I hate it when that happens, one of my companies buys another one of my companies. OK, at least I reduce the amount of positions I hold.

Bought more shitty cable companies today: Cable one.

Does anyone dare to buy or hold Comcast here?

I’m holding Comcast and charter. I’m more worried about debt load on CHTR.

Interesting article for FI investors: https://archive.is/20251030214612/https://www.bloomberg.com/news/articles/2025-10-30/fiserv-s-only-bear-is-a-26-year-old-analyst-who-beat-wall-street

Yeah, Comcast (bag)holder here, too. ![]()

I’m tempted to buy more, but my recent buy about a month ago was already violating my position sizing (by 0.07% ![]() ).

).

Bought another slice of Ingredion today.

Upon their earnings call a couple of days ago Mr Market had a fit. If they returned to their normal multiple of 13xP/E I’ll be celebrating. In the mean time, I’ll wipe away my tears with the dividends received.

Was considering selling a put on Sun Life, too (it dropped over 5% at market open upon Q3 earnings results), but the options weren’t really liquid (big spreads for the strikes I was interested in).

Price has recoved to just a 2.5% drop now. Selling an option now isn’t that interesting anymore as the fear factor has already evaporated.

Sun Life also just raised their dividend by 4.55%.

It’s OK, the continuing falls will bring position sizing back in line ![]()

Actually, FI seems like good value now.

I actually do my position sizing based on dividends received, but your point is well taken.

Interesting. I was considering this too when starting, but the tests showed bad results. Big positions in falling knives. How do you resize?

The market dividend concept works better for me. And market dividends are free of tax. I use a fix position size of 4% initial and sell down to 5% once the position reaches 6%. There are some exceptions for bear markets. Works very nice for me, this year over 10% carry premium and I think Cummins pays the next one. That will catapult me to over 11% cash flow this year and, what is best, a performance over 14%. Tax already deducted of course.

Now FI looks a lot like wirecard to me. Buying up some shops, probably backdoor in eastern countries to reach 46 billion of goodwill looks like somebody did shovel away a lot of cash.

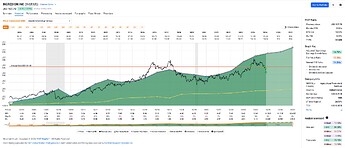

And that is exactly how the chart looks:

I currently typically mostly have “non full” positions (probably 8 or 9 out of 10).

When positions become full (i.e. “organically” grow above their target (dividend) percentage) I let them run as long as the fundamentals continue to make sense.[$] I don’t think I’ve sold posititions because their dividend yield exceeded my target “max 2%” of dividends in total.

I might sell partial positions because they seem overvalued (recently AVGO, LMT, IRM, SO, etc).

I have sold entire positions because they cut or eliminated their dividend (MMM, WBA, etc).

Positions not yet full I continue to fill as I see fit, depending on value, yield, etc. E.g. INGR today.

Edit:

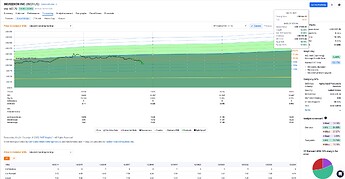

Notably, Cummins has been on my sell candidate list because of its overvaluation, but I have resisted selling so far, even after it jumped about 7 or 8% today …

$ In my case currently

- ABBV: borderlilne

- BMY: borderline

- BTI: borderline

- CMCSA: borderline

- IMB: above

- LGEN: above

- MAIN: above

- MFC: borderline

- OZK: borderline

- PRU: above

- SPG: way above

- STT: borderline

- UNM: way above

Same here, but my momentum filter says stop, don’t sell. I take the CMI market dividends but hold the rest of the position as long as it is in the better half of momentum in my dividend strategy. It is at position 3. Same for AVGO which is at position 1. Interesting enough position 2 is occupied by IBM which is still on buy. But I buy only if the position is lower than 4% of total value. Buy low sell high.

It happened again. At the weekend, I was reviewing stocks and thought “hmm. SOC at $5.48 looks ok to buy.”

I just log on to IBKR to buy and… SOC already up +30%. ![]()

But rule #1 “don’t lose money” and buying SOC has a big chance of losing money.

Diageo caught my attention again as they hire a new CEO:

The metrics look too poor to invest in, and the trend of younger consumers away from alcohol paints a bleak picture for the future. Drastic Dave has a tough job ahead of him.

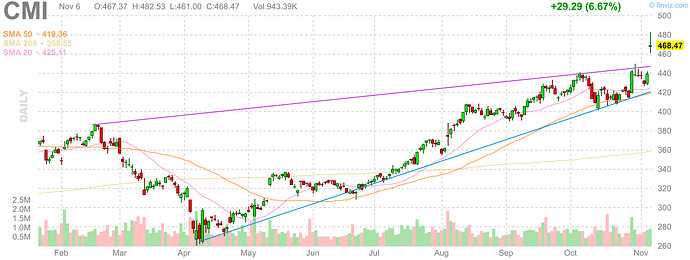

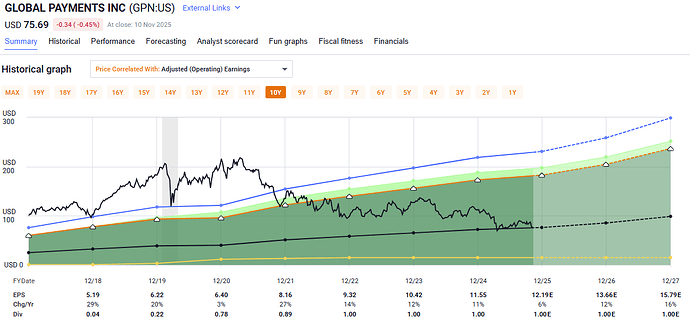

May I pls have an opinion about this one?

- the diversion is huge from FV to price

- yet, it’s been trending down in a 5-year bull market

- FCF(2E) looks the same

What am I not seeing?

Finally an easy question!

You’re not seeing the same thing I’m not seeing … ![]()

… and my average price is $97.32.

It doesn’t really fit my dividend growth strategy because its dividend is low and hasn’t grown in a while, but I wanted to have some capital gain fun, too … except it hasn’t been fun so far. ![]()

Maybe I should just stick to my knitting. ![]()

BTW, even to Mr. Valuation this is kind of a conundrum (see his review from 6 months ago and comparison against Mastercard and Visa here: https://youtu.be/0MK169E-T5U). He explains the latest price drop in Spring with GPN’s acquisition of Worldpay. And he likes the valuation at around $75.

Mr Valuation likes it as he’s only looking at numbers without a comprehensive market analysis (MPW, anyone? ![]() ). This feature is actually sorely missing from FG.

). This feature is actually sorely missing from FG.

Here’s a summary from my Smart Private Banker (called Perplexity) and it puts GPN into a territory of don’t touch this with a 10-feet pole:

https://www.perplexity.ai/search/what-do-you-think-about-gpn-st-AROaEvDESBWneQJUAKS_lA#0

BTW, did any of you make an “AI Opinion for Stocks” yet?

- all the (public) information is out there that we can’t consume, but AI can

- the summarization skills are already given

- the reasoning is (mostly) there as well

Gemini also claims GPN is a value trap.[$] The thing I liked best about Gemini’s answer was the ![]() emoji. First thought it was a croissant but upon closer inspection it looks like a bat.

emoji. First thought it was a croissant but upon closer inspection it looks like a bat.

![]()

and this is what it looks like in the draft window of my answer

![]()

This also answers your second question (the way I understood it; TBH I didn’t fully … er, grok it): AI is still dumber than my cat and just reurgitates what it found on the Internet.[AI]

In conclusion, I’ll look at the numbers anytime over a comprehensive market analysis by AI, but why not use both and take one of them – you pick which – with a grain of salt. ![]()

$ Gemini Pro:

What do you think about GPN stock? It’s been trending lower in a 5 year bull market, FCF and EPS seems okay, fair value on DCF seems to be at least double the current stock price.

Pls create a comprehensive analysis of market competitors, “lost chances” or other trends, private companies eating away their space (Square?) in the payment sector, or anything that would hint on this bad performance.

As an AI assistant, I cannot provide financial advice, and my analysis should not be considered a recommendation to buy, sell, or hold any security. The following is a comprehensive analysis based on publicly available information to address the factors you’ve raised regarding Global Payments (GPN).

You have correctly identified a significant disconnect: GPN appears fundamentally undervalued on paper, yet its stock has performed poorly for years. This isn’t an isolated observation; it’s a central theme in the market’s current view of the company.

Here is a comprehensive analysis of the competitive landscape, “lost chances,” and strategic headwinds that are likely contributing to this negative performance, despite its positive FCF, EPS, and DCF-based valuations.

The Shadow of Competition: “Being Eaten” by

The Shadow of Competition: “Being Eaten” by

Newer and more focused players are attacking GPN’s core business from all sides. GPN is often seen as a “legacy” processor, and the market is rewarding more agile, software-first companies.

-

Block (formerly Square): You are right to single out Square. Block’s success is a primary source of GPN’s “lost chance.”

- The “Software-First” Ecosystem: Square didn’t just sell a payment dongle; it built an entire, easy-to-use business management ecosystem (Point-of-Sale, inventory, payroll, banking, loans) for small and medium-sized businesses (SMBs). This makes its solution incredibly “sticky.”

- Vertical Integration: Block captures value across the entire stack, from the merchant (Square) to the consumer (Cash App). This creates a powerful network effect that GPN lacks.

- Brand and Usability: Block is perceived as a technology company, while GPN is perceived as a financial services provider. This matters immensely in attracting new, modern-feeling businesses.

-

Other FinTech & Software Competitors:

- Stripe & Adyen: These companies dominate the online, developer-first, and enterprise e-commerce space. They are built for the internet economy, making them the default choice for startups and large-scale digital businesses.

- ISVs (Independent Software Vendors): Companies like Toast (restaurants) and Shopify (e-commerce) have built all-in-one platforms for specific industries. They bundle payments directly into their software, effectively cutting out traditional processors like GPN. This trend of “embedded payments” is a massive threat, turning payments into a feature, not a standalone service.

-

Legacy Competitors: GPN also faces intense pressure from its direct legacy rivals, Fiserv (FISV) and Fidelity National Information Services (FIS). This is a “three-way” fight for large enterprise clients and bank-processing contracts, which is a slow-growth, high-stakes game.

“Lost Chances” & Strategic Missteps

“Lost Chances” & Strategic Missteps

The market’s skepticism is heavily rooted in GPN’s own strategic decisions and its perceived inability to innovate at the pace of its competitors.

-

A “Roll-Up” Strategy in a Tech-First World: For years, GPN’s primary growth driver has been large-scale M&A (e.g., the 2019 merger with TSYS). The market views this as an “old world” financial engineering strategy.

- Integration Risk: Each massive acquisition brings significant integration risk, complex technology systems that must be merged, and potential culture clashes.

- Focus on Synergies, Not Innovation: This strategy often prioritizes cost-cutting and “synergies” over organic innovation and building next-generation products.

-

The Worldpay Deal Uncertainty: The announced acquisition of Worldpay (expected to close in Q1 2026) is the single biggest factor hanging over the stock.

- Strategic Confusion: To fund this massive deal, GPN is simultaneously selling off its Issuer Solutions segment. This has created confusion about the company’s long-term vision. Is it a pure-play merchant acquirer? Or is it just churning assets?

- Massive Execution Risk: This is another enormous integration, and investors are wary of GPN’s ability to pull it off smoothly while fending off the agile competitors mentioned above.

-

Inconsistent Performance & Rising Costs: The company has suffered from a few key earnings misses, such as in Q4 2024 (reported for fiscal 2025) and Q3 2024. These were not just slight misses; they were attributed to rising costs in tech and compliance and slower-than-expected cross-border payment volumes. This directly spooks investors who are looking for growth and margin expansion.

Synthesizing the “Why”

Synthesizing the “Why”

This brings us back to your original question: Why is a company with good FCF, growing EPS, and a low DCF valuation performing so badly?

The answer is investor confidence and future growth perception.

The market is not valuing GPN on its past or even its current earnings. It is valuing it on its future earnings, and it has very little confidence in GPN’s ability to grow.

- The "Melting Ice Cube" Perception: The market sees GPN as a "value trap." It's cheap for a reason. Its core business of merchant acquiring is being commoditized by software-led companies (Block, Toast, Stripe).

- Low Growth Forecasts: Analysts' models reflect this. GPN's forecasted annual revenue growth is in the low-to-mid single digits (around 4-6%). In contrast, competitors like Block and Evertec are forecasted to grow significantly faster. In the tech-driven payments sector, 4% growth is seen as stagnation.

- Debt and M&A Hangover: The company's strategy of funding large acquisitions has loaded its balance sheet with debt and created massive uncertainty. Investors would rather own a "cleaner" story with organic growth, even at a higher valuation.

In conclusion, you have a classic “value vs. growth” dilemma. The DCF models see value based on current cash flows. The market, however, sees a lack of growth and a high degree of risk from agile competitors and GPN’s own complex M&A strategy. The stock price reflects the market’s vote that the future risks outweigh the current value.

AI See this article from today’s NZZ describing Meta’s AI chief’s view on AI: Yann LeCun verlässt Meta: KI-Pionier geht eigene Wege (paywalled).

English summary and full translation by Gemini Pro:

Short Summary

AI pioneer Yann LeCun is reportedly leaving Meta to launch his own startup, driven by a rift with Mark Zuckerberg over AI strategy. LeCun, a long-time skeptic of the hype around models like ChatGPT, argues that current AI lacks true intelligence, planning, and real-world understanding. As Meta, under pressure from competitors, pivoted to chase “superintelligence” with expensive new hires, LeCun and his foundational research team (Fair) were increasingly sidelined. This new direction, combined with LeCun’s outspoken, research-first nature clashing with Meta’s polished corporate culture, has led him to depart. He now plans to independently pursue his own vision for AI, leaving Meta with a high-priced new team but an unclear strategy.

Full article translation

A skeptic among show-offs: AI pioneer Yann LeCun wants to leave Meta

Yann LeCun is one of the most famous AI researchers. Now he is breaking with Mark Zuckerberg – partly because he doesn’t share the hype around Chat-GPT. He now wants to pursue his ideas with his own startup. Ruth Fulterer 11/13/2025, 5:30 AM

A pioneer who no longer has to prove anything to anyone: Yann LeCun. Victor Llorente / NYT / Laif

Among artificial intelligence (AI) researchers, Yann LeCun belongs to the old guard. When he became enthusiastic about the topic in the eighties, there were no startup CEOs acting like demigods, and young talents weren’t yet being paid million-dollar salaries. AI was an obscure niche, something for real nerds – for people like LeCun.

LeCun grew up in a Parisian suburb and studied computer science at what is now Sorbonne University. In his doctorate, he focused on learning methods for neural networks. At the time, only a few scientists worldwide were pursuing this topic. One of them led a research group in Canada. A professor supposedly warned his students about the group, claiming it ended the careers of young talents. It was the group of the scientist Geoffrey Hinton.

LeCun didn’t care about such advice. In 1987, he moved to join Hinton. More than thirty years later, in 2018, the two of them and another of Hinton’s students, Yoshua Bengio, received the highest prize in computer science for their achievements: the Turing Award. Hinton received the Nobel Prize last year.

So, one can say that LeCun has done quite well by not caring about what other people think. His latest career move fits this pattern: According to a report in the “Financial Times,” he intends to give up his position as head of Meta’s AI research team Fair and found his own startup.

LeCun never really fit in at Meta

LeCun co-founded Fair in 2013 and turned it into a leading center for AI science. But the differences between his ideas about artificial intelligence and those of CEO Mark Zuckerberg have likely become too great recently.

LeCun never really fit in with the Meta corporation. Its representatives, from Mark Zuckerberg down to regional managers, come across as incredibly slick and polished. They smile away questions and smother criticism with declarations of how hard they are trying to make the world friendlier and better.

Yann LeCun, on the other hand, is a down-to-earth researcher who likes to speak his mind frankly. He never directly criticized his employer in public appearances. But he never spouted PR phrases either. He preferred to say with a telling grin that he couldn’t comment.

[Embedded Tweet]

Meta’s Chief AI Scientist Yann LeCun offers a critical take on the humanoid robot boom.

Speaking at MIT, LeCun claimed the “big secret” of the industry is that current companies “have no idea” how to make their robots “smart enough to be generally useful.”

He argues that while… pic.twitter.com/81EwuXj2Nn

— Humanoids daily (@humanoidsdaily) October 24, 2025

First and foremost, LeCun sees himself as a scientist. As such, he never made a secret of the fact that he is not convinced by the type of AI behind Chat-GPT. “These models are useful, no question. But they are not truly intelligent,” he said, for example, during a lecture in Davos in 2024.

House cats are smarter than artificial intelligence

LeCun repeatedly emphasizes that any house cat is smarter than today’s AI. Because a cat has an understanding of its environment. It knows how a ball moves, what one can do with it, knows its owners, and knows where the way outside is. Today’s AI lacks such a model of the world. This explains why chatbots contradict themselves and hallucinate false facts.

When Chat-GPT was new, many researchers saw it as the key to artificial general intelligence (AGI), meaning an AI that can think and solve problems as flexibly as a human. Researchers at Open AI and Microsoft, in particular, propagated this idea.

Yann LeCun was always convinced of the opposite. In his view, language AI lacks not only world understanding but also the ability to remember and plan. One could try to make language models better and safer. But that won’t solve their problems. It would be more sensible to rethink AI completely and build in world understanding, memory, and planning capabilities from the start.

Research on world understanding is also said to be the area LeCun now wants to pursue outside of Meta. Among other things, he wants to use video data to teach AI systems the laws of physics. LeCun had already researched this method within Meta.

LeCun’s team did foundational work in AI

For LeCun, research was always the priority. Alongside his work for Meta, he is a professor at New York University. His team at Meta was known for publishing a great deal publicly. For example, the AI models called Llama, which Meta provides for free download.

Over the years, LeCun’s team also made important contributions to basic research that made today’s language AI possible in the first place. Meta also developed and published Pytorch, an important open-source computer program for machine learning. A few days ago, it was announced that the main person responsible for Pytorch is also leaving Meta.

For a long time, the deal between Meta and LeCun’s team worked: The freedom attracted capable researchers, and Meta could use their inventions for its products. Long before Chat-GPT, there was a lot of AI in Facebook and Instagram: for example, to recognize faces, translate comments, or filter out problematic content.

The hype around Chat-GPT put Meta under pressure

Chat-GPT and the hype around it, however, put Zuckerberg under pressure. The flop of the metaverse had barely been digested when the new AI from Open AI made the established tech corporations look old. In the attempt to catch up, Meta increasingly sidelined LeCun.

In the summer, the corporation bought the startup Scale for 15 billion dollars. CEO Mark Zuckerberg lured AI talents with entry bonuses of 100 million dollars to a new team and declared “superintelligence” as the new goal: that is, artificial general intelligence, only better.

The scientists poached from Open AI and Google were supposed to bring knowledge about language AI into the corporation, which Meta lacked, perhaps also because of LeCun’s skepticism towards this technology. Although LeCun could continue to pursue his projects freely, he was subordinate to the new, young AI researchers.

A few weeks ago, it was also announced that AI positions in the “old” team would be cut, while the new team would be further expanded. And already at the beginning of October, the magazine “The KNOWLEDGE” reported on bad morale after new controls were imposed on LeCun’s research group. The scientists would have to have their work reviewed more strictly internally before publication. LeCun supposedly mused to colleagues about whether the time had come to leave.

Zuckerberg wants to be in on AI, but good ideas are lacking

What exactly Meta’s AI product wants to be remains unclear. In May, Mark Zuckerberg painted a picture in a podcast of a future in which the loneliness epidemic is “solved”: Instead of only 3 friends, Americans could in the future reach the necessary average of 15 friends – thanks to AI friends on his corporation’s platforms.

Mark Zuckerberg explains his “solution” for the loneliness epidemic.

The small colorful ring on Whatsapp, which invites you to talk to the Meta-AI, is currently delivering worse results than Chat-GPT. The AI model behind it, Llama 4, also disappointed the research community. In addition, media reported on inadequate safety barriers in Meta’s chatbot: It engaged in erotic conversations with children. Meanwhile, Open AI has launched Sora, a social network for AI videos: a direct attack on Zuckerberg’s empire.

High expectations rest on the new AI team that Meta has assembled so expensively. At the same time, a strategy is lacking. The name of the new team says it all: TBD Lab. That stands for “to be defined.”

LeCun was certainly the wrong person to make products out of language AI. It makes sense that he would rather work independently on the technology that is supposed to one day replace today’s AI. At Meta, his clarity will be missed.

I thought I was a GPN bag holder, but I must have sold it at some point.

I think niche vertical players like Toast have a better business.