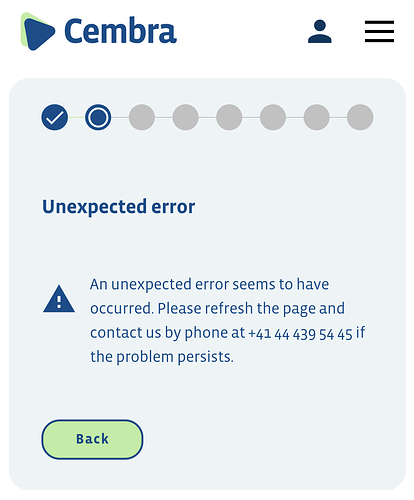

Does anyone else get this error at “step 2” of trying to open the Cembra Savings Plus account?

I failed too many times the ID check and they blocked my name & email… I guess I won’t be able to be one of their customers

Out of curiosity, have you found anything that yields more than Clientis Oberuzwil at same/similar terms (31 days full liquidation) now with SARON ~ 1%?

No unfortunately not, Deposit-Konto - Schwyzer Kantonalbank is a good „ultra safe“ alternative (cantonal bank with state guarantee), but the yield seems to be always SARON - 0.3%

Caisse d’Epargne d’Aubonne has a savings account at 1.75%

Updating for visibility after having to search for a little bit to find it. I didn’t mind somewhat lower interest on my neon Spaces but since it’s dropping to 0% in December I’ve changed my mind ![]()

- Cembra savings account plus currently sits at 1.4%

- Caisse d’Epargne d’Aubonne compte épargne plus at 1.5%

Someone knows whether the restrictions at Cembra mean you can withdraw “once” every 180 days, or whether you can withdraw many times but in total up to 20k every 180 days? I assume the second option. Assume I have 20k there and i need 6k every 2 months, that should work IMO (3*6 = 18k in 6 months/180 days).

Thanks to preferential interest rate. You can instantly withdraw up to CHF 20,000 every 180 days. Larger amounts are available to you after a 6-month notice period.

1.40% per year at Cembra Plus savings account sounds almost too good to be true.

What interest rates did they have during the last no-to-negative interest rate period? Wouldn’t be the first time the rates change radically the day after I deposited some money in a bank.

I’m pretty confident that they won’t be able to hold that in the very near future.

Found this: Bonus-Sparkonto Plus - Migros Bank

it was 1.8, 1.6 and now 1.4 since the 2 last adoptions as far as I remember.

Thank you and all the others that responded to my post!

After one year at 1.8% with the saving account plus, I am now in the fidelity account at 1.15%

Do we have some other good alternatives to Cembra saving accounts (both the flex and the plus one are good) interest wise?

Alpian is atm good-ish with 0.7% - 1%

11 days later…

- CHF accounts [at Alpian]:

- Balances below CHF 75,000: 0.10%

- Balances between CHF 75,000 and CHF 125,000: 0.275%

- Balances above CHF 125,000: 0.50%

zak Sparen changed as well from 1.05% to 0.75%. At moment, the best rate I found.

AND you can now withdraw 50k immediately and cancel the whole amount in 3 months

FYI Cembra Saving account Plus is changed to 1.0% p.a. as of today ![]()

Same applies for Caisse d’Epargne d’Aubonne compte épargne plus (not sure since when exactly).