I think it’s fair to assume that in a US sovereign debt crisis there’s be a global recession and all stock markets would suffer, earnings forecasts would go down and stock prices would follow, regardless of the innovation, in my opinion, in the short term (which will feel long!).

I was thinking about it. But if there is a debt crisis would rates keep going up? Or there comes a point where lenders have no option but to restructure the debt or face a default.

You don’t have just rates in the equation, dollar would likely lose a lot of value as well.

FWIW as other said I think a US debt crisis would have global impact, US liquidity (dollar, US debt) is what is greasing the wheels of the world’s financial markets.

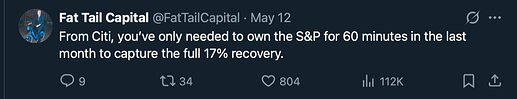

(Source)

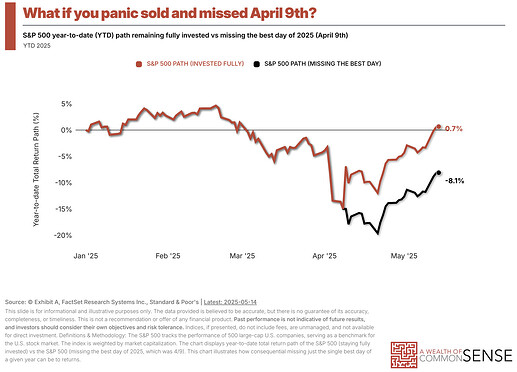

What if you panic sold right when things seemed the bleakest right before that crazy 10% up day in early April and then panic bought back in the next day:

(Source)

That is an excellent chart!

Potentially slightly dippy day tomorrow.

First it was foreign governments, then it was lawyers , then it was universities, then it was judges who were told what they should do and what they should not do. Now it’s time for corporations.

After Apple was told to stop making iPhones in India and make them in US instead. Seems like now Walmart stock investors would be feeling Yippy.

“Walmart should STOP trying to blame Tariffs as the reason for raising prices throughout the chain,” Trump posted. “Walmart made BILLIONS OF DOLLARS last year, far more than expected. Between Walmart and China they should, as is said, “EAT THE TARIFFS,” and not charge valued customers ANYTHING. I’ll be watching, and so will your customers!!!”

Continued:

… Trump’s comments echoed Commerce Secretary Howard Lutnick’s comments Sunday on CNN’s “State of the Union” that “businesses and the countries primarily eat the tariff.”

Nothing as promising as elements of a centrally planned economy, is there?

Treasury Market : Administration 1:0

CEO class : Administration (playing now)

Would be easier to create a tariff refund system (Trump subsidy = tariff paid) rather than telling retailers whose margins are anyways not enough to eat 30% tariffs.

The tariff revenue is already committed towards upcoming tax cuts for those deemed deserving them most.

Walmart’s profit margin in 2024 was about 2.6%. Of course can they absorb the tariffs themselves … ![]()

I believe the message is that „accept a loss or else….“

…hey…that’s a nice business you got there…would be a terrible shame is something were to happen to it…

We’re borderline politics again … but I do admit I am personally curious, too, who will cave in first.

We’ve already seen that the bond market has … a tight grip on the … well being of the wanna-be mafia boss and will make a … ballsy move if necessary.

I personally think so does the equity market, but if a single company like Walmart can withstand an orange utan beating his chest … we’ll find out in due time.

The majority shareholder in Walmart – the Walton family – is worth about a hundred times more than the other guy, so maybe that plays a role, too.

If anything, the other guy will help with a more attractive entry price for $WMT which has been on my watchlist since I started it but always seemed too expensive:

(I’m afraid that even halving the stock price still only brings it to its normal valuation of about 18xP/E, which is still not a bargain, but perhaps a fair price for a wonderful company or so)

I sold WMT for around $50 thinking it had gotten away from fundamentals. What a chump.

Here’s something he apparently also said a little while ago:

“After causing catastrophic inflation, Comrade Kamala announced that she wants to institute socialist price controls . . . Her plan is very dangerous because it may sound good politically . . . This is Communist; this is Marxist; this is fascist.”

(Source)

Market doesn’t seem to be overreacting to the US credit score downgrade, possibly because Moody’s is just in line with the other two. I was kinda hoping for a buy day, but let’s see until later today.

Were you hoping for a 5% drop?

Because futures are down by 1.2% for Sp500

US credit rating is pretty meaningless in my opinion.

They control the world reserve and the market knows everything there is to know about the US and its budget.

A rating agency won‘t know anything more or influence anything more than the market already does.

For smaller/less inportant countries it‘s likely different.