Welcome to adulthood, Steven Levy. Sorry the heroes of your childhood didn’t turn out to be the paragons of the story but rather flew too high and burnt their wings on the power they’ve accumulated.

Old news, market doesn’t care. Reddit was all over it as the latest and greatest Trump End of the World Signal but it turned out to be a drone a redneck shot mistaking it for a crow.

Frankly most of them are/were/will remain total assholes, guess Steve will have to eat crow.

Pulitzer prize please!

Great call.

And even though I’m (only) Gen-X I feel like this narrative (of once great tech giants but now disappointing) is as old as there are growth narratives.

When I left my first banking job in 2004 half a year before joining the GOOG a techie colleague at the bank gave me a goodbye present book: The Soul of a New Machine by Tracie Kidder, released in 1981 or so. The book was awarded the Pulitzer Prize in 1982, no less, at my then tender age of being an early teenager, then completely ignorant of “computers”.

Anyway, the book – great read! – discusses the cut-throat approach of tech companies at the time (in the 1970s). Fostering grass-roots innovation but also applying mushroom management: “Put 'em in the dark, feed 'em shit, and watch 'em grow.”

Things were perhaps slightly different in my time at Hoolie, and perhaps again slightly more different now, but if you squint a little, things weren’t really that much different 40 or 50 years ago (at least in the valley).

A little odd to me that Steven Levy didn’t catch onto this earlier, but my simplest explanation is that he had access to people like Jobs or Wozniak in the early (Apple) days and then anchored his view of “this is how great things were in the early Silicon Valley” which rotted over time (but didn’t really rot, as this is how it was all the time, or at least) since the invention of the accidental invention of the transistor by William Shockley.

I think that applies to a significant part of the market: investments are driven by the rose tinted glasses we have of past times, sometimes long past, sometimes months or weeks ago.

It’s hard to take a cold look at reality and even harder to know when we do from when we think we do but actually don’t. It takes a lot of wisdom also, I doubt it is so widespread as to cover all of the many porftolio managers and analysts who are responsible for the investment decisions that actually move the markets.

Edit: even more so when I see so many “senior whatever” people with 3-5 years of experience (especially in the financial and HR fields). Seniority implies experience that takes time to accrue, it isn’t something that goes with a young wolf, no matter how long their teeth.

Effing Linkedin is such a cesspool. Everyone’s a “lead”, “story teller”…makes me want to vomit from the eyes.

“Food & Beverage Manager/Lead (more grand) in a multibillion, multinational dollar company” - meaning acne-faced sap working the Mickey Ds till.

“With great commitment and collaboration from my team, hard work and targeted choices I managed to obtain this milestone/achievement/inflection point which will change my life, give me great mobility (mirager: hopefully only horizontal, not vertical)” meaning they passed a driving test.

And the Lead Commodities Trader is the tea-boy who re-stocks the kitchen.

I think you are right. This endless stream of money must inflate prices and depress returns if it is not consumed or increasing production. Active trading can make the market more efficient or change volatility, but in the end they just push value from one corner to another. They might branch out into other assets, but that won’t solve the underlying problem.

I think this might not be limited to Tech Execs. I think even a lot of general public might be bewildered with what’s actually going on. Press, Law firms, Universities, Business Execs and even lawmakers have been silenced systematically. Now even Brazil judge is sanctioned by US because of judgement against Bolsonaro.

The way the entire policymaking has been centralised and there is literally no political recourse is quite a change. For years US has made snarky remarks about China and Kremlin for doing the exact same thing.

Now - Only option left for people in US is to go to courts and even there I am not sure if justice is actually served or is again divided by party lines.

Court decisions have been fairly impartial so far and the justice system is the one branch that serves as a mitigant on executive decisions. Corporations would have high likelihood of winning if they went to court and those who do often do, which is what makes big corporations/lawfirms/universities folding without a fight even more disturbing.

I don’t think tech execs are currently intimidated into bowing to the administration. It feels more like they are actively making things happen and see the situation as a way to gather more power. I’d say short term, it should be good for their stock price but I’m bearish on the US being at the forefront of innovation going forward.

I think they’re just riding the wave, they saw that flattering Trump is the key so they play along. Musk is just too much of an egomaniac to play along so he got snookered by the others.

When there’s another admin they’ll just change the tune. Money will flow either way.

How Nvidia Is Backstopping America’s AI Boom

The WSJ’s own quick summary:

-

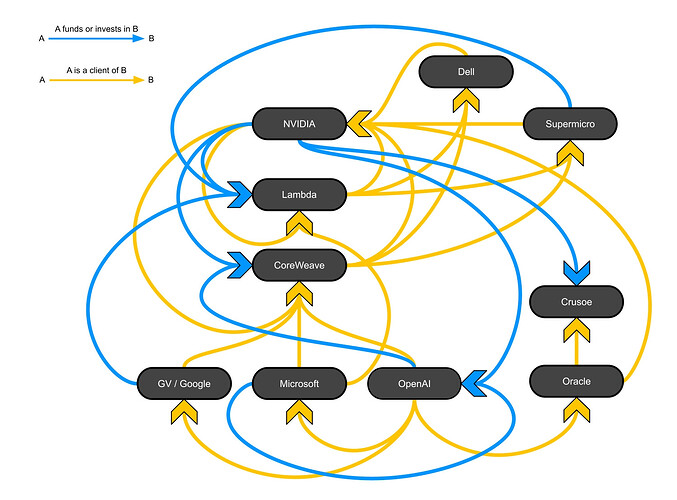

Nvidia’s $100 billion investment in OpenAI follows a pattern in which the company helps strengthen supply chain partners.

-

Some analysts highlight Nvidia use of “circularity,” investing in key partners like OpenAI, CoreWeave, Intel, and xAI to boost demand for its AI chips.

-

Nvidia’s investment significantly reduces OpenAI’s credit risk, granting it access to cheaper capital and lower interest rates for data center financing.

Excerpt:

For every $10 billion Nvidia invests in OpenAI, the startup will spend $35 billion on Nvidia chips, according to an analysis from NewStreet Research. That arrangement reduces Nvidia’s typical margins for cutting-edge chips, but ensures continued demand and offers a lifeline to cash-strapped AI companies. It effectively amounts to a discount for OpenAI.

Goofy’s naive math:

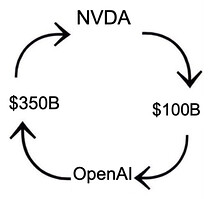

Nvidia spends $100 billion on OpenAI.

OpenAI spends $350 billion on Nvidia chips.

Brrr …

Am I holding this wrong?

Talking about AI bubble ![]() seems like self fulfilling idea to fund your customers to buy your products

seems like self fulfilling idea to fund your customers to buy your products

Actually all this is almost unbelievable. But it happened. And I or most other people can’t do anything against what already happened.

Meaning I know I can’t influence much of what will happen and none of what has happened… I just live.

Thanks for tolerating a philosophical post in -chronicles of 2025.

Ah, glorious vendor financing.

Us older ones may remember Nortel and Lucent anno 2000.

AI summarizes -

„When vendor financing becomes a tool to inflate sales rather than support solid, creditworthy clients, it can backfire badly—leading to liquidity crises, balance sheet implosions, and even bankruptcy.“

(Source)

Still can’t quite wrap my head around these transactions, but the meme by Kuppy made me lol.

It drives the stock price up, which increases execs’ compensation. That plus there’s a looney toons effect to investing which is that if you can pretend for long enough that you are not walking on empty air, you can just reach the other side of the chasm and achieve profitability with your hot air baloon. Case in point: Tesla.

Btw the 39% are just here to stay it seems? That‘s a severe strain on the economy and I kind of don‘t see much talk about it?

Is the swiss market slowly catching up as well? Been going down steadily for days now.

I think since there is no tariffs on Pharma or gold yet, the impact is restricted to few sectors for now .

In back end , Switzerland is trying to make a deal but it seems tough because US wants wealth transfer type of deals in exchange of lower tariffs. I don’t even know if it actually helps Switzerland or not. South Korea already mentioned that their deal might not conclude as it can cause financial crisis for Korea.

We have to see what eventually happens with EU deal because US is pushing to have in written that if commitments on purchases / investments are not fulfilled then tariffs will be higher.

Switzerland will need to find a way to export to other regions & invest locally into digital services infrastructure that should help create jobs in service sector..

“Switzerland is indeed pushing harder than ever to diversify its trade,” says Guido Cozzi, chair of macroeconomics at the University of St Gallen and an expert on global trade and markets. “Agreements with India, Mercosur and Thailand, which had stalled, are now moving forward. This reflects Bern’s determination to reduce its reliance on the US market.”

I think we can just wait for Trump to TACO or be gone in a few years.