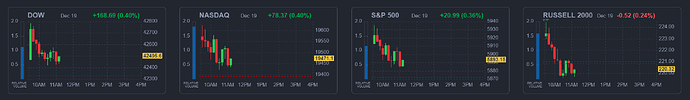

Yesterday, we had an about face by the Fed. BoE also pausing:

Hold onto your hats, I bought the dip!

Just to update, everything I bought today went down in value. Everything I sold, went up in value. So business as usual, then.

(source)

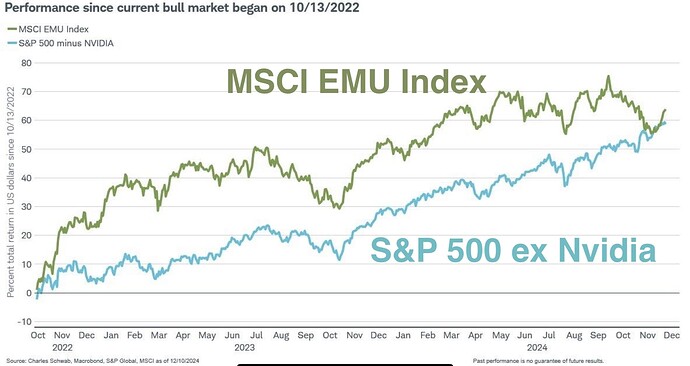

Now take out the Mag7 and watch the S&P500 beat by Europe ![]()

Insane drop in Novo today, showing how frothy even this stock is…

a >20% drop and still has a massive PE!

Yeah, market is being the proverbial infant dropping their toys out the pram, again.

Sir, excuse me, but the market is always efficient.*

* Nobel and other important prizes and papers cited here.

Dear Santa,

Please bring us back to November’s ATH so I can sell all and wait for the big crash of 2025.

Yours sincerely,

Mirager

The previous ATH was on Monday, ahem, ahem.

Oh well, Monday 16/12/2024 then ![]()

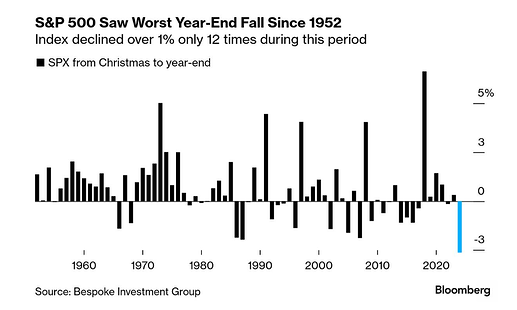

Where’s my Santa rally? Was I a naughty boy?

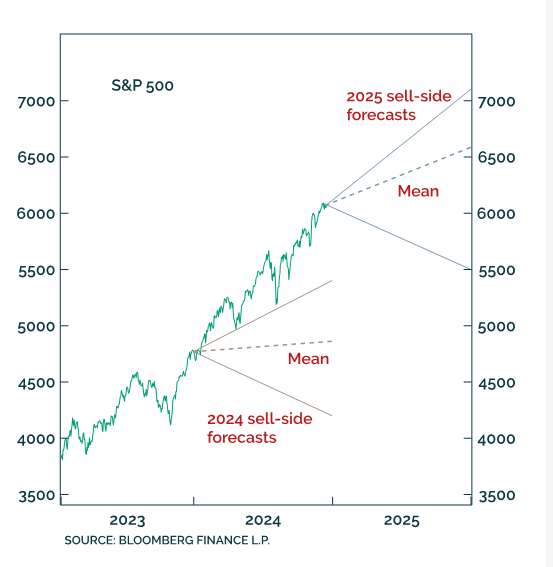

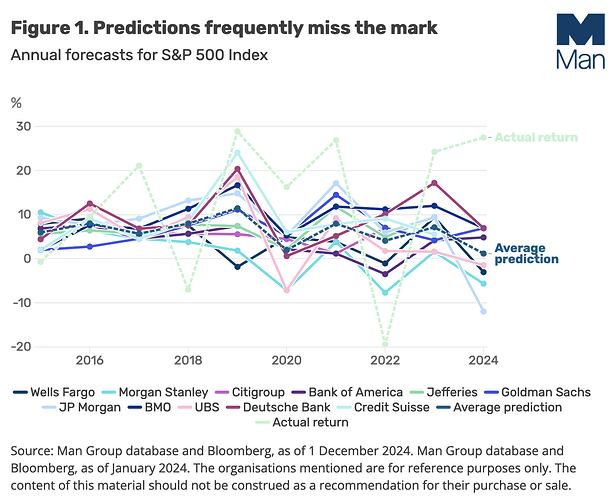

With the exception of 2017 and 2024, the average prediction direction was actually correct all the time (whether S&P gains more or less than the previous year). Absolute values are quite off, but I would still have expected worse predictions ![]()

My conclusion is that it’s tough to predict irrational behaviour ![]()

Did anyone do better than a simple momentum predictor (i.e. if went up last year, predict up, if went down last year, predict down)?

Actually the outcome (actual return) was exactly the opposite (if it went up more this year compared to last year, it has less growth next year; if it had less growth than the last year, it has more growth the year after).

But that fluctuating pattern is also to be expected, because of regression to the mean.