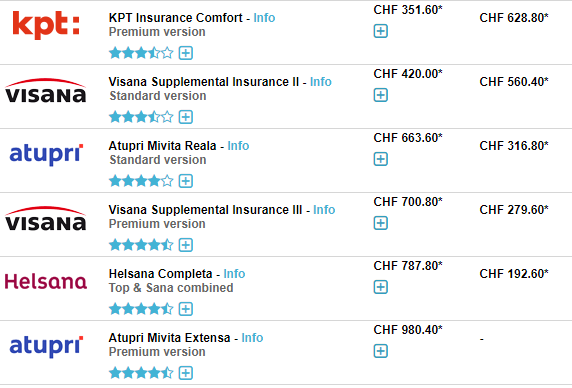

If part of why you want it is for things like semi-private, you’re more likely to make use of it when you get older. From what I’ve seen the premium curves over time can be vastly different (and those comparison tools don’t tell you that), at least if the goal is to have coverage at later time, it’s likely better to look at the cost over 20+ years instead of just the monthly cost now. (since you may not be able to switch later)

I would venture to say that you really have all the actual health insurance coverage you need with mandatory health insurance. In my opinion, the only real added value that supplemental insurance brings is in the allowances provided (for gym, glasses, dentists) or if they have no deductible for medical checkups. Maybe if you travel to the US a lot, that would be an argument for the extra travel medical cover. The vast majority of hospitals in Switzerland already only have semi-private wards, so supplemental hospital insurance doesn’t really make sense unless you get private-ward insurance, which is expensive.

As far as health problems in old age, I think mandatory health insurance is really the best deal you can get: you pay the same premium as a 28-year-old no matter how old you are, and coverage is pretty comprehensive. Supplementary health insurance premiums go up as you get older, so the cost-to-value ratio becomes less and less favorable.

Daniel, can you make a page where you show prices for different ages? I think I could just edit my settings in moneyland and then calculate it by myself, but a page would be easier.

This is the same search, just for 1940

We are personally using several Helsana complementary insurances and we have had a very good experience with them. Payments are really fast and they have nice coverage. You can get a full checkup every 3 years. But they are not cheap (I’m there because my company pays for mine and did not want to use two insurance (lazy, I know)).

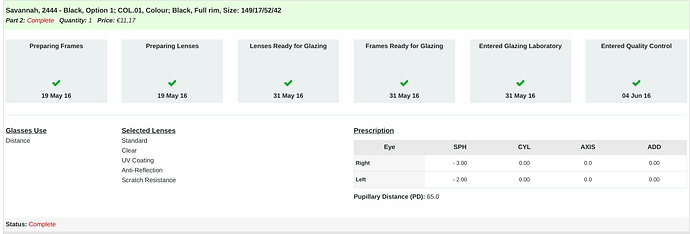

200 chf on glasses? I don’t want to make assumptions, but i spend max 20-30 chf on glasses from cheap website. I wouldn’t even know how to get to 200.but I’m lucky I’m just myopic and don’t have a complex situation.

My only complementary is a semi-private in Switzerland - if something happens to me and my wife, I want to be hospitalized near my parents in a far away canton, so that they can look after my kids. No other from me, and i just picked the cheapest one

I only have complimentary insurance for my wife for free hospital selection in CH and the dental stuff for my son. Totals to around 450.- Fr (I pay like 5.5k yearly) for the whole family. I’m with Assura.

Well let me know which site and what you buy, because I can’t get lower than 150chf probably.

Especially because I want photocromatic glasses and possibly thin.

Well I thought all complementary for hospital allow you to pick which hospital to use.

it depends really on what you want. I order the most basic glasses with standard plastic lens with prescription, once clear and once with sunshade. I stopped using photocromatic because I was not satisfied in how they worked. I thought it was for me, but in the end not. Now I simply carry a pair of prescription sunglasses in my bag and swap them out whenever I need them.

The site I order is www.selectspecs.com

Be aware, they are cheap plastic glasses, but they work well and since they are cheap I don’t care if they fall down or take hits. They are basically indestructible anyway.

You can see here my clear glassess were 11 eur, if you want them sunshade goes up to 30-35 eur:

I see, you probably use 1.56 lenses. Mine are 1.67. If I make a simple test I get to 200 with 100++ for the photocromatic lenses included.

I had luck a while ago and got mine from a shop in Constanz that makes black Friday prices (50% off).

I can see why you would want to be hospitalized near your parents. But it is worth checking whether the costs of hospitals there are higher than those of hospitals in your canton of residence. If the costs are the same or lower, then you are covered by compulsory health insurance.

You can find the exact rules here:

This basic list of what is covered by compulsory health insurance may also be useful:

https://www.moneyland.ch/en/basic-swiss-health-insurance-costs-covered-overview

Re: glasses, 200 francs is fairly luxurious for glasses, but goes pretty fast if you use contact lenses or both.

One plus of Assura is that their dental/orthodondist insurance covers dentists outside of Switzerland. Others generally only cover Swiss dentists.

I’ve never checked dental insurances. They looks like a scam.