I think just Goofy liking Cramer ![]()

Yep.

In other news, reddit was awash this morning with threads on OpenAI preparing for an IPO in 2026. Naturally for 2025 and reddit the conversations had no middle ground fit for this centrist. It was either “BOOM HERE WE GO” or “OLOL VC’s exit liquidity loading GLHF morons”.

Having a friend who really did buy into Facebook (meta) on IPO day I am going to put some little money in and let it run, as a bet, aware of the mantra/axiom that buying on IPO is a bad idea because it’s really insiders unloading.

So the Trump/Xi meeting turned out to be a nothingburger. They agree to a 1 year deal? WTF? So now we get to replay this every year?

There is huge difference here in my opinion.

When facebook IPO‘d, the major tech company boom has not happened yet. Facebook did not reall have a product they could sell, proper monetization was many years away and people didn‘t know yet how to really monetize all that data etc.

Today everyone and their mom is piling in on AI/tech companies and the valuations are beyond reasonable.

And especially they are extra driven by OpenAI activity.

OAI will IPO with an absolutely insane valuation.

Unlike facebook back then.

Pray for midterms.

You’re very right, agree, however it’ll be a bet, CHF1000 or so, and let to run.

Worked well for PLTR ![]()

Ehm, it did indeed, so not sure about the clown face, edit: I remember reading or listening to Prof Damodaran saying how he believes “PLTR is the one convincing company to bring AI to reality”, or something along these lines, (I could sneakily stop there but for accurate “reporting” I won’t) and it’s the valuation that holds him back from investing. This quote - read/heard it at least 6-9 months ago - has stayed with me, but it was the valuation holding me back, too…edit: 68% gains later I still don’t have PLTR because valuations ![]()

Plus imo PLTR is more esoteric for retail at large, nevermind us here, OpenAI is probably known even by shoe shine boys and Greek goat herders ![]()

Edit: On topic of videos, I happened to have listened to this one over the w/e, very good listening.

I am a regular follower of Ritholtz team content like Animal Spirits or Ask The Coumpound. Really a big fan of Ben Carslon and read his books. Also read the last one from Barry and found it entertaining.

Much less fan of Josh Brown and its tone but will listen that episode with Jim Cramer for fun

What a disappointing week:

- Trump/Xi meeting didn’t re-ignite animal spirits

- JPOW remarks on December rate cut not being a foregone conclusion further dampening things.

I was really hoping on both of these to do the opposite so that I could offload some stocks this week! ![]()

Usually a sign that the market will drive hotter, when the IPO starts ramping up..

On the bright side gold should go back up again ![]()

Come on, man! Nearly 2% on FTSE World, in CHF is disappointing?

I used PLTR products and I am ambivalent. Very limited capabilities and horrible to use for technical staff but easy to sell to managers and accounting of non technical companies at massive margins.

Maybe that’s why the stock is successful?

wall of worry, scaled?

Nobody knows the outcome, of course, and BoA might be right.

But just this approach in and of itself … I find it … well, what is the right word … mindboggling that analysts of a (large) bank (a) meet with the CFO of a company they rate, and, (b) adapt their expectations of the company’s financial results afterwards.

Isn’t this just plain … I don’t know … Goofy shakes his head.

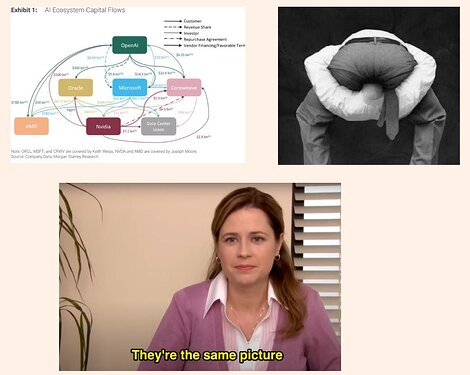

I’m still in camp circular, though:

(Source)

Added $500/year worth of SCHD dividends from TQQQ chickening out sale when it hit $110 (down from $120, cost basis $62). My wife laughed at me.

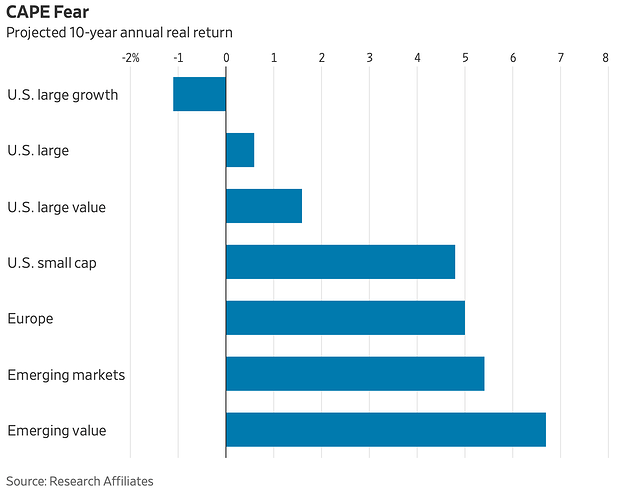

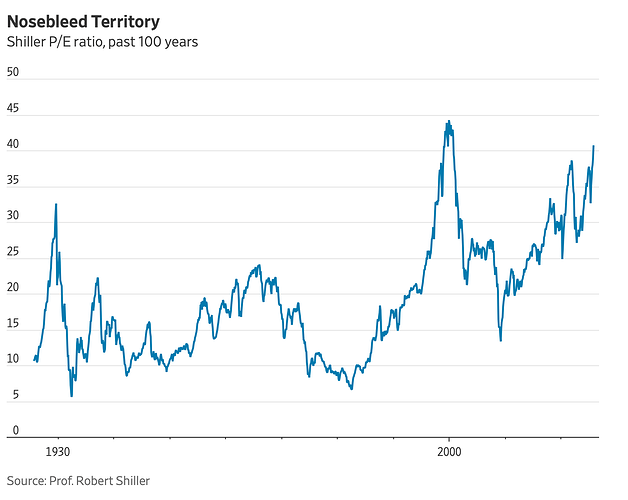

WSJ: This Famous Method of Valuing Stocks Is Pointing Toward Some Rough Years Ahead

…

The version [of cyclically adjusted P/E] popularized by Nobel Prize-winning economist Robert Shiller looks back at 10 years of earnings and adjusts them for inflation to cover an entire business cycle. It recently broke above 40 for the second time ever.The first was in 1999, and it didn’t stay there long. Cyclical peaks in the Shiller P/E have coincided with negative real (inflation-adjusted) returns for stocks over the ensuing 10 years, including in 1929, 1966 and 2000.

…

The Shiller P/E isn’t necessarily a timing tool and can stay elevated for a long time. Zoom out, though, and it does an impressive job of steering investors away from dangerous shoals.

But if your risk tolerance isn’t high enough to have a large equity allocation to US stocks/growth stocks at this time, what alternatives do you have to invest in?

- Gold already went up and is arguably overbought

- Stocks around the world have done better recently

- SNB considers -ve interest rates

- Real estate costs are still high

- US bonds risk inflation / falling USD value

- CHF bonds have low yield

Do we have any alternatives left?