I have just checked my WIR ¨Treue-Sparkonto¨ and its interest rate dropped from 1.1% to 0.5%. It’s all so tiresome…

This is to be expected with SNB rates dropping. We might reach the point like a few years ago with negative rates where the best safe investment is prepaying your taxes or a cash account at 0% in a bank.

Doesn’t seem like a very wise advice, the risk profile is very different…

WillBe has only 0.35% too now! Will now open all three Cembra accounts (Sparkonto Flex, Sparkonto, Sparkonto Plus) and put in each CHF 20’000 to remain 100% flexible. Gives way more interest than WillBe.

Or people take measured risk and manage the volatility of their portfolios (and stock investors are exuberant never having gone through a downturn in their investing lifetime, 2000 and 2008 were a long time ago).

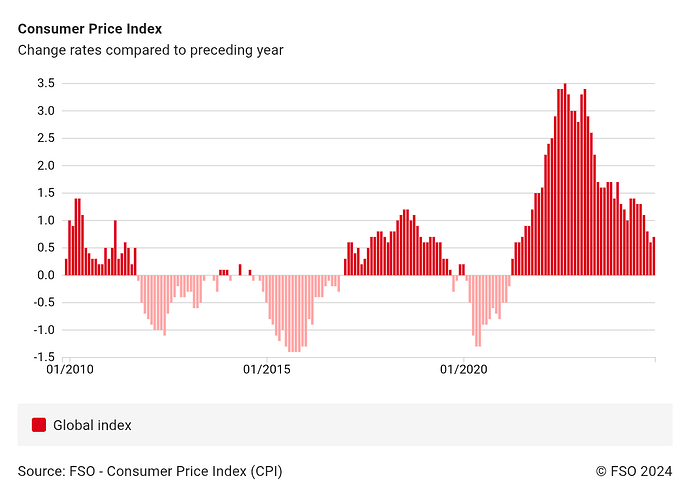

Also people tend to overestimate Inflation in CH as they read a lot of headlines from abroad (US/EU). Over the past 15y, total Inflation is only 5.2% (cumulative). Max annual Inflation was 3.5% (during COVID) and alternating between -1.5% and +1.5% the rest of the time.

Go for the sparkonto plus for the money you probably won´t touch, but ZAK looks more interesting as a flexible “parking” account (0.75%).

I just realized that in order to initiate a transfer from the Cembra savings account, the only way is to send them a message ![]() and… wait until they get around to it, I guess?

and… wait until they get around to it, I guess?

Not an acceptable solution for my EF, so I decided to send a message asking for liquidation. Stay tuned for follow-up about how long it took.

48 hours update: no reaction so far.

6 days update: „Ihr Auftrag ist in Bearbeitung.“

Yep, I realized that after transferring some of my savings, too.

Cembra is still implementing electronic ¨kassenobligationen¨ and merging duplicate accounts, so I don´t expect them to implement ¨normal¨ wiring anytime soon, unfortunately.

The “treukonto” started at 1.35%, then the interest was reduced at 1.1%, finally the rate is currently at 0.5%.

I have currently at 1.8%, once they pay 0.5% I will move elsewhere…

Just to set expectations, any rate above 1% will become fairly rare (and incur extra risk) since the BNS rate is at 0.5% (and 0% above the threshold).

Same here. I assume Wir will change to 0.5% on 1 March. Until then, it’s probably by far the highest rate on the market. I hope they have enough liquidity to back it up ![]()

Last update: Liquidating my Cembra savings account took exactly 1 week, from sending a message to money arriving in my regular bank account.

to withdraw some of the money took 2 days in my case. Still a bit cumbersome to have to send them a message, but it worked fine.

Yes, indeed, in such cases I always hope that they copy the right IBAN number and don’t transfer it to a wrong one. I also always worry that since this message can only be sent on their own system, I won’t have a copy as proof if something goes wrong, as is the case when I send it from my regular email address.

Anyway, which alternative do you chose to Cembra? Because I’ve just opened an account as it seems the best option (1%) for lower amounts.

Every (it seems) Raiffeisen offers the “180 account” with 1% on max CHF 1’000’000 until end of year.

6 month notice to withdraw.

Money has to come from an other bank.

Account is opened by a simple phone call if you are allready client.

Alpian offers 1% interest rate.

My reaction when I’ve read the title of the email:

My reaction when I’ve read the email:

tldr;

You need to deposit 125k before the 28th of february

I understand that it is cheaper for them to pay 1% to their customers than 5% or whatever to creditors. Bonus point: if they go bankrupt, the part above 100k per customer doesn’t have to be reimbursed in either way.

In case anyone has any doubts: don’t even think about putting cash above the insured amount, 100k CHF.

6 posts were merged into an existing topic: Alpian - New Private Banking Fintech in Switzerland

Is it really worth the time and effort messing around with bank accounts for a % gain in interest rate? Presumably for larger amounts it doesn’t make sense to keep all in cash and smaller amounts, the difference isn’t large and probably time and energy could find better rewards elsewhere.

Some people collect beer bottles, some other sugar bags…