TL;DR: Looks interesting.

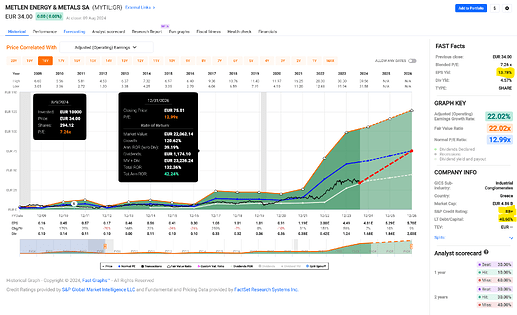

I trimmed the FASTgraph to the period starting in/after the Great Financial Crisis.

Things I like:

- earnings yield* is currently almost a whopping 14%!

- nice and growing dividend, and – equally important – their payout ratio** was at a healthy 27% last year and is expected to be at a still healthy 35% for this financial year

- not that many analysts covering the stock, but the expected earnings (estimated by the analysts) have been going up compared to analyst earnings predictions 3 or 6 months ago*** — and perhaps most importantly for this particular argument: earnings are much easier to forecast than price targets

- if the stock returned to its normal* P/E multiple of 13, you could expect a 130% total rate of return by the end of 2026 … not too shabby, even for me

Things I don’t like:

- the below-investment-grade credit rating (S&P: BB+)

- I guess the market, or rather, your description of the market and your experience …?

- 40% long term debt outstanding – doesn’t need to be a death spell, but I’d prefer lower debt. I would check this out further, see one of the items below

Things I would do next if I were considering to invest in this company:

- look at their equivalent of a 10K (SEC filing if they were listed in the US)

- in particular look at their debt maturity schedule, i.e. when their next tranches of debt expire, what interest they paid on their expiring debt, and what interest they’ll likely have to pay on renewing that debt if they can’t pay it down

Summary:

After this amount of research I’d rate this as a speculative buy.

If this encourages anyone to start a position – as one of my unsung investment heroes, Harley Bassman – phrases it: “Sizing is more important than entry level”.

Manage your risk.

I for one have added this company to my “eternal” watchlist. ![]()

* Earnings yield: if you bought the entire company for its current price, you would make (an expected) 14% in profits on the money paid.

** Payout ratio: percentage of earnings paid out as dividends.

***

*** Normal multiple: the P/E multiple the market has historically given this company, averaged over the chosen period of time, here: since Dec 31 2008.