Indeed, not mirrored by talk when there are +1-3% pumps, which perfectly relates to human psychology of loss aversion!

I see. Basically in times when all assets look expensive , it can be scary because on one hand momentum is driving prices up higher while risk free assets look boring. In those times, investors should focus more on wealth preservation and manage their downside risk rather than focusing on returns only. No wonder Buffet cash pile is increasing as he is not able to find good deals these days

Personally I make the allocation and just stick to it because it’s very difficult to change based on news. I don’t have tolerance for 100% stocks so I keep it at 65% or so.

Yup. I have forced sales over the next few years as I fill up the pension.

Just ignore this topic. Message count is skewed - a few posters with low discipline that post too much.

If you are a 100% stocks investor, never have a look at the share price and grey out your sales button. If you are a balanced investor, check your Portfolio once a quarter only.

If you were a senior balanced investor (Portfolio exceeding x15 or so of annual contributions) - then write quarterly expiring cash covered puts on your preferred ETF - that were deep out of the money. Meaning you every month get a tiny insurance premium, and when shit hits the fan you automatically re-balance at least in part.

Otherwise neither read here nor watch your Portfolio.

are you classed as a professional trader based on the above trades and frequency of these trades?

No. It is quite difficult to be classed as a professional trader.

Good advice.

I’m 65/35 but will gradually shift to 60/40 over the next few years.

Then I have to get a life. Rude.

As explained, I did that, also a good method for it: transfer your assets from US cheap fee broker to a low cost Swiss custody account where transaction fees make you want to keep your holdings. Diamond hands with Swiss security!

Hopefully quarterly contributions can match, otherwise I’m stuck with my greyed-out button.

If you don’t get it, I can’t explain it to you. Do your own research.

(That sounds so 2021).

We’re missing an important event, David Beckham’s knighthood. I saw this match live, in the UK, wasn’t fun being a Greek in that crowd. David Beckham’s free kick against Greece

That said, developed big respect for Becks since watching the Netflix documentary.

Trump met with Swiss representatives from the private sector yesterday (article, German).

From his post on Truth Social:

It was my Great Honor to just meet with high level Representatives of Switzerland. We discussed many subjects including, and most importantly, Trade and Trade Imbalance. The meeting was adjourned with the understanding that our Trade Representative, Jamieson Greer, will discuss the subjects further with Switzerland’s Leaders. I’d like to commend all of the people present on a job well done. Thank you for your attention to this matter!

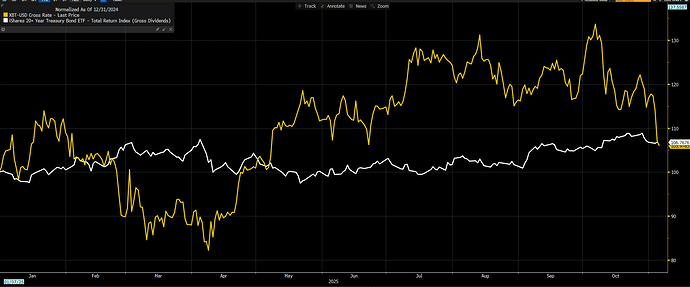

now do a 2-yr chart ![]()

How about … random number, honest to God ![]() … a one month chart instead?

… a one month chart instead?

For anyone who hasn’t seen Margin Call, I’d highly recommend it. It is so understated and I’m always amazed that they created a film about such a dry subject (and played it straight) - there was amazing acting and very realistic scenes (as anyone who worked in a big firm will recognise).

So, DB apparently have started to short the AI stocks to hedge the risk of it’s lent money to the same AI companies. Very smart! ![]()

+1

I recently read a quote by Jeremy Irons on preparing for his role on Margin Call. He (apparently) studied finance execs / CEOs to find the best way to portray his role as John Tuld as the CEO of one of the surviving banks in the GFC by studying how they behaved publicly, on earnings calls, etc.

He came away concluding that a totally unemotional, un-empathic way of behaving and communicating was the way to portray these execs.

Totally nailed it.

Btw Michael Burry is shorting Palantir and Nvidia with like 80% of his portfolio and over a billion.

He has been quite wrong in the past after 2008, but who knows.

Shorting Nvidia is courageous.