“rare” is how Revolut defines Thai Baht, together with Ukrainian currency.

It is still cheaper comparing to most credit cards.

I confirm that there are no additional fees with a Swiss bank transfer of revolut in CHF. The only thing is that the first time the procedure was very slow 2-3 days; maybe the next one will be faster

A similar experience for me. I transferred 100 CHF as a test transfer. It took 3 days to appear in Revolut.

Next day transfer for me (not the 1st time).

Have you also done it for the 1st time as AJ?

Maybe it depends from the bank. PF I think asks for money for fast transfers. (correct me if I’m wrong, I’ve never used that feature)

Yep, 1st time transfer.

My first CHF bank transfer came next day. I have never transfered CHF before, have always used credit card top up. But I am doing many Eur transfers to and from the same account (Yuh) and in general there is quite a lot of activity in my Revolut account.

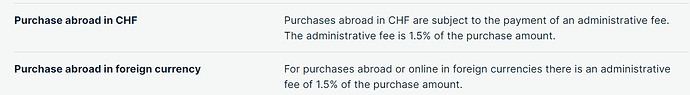

Well… this is not the case anymore for Coop supercard My last transaction withouth fee was on the 23.10.22. After that I got the 1.5% fee withouth any notification from them… ![]()

Was the fee from Revolut or SuperCard? If it’s from SuperCard, there is basically no use for that card for me anymore.

It seems that all Swiss users of Revolut have received an email about the change of fees. Are you registered with a Swiss address? Maybe that message went to spam?

Well, Revolut is taking the 1.5% out of my Coop Super card.

Keep in mind Coop super card states:

According to Money Land info

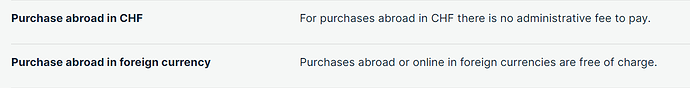

Migros in the other hand states 0%:

as per Money Land as well.

I have just ordered my Migros card to test it.

Can anyone with a Migros card can confirm that the Revolut Top-up cause not extra 1.5% fee?

cheers!

I know that, it also says that at many other credit cards, but so far they haven’t enforced it. I wonder what changed.

Anyway, I have removed my Supercard as a top up possibility from Revolut.

Are you taking about a fee taken by the card issuer or by Revolut?

As it was communicated 3 weeks ago.

Until few days ago Revolut top up with Google wallet didn’t work for me. Then it was working, I was able to add CHF to Revolut from a credit card added to Google wallet. I have added a small amount, the transaction is now booked in the credit card’s list of transaction. No fees in sight. So, what was all that fuss from Revolut about fees about?

I’ve heard that only the first transaction is fee free (might be a technical reason).

I did try yesterday and had the same issue. Did anyone succeed with Apple Pay ?

I did another top up. 15 CHF debited from the credit card, 15 CHF credited to the debit card.

I was trying to exchange CHF to EUR and I see 0.25% markup between buy/sell price and the mid price. Free account.

What is happening? I think FX markets are open.

Could it be that the spread was there all the time and I haven’t noticed it?

Today afternoon the markup went down to 0.08% approximately. Not free, but not bad as well. Probably Revolut also adjusts their markup according to the market liquidity etc. beyond what is clearly documented. I have not thought about checking their spread, now I will.