Non serious answer: r/wsb ?

Hi Julianek, did you look into whether these guys have good products we can invest in as small, retail investors? I struggled to find information

Did you know we can now buy Fundsmith in Interactive Brokers?

Except for Smith, most of them run a close fund, which is usually closed to external investors.Akre maybe has a mutual fund for retail investors here although i did not check if it is available on IB.

Yes I know ![]()

I reached a similar conclusion. I found an Akre mutual fund with an impressive track record but which seems to only be available to US based investors.

I really appreciate your inputs in this thread. I have Fundsmith as my core investment but am always exploring improvements and different approaches

This forum is very interesting; may I ask if, a part from ETF investors, there is any “value investor” here applying Graham and Dodd’s principles when selecting stocks?

If yes I’d like to exchange some best practice and opinions.

There are certainly potential “value stock investors” hiding here. My impression is that the shelves for such stocks (assuming you apply Graham’s criteria) are depleted… But perhaps someone did spot such stocks?

Hi. As food for thought it might be interesting to look at quality vs. value and the Fundsmith annual letters to shareholders or the Fundsmith thread in this forum. Warren Buffet started out with a value strategy then moved onto quality.

"As Charlie Munger, Warren Buffett’s business partner, said:

‘Over the long term, it’s hard for a stock to earn a much better return

than the business which underlies it earns. If the business earns

six percent on capital over forty years and you hold it for that forty

years, you’re not going to make much different than a six percent

return — even if you originally buy it at a huge discount.

Conversely, if a business earns eighteen percent on capital over

twenty or thirty years, even if you pay an expensive looking price,

you’ll end up with one hell of a result.’ Our emphasis added.

Mr Munger is not offering a theory or an opinion — what he is saying

is a mathematical certainty. The only uncertainty concerns our ability

to forecast returns far ahead, which is why we prefer to invest in

relatively predictable businesses. "

Hi, you are right, finding value stocks is not easy but the research (and analysis) is worth doing. The final result can give you a lot of (financial) satisfaction with a good security margin. Yes I apply Graham’s criteria, with a certain flexibility which I think is needed in today’s market.

This said, I think we have to consider both, quality and value, when selecting a stock especially if we are investing our own savings knowing that we do that for the long term. Prudence is a must!

So I invite all value investors to join this debate and exchange experiences…

What exactly does “quality” mean for you?

Profitability, something else?

IMO it is very vaguely and differently defined by different people (and funds), so I am curious.

For starters, one could apply the MSCI definition and method of calculation.

I mean… companies that are being relatively profitable, having relatively low debt and a not to volatile business - how else would you filter your choice of investments?

Certainly sounds more sensible than blindly investing in everything that is exchange-listed anywhere. Or based on the CEO that has the coolest name and cutest memes on Twitter.

What do you mean by “value”?

- Value as an analytical style, i.e buying something for less than it is worth? (and, in my opinion, is what any sensible investment should look like?)

- Value as a statistical factor (Fama/French), where you buy a basket of stocks scoring low on certain measures such as Price-to-Book or Price-to-Earnings?

I am asking because there is no necessary correlation between both. A P/E of 8 is still too much for a company with low return on capital, high capital expenditure needs, no barrier to entry, unionized labor, etc (think airlines before 2010 before we had some consolidation). On the other hand, paying a P/E of 25 or above can still be a bargain if you deal with an long term compounder (someone who would have bought L’Oreal at a P/E of 80 in the 1970s would still have beaten the S&P500 by a wide margin over the next 50 years).

Similarly, what do you mean by “Graham’s criteria”?

- Ben Graham’s Net-net strategy? (those stocks are very rare lately)

- Ben Graham’s Formula for evaluating stocks? Take care that he revised the constants in his formula for each new edition of Security Analysis to adapt it to the market conditions of the time. As he died in 1976, I’d like to know how his formula would have evolved today.

- Or more generally, his qualitative principles for investing, such as “a stock is a shared ownership in a business”, the concept of Mr Market, and the Margin of Safety? (with which I fully agree)

Going forward I will define quality as “a business with high return on invested capital, with a long runway for reinvestment of profits at an attractive return on incremental capital, and honest management with an owner mindset and skilled at capital allocation.”

So, coming back to what I said at the beginning, if you consider value as a statistical factor, I have absolutely nothing to say about it, as both are likely to be completely independent. There are many people buying value ETFs (as a statistical factor) on this forum with variable degrees of results.

If on the other hand you define value as buying something for less than it is worth, then quality can vary from absolutely irrelevant to the incredibly important. It is pretty obvious that a business compounding value per share at a high rate on a long time horizon is worth a lot. So it all depends of your time horizon and your holding period:

- Within 1 year, price is the most important factor and quality matters very little. If you bought a bad business but still got a bargain, good for you. But then you need the market to react quickly (i.e, have a catalyst event to realize the true value of your investment), otherwise time runs against you. Another drawback is that because you renew your portfolio often, you need to have good ideas often as well.

- In the very long term, all your returns are driven by the return on invested capital. As long as you did not pay an absolutely extravagant price for your holding, if your business has high rates of return on a long term horizon you will still have a hell of a result. You can pay 40 times earnings for a stock compounding 20% over 30 years, and it will still be a bargain.

- For holding periods between 3 to 5 years, price and quality matter equally, and, as you would expect, the longer the holding period, the more quality matters.

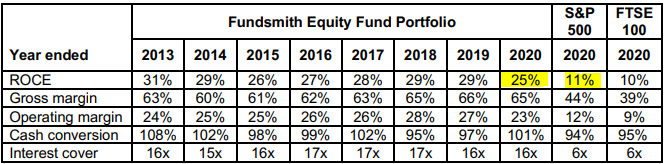

For me it is clearly the definition used by Fundsmith. See link to FS annual letter to shareholders above. The main criteria used is Return on Capital Employed. As you can see margins are also superior as well as debt coverage. They also try to assess the defensive “moat” of each company

In a recent interview Terry Smith (FS fund manager) acknowledged their approach is not secret and is the same one used succesfully by Warren Buffett since 1980. When asked why the rest of the market doesn’t follow it, he shared an observation that analysts are fixated on EPS growth and hardly ever talk about ROCE.

Personally I mistrust factor ETFs - although MSCI quality has still beaten MSCI WRLD. I imagine that filtering blindly on a set of formula’s could capture the odd sub optimal investment by bad luck. I have been more than happy to pay for FS active management until now, long may it continue

Hi, thank you for your answer. I totally agree with you; value and quality mean for me a good business (no necessarily a large capitalization…), with good returns on invested capital (or on net assets), good and stable results, good liquidity ratio, low debt, stable or growing dividends, no expensive stock-option plan for the management and with decent perspectives.

This are some of the characteristics I look at when selecting a stock.

It is important that the financial statements are clear and that everyone with minimum knowledge and some reasonable effort can understand them (I am not an expert in accounting but I am keen to know how the management use my money…).

You learn a lot when you study the financial statements of a company…sometimes you learn very useful things and sometimes very odd ones…

I usually analyse the company over the last 10 years (Graham was used to do it over the last 20 years!) and try to understand if figures are coherent over the time. I try to estimate the intrinsic value of a business and buy it if it sells at a sensitive price which has to be (in principle but not necessarely) lower or not too much higher than the intrinsic value. My investment horizon is 3-5 year or longer.

So, value for me is more an analytical but reasonable approach than a statistical factor.

Just a word on Security Analysis; I read this book and check it every time I need (…it means very often…). I think that those interested in the real value and in protecting their money will find it very useful.

Dears Investors,

is there anyone interested in meeting up (eventually in Lausanne region or elsewhere) to share our experiences about investments?

Hope to hear from you…

Hey there! Why not? It would be interesting, and maybe useful (or just a beer, which still is interesting :D)

I’m in Lausanne, btw, so easy peasy for the logistics…hope to have more Waadtlanders join the group

Feel free to update this thread ![]() We can sure organise a new meet-up for Romand people before Christmas.

We can sure organise a new meet-up for Romand people before Christmas.

Doodle to pick up a date?

New meetup in Lausanne or Geneva? - Meetups - Mustachian Post Community

We are organizing the next meeting, feel free to participate