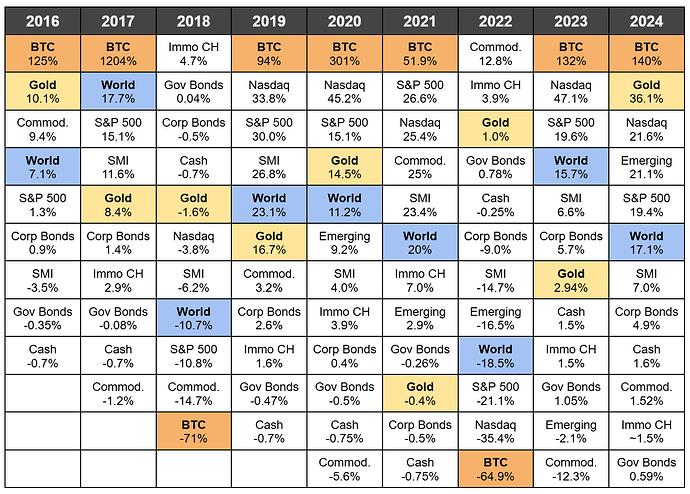

I like my asset class quilt in CHF.

My sources are:

8 Likes

Thou shall add Swiss RE Funds, have a look at ‚24 and you know why

PPINIOFR*

*past performance is not indicative of future results

just wanted to make post no. 1000

yesssss!

12 Likes

Dr.PI

April 4, 2025, 3:54pm

1087

2 posts were merged into an existing topic: Benchmarking The Market

Dr.PI

April 5, 2025, 2:22pm

1132

109 posts were merged into an existing topic: Chronicles of 2025

Dr.PI

April 5, 2025, 2:30pm

1242

100 posts were merged into an existing topic: Chronicles of 2025

Maybe we should close this topic…

9 Likes

covfefe

April 4, 2025, 12:15pm

1346

Only 5 quarters in? We still got 11 more to go.

4 Likes

Dr.PI

April 5, 2025, 2:33pm

1347

Fat years were aborted prematurely.

4 Likes

The bull got prescribed Ozempic

3 Likes

Dr.PI

April 5, 2025, 7:32pm

1349

2 posts were merged into an existing topic: Chronicles of 2025

@Dr.PI Can we rename this one to Chronicles of 2024? Consistency is beautiful

1 Like

Dr.PI

April 7, 2025, 7:04pm

1351

No, it’s a good example of how unexpectedly things can turn.

4 Likes

Dr.PI

April 7, 2025, 9:52pm

1352

5 posts were merged into an existing topic: Chronicles of 2025

And yet my totally accurate Lean Years 2025-2027 was deleted! Grr.

3 Likes

Your_Full_Name:

If you live off – or at least partially live off – your cash flow produced by your portfolio, you’re much less worried about the prices of your holding(s). If you don’t entirely use up your holdings’ cash flow, you actually look forward to corrections to further scoop up further future cash flow at cheaper prices.

I think this is what makes dividend investing and real estate investing more ‘psychologically’ easy.

You see a fairly steady income and don’t worry about day to day movements of the asset price.

Yes, from time to time, you have voids and dividend cuts, but most of the time it is steady and you don’t need to expend mental energy on it.

2 Likes

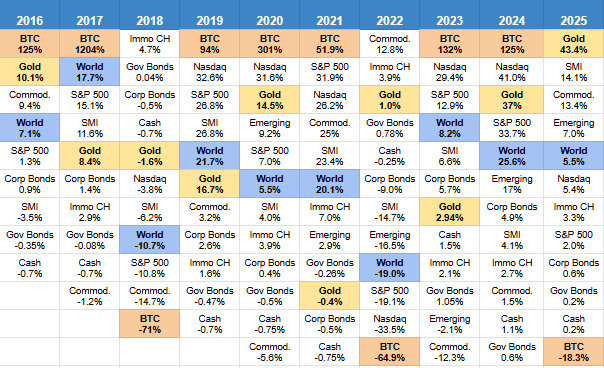

Here’s the asset class quilt for 2025 in CHF. Amazing returns of gold and in hindsight, local bias SMI would have been beneficial. Still, our anchor World ETF delivered above 3.5% (“safe” withdrawal rate). Bitcoin was a substantial loser.

Final numbers for Immo CH (Real Estate) and (10y CHF) Gov Bonds are not yet in and have been estimated. Inflation for the full year is estimated at 0.1%.

List of 2025 in CHF:

Gold 43.4%

SMI 14.1%

Commod. 13.4%

Emerging 7.0%

World 5.5%

Nasdaq 5.4%

Immo CH 3.3%

S&P 500 2.0%

Corp Bonds 0.6%

Gov Bonds 0.2%

Cash 0.2%

BTC -18.3%

16 Likes

EPeon

January 1, 2026, 11:25am

1357

Notable some other European stock markets also - FTSE and DAX up more than 20%, IBEX even 48% for the year (in local currencies).