Yeah something like that to be in some way meaningful. I saw the futures and they’re basically noise.

This is why the 2nd pillar should always be included in the asset allocation calculation, so the asset allocation does not need to be changed from one day to the other.

Actually I was referring to fact that someone who has never invested in their life have no asset allocation to begin with

But they still will be forced to invest when they get a lot of retirement money unless they buy annuities

Or simply do not withdraw the capital but take the pension …

Someone who never invested before, shall in my view under no circumstances take the money but just the normal pension. Pensions are actually quite a good deal - yes, there is no inheritance but at the same time, you still get a very decent withdrawal rate. Yes, its not inflation adjusted but it is still between 5 and 6%. Compared to an inflation adjusted, safe withdrawal rate of 4%… 5-6% in a world with 0.5% to 1.5% CPI is a good deal actually. Clearly, when you invested all your life, the situation is different and you can take on more risk.

With regard to asset allocation. The point of having a multi-asset allocation is to have the option of re-balancing. You simply can’t rebalance with second pillar money. Therefore, I don’t think that second pillar should be considered as part of your overall asset allocation. If you can chose your asset allocation of your second pillar (aka in a vested benefit account), you should roughly have a comparable asset allocation than outside of second pillar. Yes, you can tweak it a bit based on your liking… but you shouldn’t go extreme because as said, you can still not rebalance nor eat these funds until you retire.

My second pillar is (don’t quote me on the precise figure) I think about 40% of my total, investable assets. If I considered it in my asset allocation, logic would call for a 100% shares only portfolio (so that total Asset Allocation was roughly 60/40). But seriously… a 100% shares portfolio was a major mistake for me, particularely in case of a downturn (as I couldn’t re-balance anymore).

It‘s a phenomenal deal actually and beats literally any offered anuity you can buy, by a mile.

It‘s such a good deal that it creates problems and the need of the young to cross-finance the old.

You can go negative bond on the taxable part, tho.

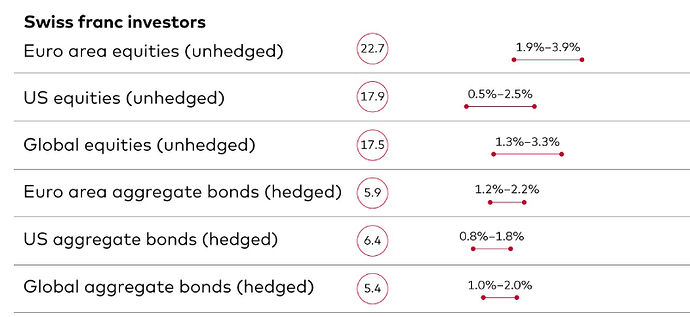

Vanguard updated their long term forecast

Numbers in circle represent Volatility & the range reflects expected return over next 10 years

Tough life for CHF based investors as always. Expected return for 60-40 portfolio is about 2%

bonds not much worse than stock …

That’s a bleak outlook.

What is their forecast for CH stocks?

They don’t really separate CH stocks. They just have the breakdown mentioned above. Perhaps Swiss stocks expected returns should be similar to Euro area.

Note that Vanguard tends to weigh valuation relatively heavy (just like Research Affiliates which tends to really like value investing), so the US return expectations are lower than most other predictors.

See e.g. Experts Forecast US Stock and Bond Returns: 2025... | Morningstar to compare between the different parties giving forecasts (in USD though).

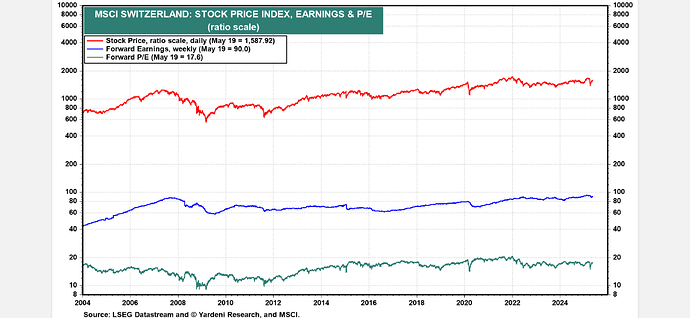

Talking valuations, Swiss PE ratios being way up there almost with the US definitely doesn’t make me a very happy Swiss equity investor (vs. going ex US in general). Wonder at what point the tax advantages are not worth it anymore.

Looks like the gains of previous years mean few years of reduced gains.

Which PE you are referring to?

It seem the Forward PE of Swiss stocks is not much different than historical numbers

US forward PE is 21.9

If that would be a consistent rule, it would mean great time for accumulators in the next 10y, as the big gainz coming after that 10y phase would be bigger than big gainz now (1-10) followed by drought (after 10y).

But I kind of doubt it is that easy.

backward PE I guess, mostly looking at PE in morningstar portolio tab and Switzerland Stock Market: current P/E Ratio . Forward (looking at at IBKR for EWL) looks still in the middle between VXUS and VTI (12.21 <=> 16.14 <=> 21.13), but it does indeed look a bunch better.

I think very long term average suggests 4-5% inflation adjusted returns from equities. For a 20-30 year period, I think that should be possible if world GDP continues to grow and don’t fall apart.

The thing is that equity investment history is based on growing population and a big part of it was in peacetime.

In addition, in past equities were considered risky and hence investors demanded lower multiples. But these days most people believe equities are the best place to be which kind of reduces risk premiums as they are not seen that risky and hence returns should also reduce (that’s an opinion)

We don’t know how it would be in future

Yeah.

Google „Yardeni charts“ which is a great source of market data and comparison of different metrics for multiple regions / countries

Oh come on doomers!

“Hey MP-LLM, set a reminder for 10 years” ![]()

I say it’s going to be 5.5% - my guess of the future is nearly as valid as theirs.