Added $500/year worth of SCHD dividends from TQQQ chickening out sale when it hit $110 (down from $120, cost basis $62). My wife laughed at me.

WSJ: This Famous Method of Valuing Stocks Is Pointing Toward Some Rough Years Ahead

…

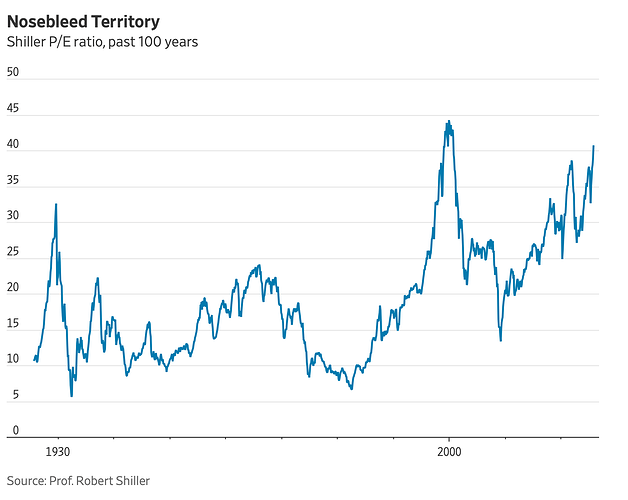

The version [of cyclically adjusted P/E] popularized by Nobel Prize-winning economist Robert Shiller looks back at 10 years of earnings and adjusts them for inflation to cover an entire business cycle. It recently broke above 40 for the second time ever.The first was in 1999, and it didn’t stay there long. Cyclical peaks in the Shiller P/E have coincided with negative real (inflation-adjusted) returns for stocks over the ensuing 10 years, including in 1929, 1966 and 2000.

…

The Shiller P/E isn’t necessarily a timing tool and can stay elevated for a long time. Zoom out, though, and it does an impressive job of steering investors away from dangerous shoals.

But if your risk tolerance isn’t high enough to have a large equity allocation to US stocks/growth stocks at this time, what alternatives do you have to invest in?

- Gold already went up and is arguably overbought

- Stocks around the world have done better recently

- SNB considers -ve interest rates

- Real estate costs are still high

- US bonds risk inflation / falling USD value

- CHF bonds have low yield

Do we have any alternatives left?

Also from the referenced article:

Something’s gotta give. And, with the Shiller P/E now higher than it has been 99% of the time, it will have to be the “P” more than the “E.” Some consolation, though: Other stocks look more promising.

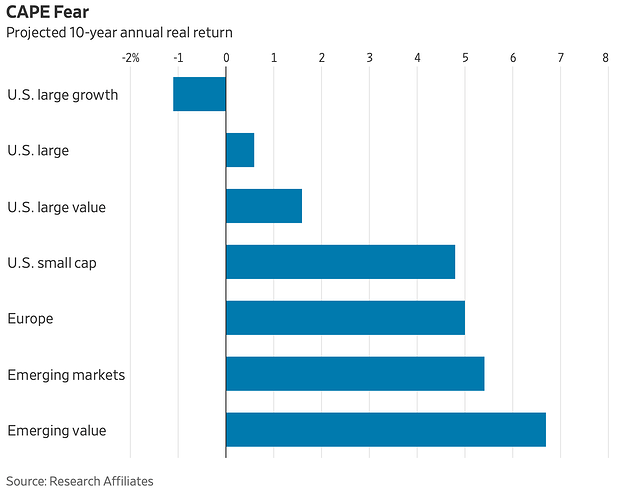

Index developer Research Affiliates has a model that forecasts future returns for investments based on cyclically adjusted P/E ratios. Its model gives the U.S. the benefit of the doubt on measures like economic growth. Its calculations call for large U.S. growth stocks such as the Magnificent Seven to have a negative 1.1% real return over a decade while large value stocks could eke out a positive 1.6%.

The picture brightens for small U.S. stocks, which have an expected real return of 4.8%. European and emerging-market stocks look a little better at 5% and 5.4%, respectively.

P.S.: I feel comfortable quoting large swaths of the article since it also exists as a free newsletter.

I’ve heard of BTC.

Yes, spend it and have fun doing it!

hedge funds

You mean, shorting GME?

- Rule Number 1: Don’t Lose

- Rule Number 2: Don’t Forget The Rule Number 1

I keep forgetting rule #2.

I had an insight in a discussion with ChatGPT. If P/E is too high, we can of course move laterally into other assets & strategies. If they don’t have enough return, but acceptable sharpe, we can just lever them up. We should actually always do this: A levered highly diversified portfolio. Takes more time than VT and chill, but is the only realistic way to significantly increase expected returns in public markets (e.g 9% to 15%).

That was not the insight. The insight was: If P/E is too high, we must sell E for P. To get E for selling, we must create it. I sadly don’t know nearly enough, but I would expect that it is possible to create new E with capital less than P, especially if the market is willing to pay so much for E.

Could this only work at the size of TESLA? Or could you also relieve the market of its money at smaller sizes?

Anyway. I’ve been meaning to sell for a while so of course, I picked probably the worst time to do it.

I had about 10% leverage in the portfolio and sold about 10% just now to bring it closer to zero.

Enjoy your stock market rally tomorrow!

No offense but sometimes I don’t get this forum.

Panic mode is above all what we should never trigger.

Such an inconsistency between the skill, analysis, curiosity in personal finance… asset allocation, sometimes advanced finance/market/product debunking… and … selling when market drops.

Maybe that’s a smart move though, time will tell.

I greyed out my sell button (which can lead to other problems).

Today’s not even particularly noteworthy, it’s a touch above market noise, even for TQQQ.

I think the list you have made are the alternatives. So why do we need more alternatives ?

They are not so appealing ![]()

Actually, I ended up buying as well as selling so only a net 5% reduction in the end:

| Type | Asset |

|---|---|

| Buy | KDP |

| Buy | FDS |

| Buy | CB |

| Buy | AES |

| Buy | KHC |

| Buy | GDDY |

| Buy | GRAB |

| Buy | AES |

| Buy | CAG |

| Buy | CHTR |

| Sell | CNR |

| Sell | GPN |

| Sell | APA |

| Sell | UNH |

| Sell | BIPC |

| Sell | ADC |

| Sell | LHX |

| Sell | FI |

| Sell | KVUE |

| Sell | BN |

| Sell | ADM |

As Tuld would say: “If you’re first out of the door, that’s not called panicking”

But if you keep going out and in the door as soon as the market moves +/-2%, is that such an efficient strategy either?

What gets me is how we react to daily gains/drops instead of focusing on longer period of time. Some news can be alarming and warrant pondering if an actual change of paradigm has occurred but not all 1-2% drops are it.

Don’t equate Phil’s trades with everyone on the forum. ![]()

As things stand, every time the stock market drops 2% there’s talking on this thread.

IMO it’s not the best dynamics for new or squeamish investors that might be reading along (or even for the more experienced and relaxed ones).