Check again now ![]()

But which mean? ![]()

29 posts were merged into an existing topic: Chronicles of 2025

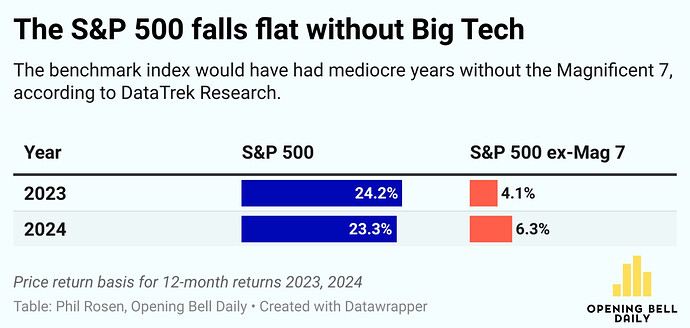

Here’s final 2024 Top 20 ETF Leaderboard: $VOO ended w/ $116b which is $65b beyond old record (absurd). $IVV closed strong w $89b (bc used more than $SPY for TLH?). $IBIT took 3rd spot w $37b (still <1yr old!). Total flows at $1.14T, which broke old record by 25%, or $225b…!

(Source)

More inflows to Blackrock’s Bitcoin ETF IBIT than into VTI …

Anybody got a link to the Greed index? ![]()

This really feels like the “everything bubble”

Come on, it’s the first result using a range of search engines provided with the exact terms you’ve used.

A post was merged into an existing topic: Benchmarking The Market

oh what a thread I missed ![]() so just making this pointless comment to follow

so just making this pointless comment to follow ![]()

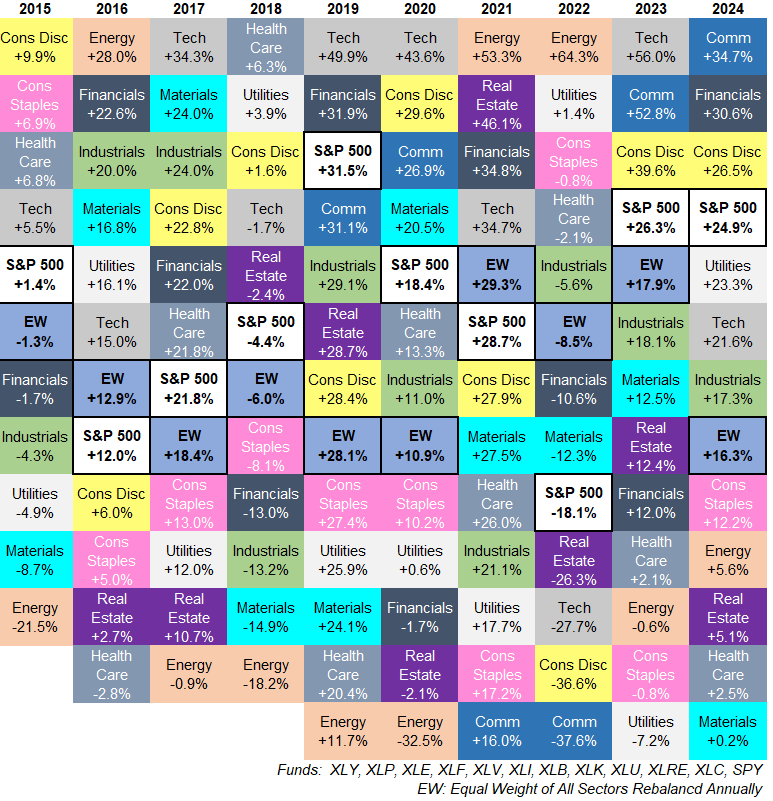

Ben Carlson’s sector quilt including 2024:

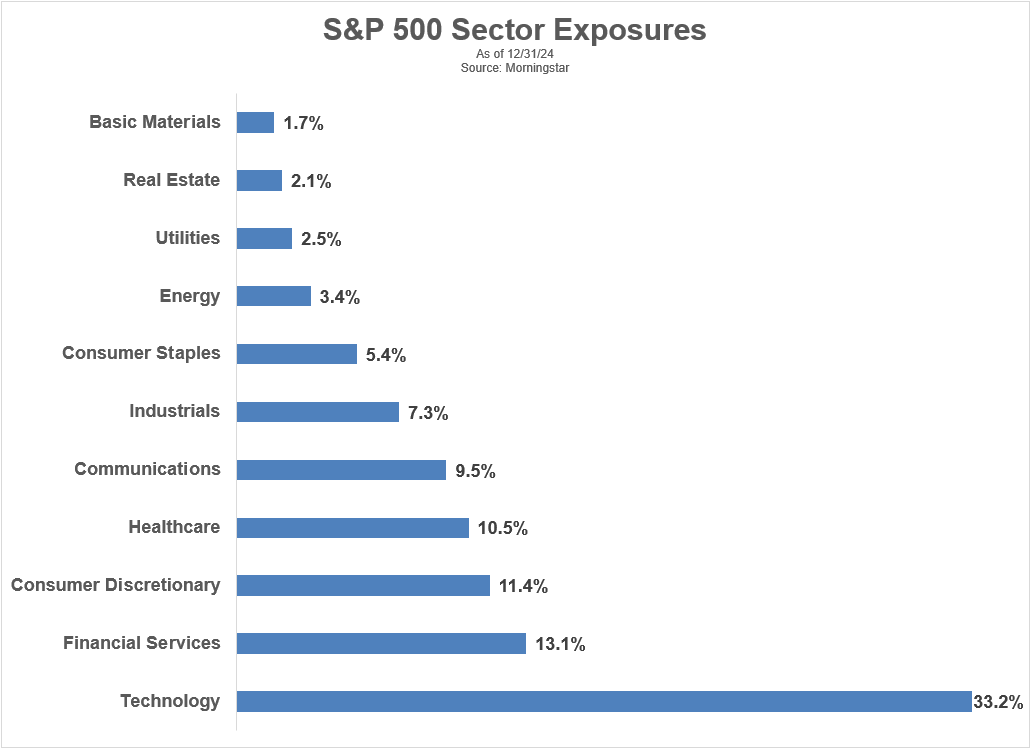

And the sector weightings for the S&P 500 as of year-end 2024:

Communications and Tech making up almost 1/2 of the market cap is surely sustainable ![]()

Everything just screams Dotcom to me

I don’t know.

All but one of the Mag7 companies are hugely yuugely profitable and are expected to keep growing their earnings.

Are they overvalued? Probably. Are they bubble overvalued? Don’t think so … (except that one outlier).

FASTgraphs:

interesting to see the discrepancy between GOOG and GOOGL - same company, same finances different chart.

Is there anything you can read out of that discrepancy? I can’t.

One has voting rights and is supposedly still mostly owned by founders and friends, the other is for peasants like myself.

Genuine question, I agree the earnings charts look different, price is mostly the same, but I don’t know what to make of it?

They are different share classes.

me neither, hence I’m stating that it’s strange.

I’m following GOOG and hence I was convinced it has a tendency to be overpriced a little (which would be normal for a Mag7 stock).

But then GOOGL is like almost always underpriced, which can’t be right…

Maybe it’s just a liquidity thing. Larry and Sergey (and some early shareholder – I believe I used to also own GOOG – and maybe others) just don’t trade that much except through pre-scheduled sales plans.

157 posts were merged into an existing topic: Chronicles of 2025