Succinct as always.

I would advocate for semi-automated. I bet that’s what you do, too, unless you have codified sell orders on IBKR at which point I’ll be … not sure … I was going to first write impressed but on second thought I would probably choose a different adjective …

Anyway, we can probably agree that selling should be at least rule based.

Going back to EXPE. I didn’t even know EXPE is Expedia. Or that it still exists …

Probably last used them more than 15 years ago alongside Kayak when looking for cheap flights before Google acquired ITA and Google Flights launched. Don’t know anything about Expedia’s business model today.

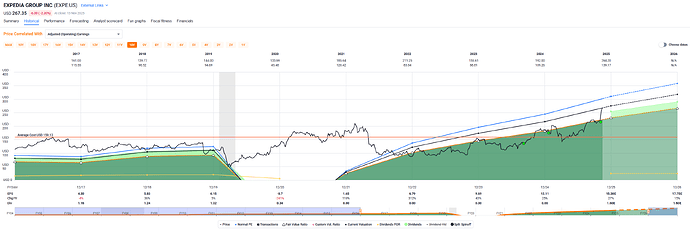

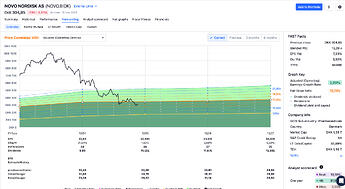

Anyway, looking (purely) at FASTgraphs I would have chosen the full view including the FAST Facts (column on the right) as well as the full 20 years of history.

With this view at hand I would (personally) conclude:

- overall nice growth

- susceptible to recessions (GFC, obviously Covid-19)

- low (dividend) payout ratio, but …

- dividend cutter despite that low payout ratio

- a little high on long term debt to equity (60%)

- slightly overvalued; fair value given their long term growth is 15xP/E

- they don’t provide great guidance (they missed analyst earnings estimates more than 1/3 of the time, looking back over the past year and two)

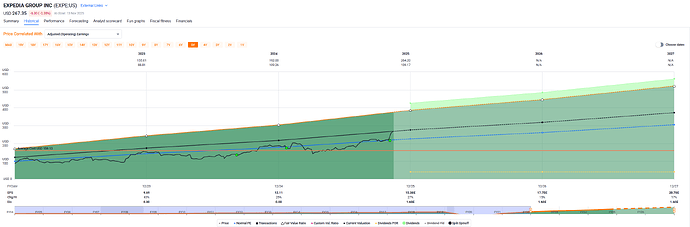

Looking at the (estimated) future …

Doesn’t look too bad:

- earnings estimates have been rising over the past 6 months (but remember the estimates are often missed, see above)

- another bullet point, but empty … can’t really think of anything else

I summary, this company probably wouldn’t appear on my personal potential buy list, mostly just purely out of taste/personal preference. If this company for some reason existed on my holdings list now, I’d perhaps hold onto it a little longer given the expected earnings and potential dividend growth trajectory, but it wouldn’t be a position held with conviction, again mostly for personal reasons:

- I rely on income and don’t like dividend cutters unless it’s for a reason that resonates with me.

EXPE’s dividend cut seems (to me) like either panic or bad cash flow management. Or using “market conditions” as an excuse to screw with their shareholders.

- I don’t have any understanding of their current business model but from memory it seems like without any moat.

The way I remember their business model (buying vacation inventory, selling it at a premium, and sharing the profit with the original inventory provider) I actually kind of hate them. I always try to go to the original vacation provider and buy direct and shake my head about the middlemen like Expedia, Google, etc taking a cut not because they’re better, but because they somehow oligopolized the selling channel. Anyway, maybe their business model has completey changed, in which case you should just ignore this comment.

Your reasons for owning it might be totally different, e.g. not interested in the dividend but the long term total return in 20 years, you might have a more up-to-date understanding of their business model, you might understand how they have a moat, so please don’t take my deliberations as any advice either way.

It depends on your own goals and how you think this company might get you there.

And yes, implement some rules about when it’s right for you to sell.

Lastly, freely quoting one of my heroes:

“(Position) Sizing is more important then entry/exit level”

– Convexity Maven aka Harley Bassman

![]()