Done today. Thanks. Great actors, dialogs, Wall Street culture portrait.

I preferred the big short for the sake of illustrating the turmoil and financial mechanisms. It’s more abstract there (well I got they were in deep shit and had to sell it all).

Cheers

Surely this must be inaccurate reporting, otherwise it would be strange to hedge debt by going short stocks? A CDS would be much more appropriate, no?

For those of you who almost forgot - it’s TACO Wednesday! ![]()

I was already thinking before, Trump becomes boring.

You’re selling again today? ![]()

I do need to sell off another 5%…

I read today that BRK has been a net seller of stocks for the last 12 years. WTF? Is that true?

That sounds more reasonable.

I’ll probably next year or so have to replace my iPhone SE 2nd generation, too, once it’s no longer supported … ![]()

Yup. Enjoy Monday ![]()

I’ll be in lovely Glasgow on Monday, hunting for clients and deep-fried Mars bars ![]()

Part of a trip looking (self-experimentally) at GLP-1 drug manufacturers and doing research for their potential investors?

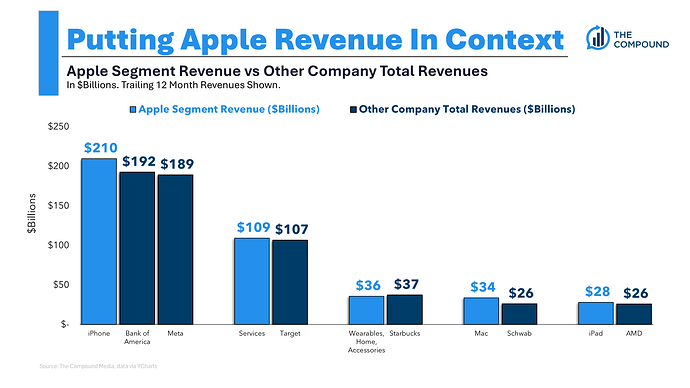

I was once responsible for a then still somewhat single point of failure environment at Google for credit card processing (of then only ads and mostly Adwords revenue). When a new engineer was planning change management on a critical part of the environment, I could casually remind them of how much revenue was being processed per second[$] and ask them what their estimated recovery time was from an unexpected failure in the change and what amount of revenue that translated to.

This usually resulted in another go at revising and testing the planned change …

Kinda mean, of course, as a failed payment by a customer who wanted to pay for their ads probably meant they would try again later since Adwords then kinda had a monopoly (mostly still does …).

$ IIRC it was a significant five digit USD amount at the time, $20k or $30k or so.

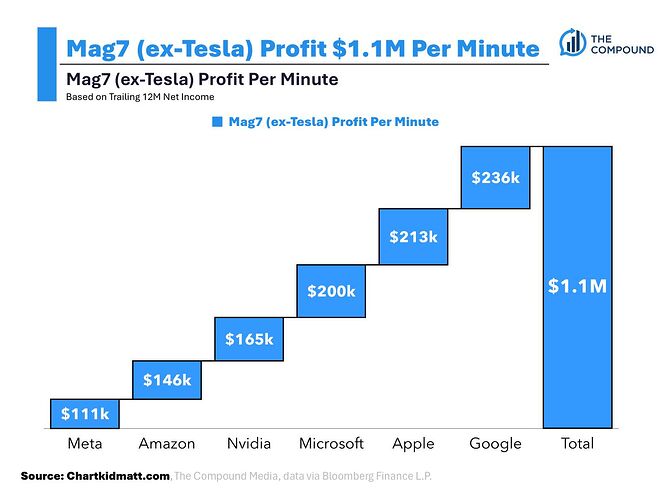

I’m curious, if beside the point. When did the need of a Mag7 (ex-Tesla) grouping arise, what is its significance and why didn’t they go for a Mag6 or whatever MANMAG acronym they would have come up with?

That data may be relevant but I just can’t for the love of me give it credibility when it uses such monikers and I struggle to look past it at what it may be signaling.

Problem is that mag7 were chosen for tech companies with good stock performance and tesla is a memestock* with barely any profit. (Though I think adding it to this chart makes it still very true, tesla is just tiny in the group wrt profit)

*From a recent Matt Levine piece on the CEO compensation saga:

Right, if you are a shareholder of an Elon Musk company, the deal is (1) you give him whatever he wants whenever he wants it and (2) the stock goes up. Obviously corporate governance experts hate that; it’s terrible governance; really it’s no governance at all. Some investors hate it too, but the remedy for them is not to invest in Elon Musk companies, and they mostly don’t. The people who invest in Elon Musk companies are mostly fine with the deal, and that really is the deal.

First time I see it explicitly, but over the course of the past year I’ve also anecdotally heard that Tesla should be replaced by Broadcom in the Mag7.

The issue for excluding it from this profit graph is of course that Tesla doesn’t really make a a lot of profit (and it’s been shrinking), especially with EV credits now gone.[$]

But that’s another can of worms we should probably stay away from in this topic … ![]()

[$] According to Gemini Tesla’s profits are $11’606 per minute. According to Grok it’s $9’663.

I remember the last time in a similar situation, the Mag7 were called somehow different, an acronym with the starting letters, FAANG I think.

My captain made me buy oil stocks then (like now) and I did compare my oil holdings with those stocks. I just stopped because I let them all way behind. Of course you have to know to sell… and there were many many bad years for oil stocks.

The stock market is cyclic, just some tech companies still have not found their cycle.

There is a famous western movie called the Magnificient Seven. That’s literally the reason why the name catched on, and also why it’s kept still.

Which is a remake of a movie by Kurosawa. Not sure if people who named these stocks are aware of this fact, though.