So at the beginning of the year, my portfolio is approximately per the table below. In 2024, I sold down the portfolio to fund my pension and also trimmed all positions so that none were >10% of the portfolio.

One result of the change is that the main part of my liquid bond portfolio has been sold off and put into the pension and all that remains are relatively illiquid single company bonds which will be held to maturity (represented by the symbol JNK) and a bit of BIL, BOXX.

I’d like to increase the liquid cash equivalent part of my portfolio (BIL) to >5% and also keep stock component in total >50%. I’d also like to reduce the portfolio volatility and exposure to low income consumers (e.g. eliminate DG position).

I’d like to consult the wisdom of the crowd and happy to receive your comments, criticisms and suggestions.

| Symbol | Proportion of portfolio % |

|---|---|

| BTI | 9.8 |

| JNK | 8.8 |

| AMLP | 3.5 |

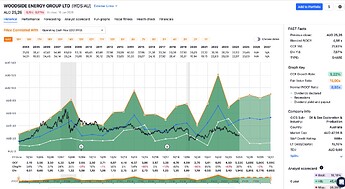

| WDS.AX | 3.0 |

| AWE.L | 2.9 |

| VICI | 2.9 |

| CAOS | 2.9 |

| U-UN.TO | 2.9 |

| GLD | 2.7 |

| URNM | 2.3 |

| VDY.TO | 1.9 |

| ADM | 1.7 |

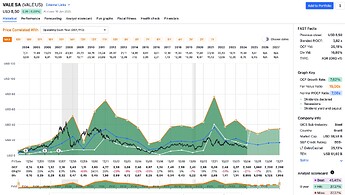

| VALE | 1.7 |

| CCJ | 1.7 |

| O | 1.6 |

| VWO | 1.3 |

| BOXX | 1.3 |

| LNC | 1.3 |

| IAK | 1.2 |

| CMCSA | 1.2 |

| IMB.L | 1.2 |

| CRH | 1.2 |

| CALM | 1.2 |

| NNN | 1.1 |

| PRU | 1.1 |

| GDX | 1.1 |

| PFE | 1.0 |

| UGI | 1.0 |

| COWZ | 1.0 |

| BN | 0.9 |

| PBR | 0.9 |

| DG | 0.9 |

| MO | 0.9 |

| 2914.T | 0.9 |

| VZ | 0.8 |

| RIO | 0.8 |

| UEC | 0.7 |

| RTX | 0.7 |

| ADC | 0.7 |

| PGR | 0.7 |

| NOVN.SW | 0.7 |

| LHX | 0.7 |

| ZD | 0.7 |

| VPL | 0.7 |

| FMC | 0.6 |

| PDN.AX | 0.6 |

| BIPC | 0.6 |

| OVV | 0.6 |

| VRSN | 0.5 |

| WHR | 0.5 |

| NEM | 0.5 |

| PM | 0.5 |

| CGT.L | 0.5 |

| MDT | 0.5 |

| LNG | 0.5 |

| NG.L | 0.5 |

| WHC.AX | 0.5 |

| XOM | 0.5 |

| GPN | 0.5 |

| AEM | 0.4 |

| PCG | 0.4 |

| BLN.TO | 0.4 |

| MOS | 0.4 |

| JD | 0.4 |

| NTR | 0.4 |

| ELV | 0.4 |

| KAP.IL | 0.4 |

| CB | 0.4 |

| FR | 0.4 |

| GUNR | 0.4 |

| ED | 0.4 |

| GDDY | 0.4 |

| ES | 0.4 |

| ATKR | 0.3 |

| WPC | 0.3 |

| YCA.L | 0.3 |

| GOLD | 0.3 |

| GEV | 0.3 |

| SBSW | 0.3 |

| RUI.PA | 0.3 |

| SLX.AX | 0.2 |

| SO | 0.2 |

| NCSM | 0.2 |

| BHP | 0.2 |

| SPPP | 0.2 |

| BIL | 0.2 |

| BYNN.F | 0.1 |