Maybe Vanguard folks are now feeling vindicated for their long term capital market forecast

They may, they may not ![]()

There are many scenarios where the next 10 years may see the S&P500 give 2-3% annualised.

Now if you want a GOOD LAUGH picture US policymakers kick non-US investors off IBKR, I’ll be exactly like this: https://www.youtube.com/watch?v=w0lV6uMtcz8

Here’s a funky mind-copulating thought I had last night: “if one stacks cash in anticipation for a fall in the market, or is planning to raid emergency funds to buy a dip, it makes no sense that they don’t just sell right now”.

I agree that if you have decided to stop buying stocks and accumulate cash in anticipation of a crash, then you probably ought to sell some stocks if you want to be perfectly rational and logical.

However humans are not logical nor rational. I for one have a rule that I will “never sell” my equity exposure to avoid the potentially catastrophic risk of panic selling during a downturn. So for me to implement a reduction in equity exposure, my only option is to cease investing and hoard cash. (I’m not doing this though, it’s just for argument’s sake)

You’re exactly on point. I consider myself very pragmatic and rational, so do my family, friends and coworkers, however I felt I caught myself doing something illogical by saving cash - never stopped saving - since last June, since I did and still do believe in a crash, first due to P/E and now increasingly due to volatility in a euphoric market which, in my opinion, just needs a few sparks to burn up.

I plugged it all into gold last Monday but mostly thinking it’ll run up counter to a dip in stocks so I’ll plug it in stocks when that happens. Have set some sell X/buy VWRL targets for VWRL which is my main investment.

Same, I don’t plan to ever be uninvested, if anything the only thing that stopped me selling is the idea that I am giving away dividends.

Wrong.

You hedge the fall of the market by stashing cash. If it crash, you have cash to buy it, if it doesn’t, you have your ETFs.

There’s no real right or wrong, other than panic selling.

Edit: theoreticians will come and talk nebulous things like opportunity cost.

Edit 2: hedging I agree with conceptually, but in reality it also depends on the portfolio’s size and saving rate. If one can save 2,000/month and their portfolio is 500k then the “hedge” is not a hedge, it’s peanuts.

I heard that argument before, and I don’t think it plays fair.

If you were 100% sure there’s a crash coming, you should be selling all stocks, and it would be illogical to still keep some. But you cant’t be 100% sure, everyone is guessing what will happen, and in that case, you stay invested in case the crash doesn’t come.

I haven’t heard it before, other than in my own head. It’s not an argument, just a thought. Of course nobody legally knows what’ll happen and when, otherwise there’d be acting upon and making a ton of money at it.

27 posts were merged into an existing topic: Thoughts on portfolio diversification [2025]

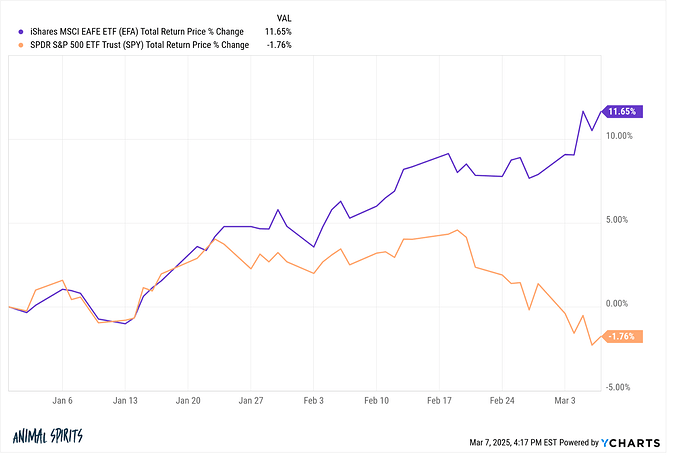

Fast forward to 2025 …

(Source)

Beginning of tables turning or just a Trump induced hiccup?

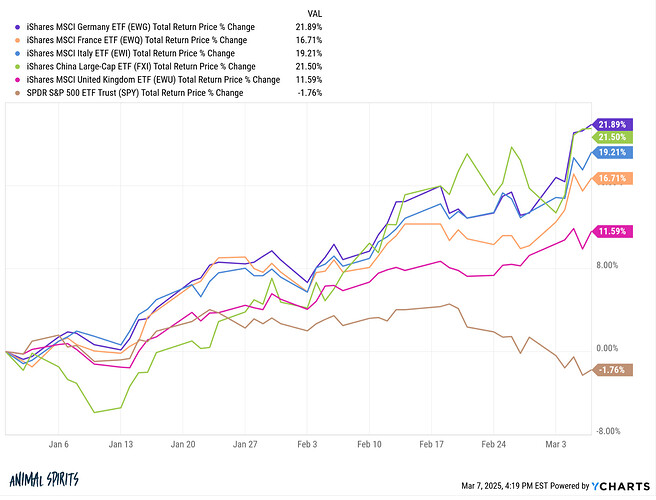

Country breakdown:

(Source)

Insert why not both? meme

Coming for us now too.

I mostly have unspeakable things left to say about the whole Trump situation and I don‘t think I remember the last time I felt as angry about world affairs.

I think this is not the first time that happens. The reason last time was the artificial keeping of low value for the Swiss Franc. That sounds absurd as the Swiss Franc is one of the only currency that performed better than the U.S. Dollar, but the Swiss National Bank then kept the CHF at an artificial low level to the EUR.

For the tax we have VAT on everything, even much lower than other countries. The U,S. has no countrywide VAT. This difference may count as an import tax U.S, exporters have to pay but Swiss exporters don’t.

The best outcome would be to send the VAT where it belongs; to hell. We could replace it by a cash flow tax for companies. But as this outcome is very unlikely I suppose the U.S. will simply add a tax of the same percentage to Swiss exports.

I hate those nonsense taxes, VAT has destroyed many businesses in Europe already. But the solution should be that we leave it and not that the U.S. charges it too!

I would say - all this shows one thing, US is not as exceptional as everyone seem to believe. When a country goes after every country in world to try to squeeze them, this clear shows they are desperate and not really strong

Having said that - I think this whole notion of complaining about trade imbalance is very childish. US folks don’t but foreign goods because of low tariffs , they buy them because they like them or they are cheap. Just by adding tariffs doesn’t change any of these facts.

For example -: if I want to buy NVDIA chips, would i produce them myself if CH were to add 100% tariffs. No

I really don’t get how VAT came into a debate about tariffs. It’s probably just because the US is one of a handful of country not having VAT so they don’t understand it.

VAT is a tax on consumers, not on companies, and it’s agnostic to imports (US imports are taxed in the same way as internally produced items). If US wants to introduce VAT they can go for it (and actually it’s more efficient than sales tax, because it doesn’t stack when things cross borders).

Also it doesn’t take into account the services flow, US is a huge exporter of services (I think trade balance might even be in favor of US when looking at goods & services instead of just goods).

Yes they ignore it because they know Europe has no option but to use cloud services or other services which are from US.

Hopefully some new companies will be formed in Europe to compete

Let’s focus on economic/policy issues? (I don’t see how that line of argument ends up with anything constructive…)

As pointed out by @cubanpete_the_swiss: this is not the first time. And the Swiss National Bank openly admits that they intervene in the currency market, which, by the US, is a no-no, especially if the USD is part of it, even if only indirectly.

Your words in God’s ears. I’m not holding my breath, though.

Here’s the thing, though:

(a) the guy at the table with the biggest gun (by far) is Uncle Sam. Uncle Sam currently thinks he’s being treated unfairly. Doesn’t really matter whether he’s right or wrong as he’s holding the biggest gun and thinks it’s fair (to threaten) to use it.

(b) you can neither produce nor buy the latest NVIDIA chips unless Uncle Sam agrees, even if the single most critical chip producing equipment piece is made in the Nederlands by ASML and even if these chips are mostly (all?) manufactured in Taiwan by TSMC.

Uncle Sam says where ASML can export their equipment to and Uncle Sam says who can import NVIDIA chips (of course there’s loopholes and what not, but the playground rules are established by Uncle Sam, and enforcement is up to Uncle Sam).

As for the further remarks about this being “childish” and not taking into account this view or that angle: you’re (IMO) mostly right, but does that matter to anyone actually deciding on these policies?

And when was life ever fair, to add insult to injury?

(Just to be clear: I think I mostly agree with you, I’m just challenging you on idealistic desires and views versus current Realpolitik and likely outcomes)

As suggested by @nabalzbhf, let’s focus on economic/policy issues and trying to stay clear of mostly policial views.