Does anyone have an idea which free API provides the actual price of any of l these Credit Suisse funds which Finpension offers?

I actually use Yahoo Finance for that which has a nice and simple API which I can use to easily gather a lot of information about an instrument but unfortunately Yahoo Finance does not have any of the Credit Suisse funds which Finpension offers.

Sorry if this has already been asked somewhere else, I remember seeing something similar, but searching for the words “API” has been proven to be quite a pain.

Portfolio software fetches prices from Credit Suisse website.

An http request should be enough as explained in source code comments here

This class provides a feed for Credit Suisse Quotes. Probably all quotes provided by Credit Suisse can be downloaded but it is only tested with Credit Suisse institutional funds which are normally not offered to the general public except in special scenarios like via the Swiss third pillar provider VIAC (third pillar = “Säule 3a”, a tax-exempt retirement saving scheme). The challenge of downloading these quotes are: 1) there is a HTML page where the user has to state his/her country of residence plus investor status (private, professional). This page can be avoided by using “curl” as user agent. - there are header titles that are specific to Credit Suisse and 2) Credit Suisse returns the quotes with Excel mime-type which are in fact HTML tables but would be converted upon opening Excel. This is a little bit of a hack on CS’ part.

For testing ==>

https://amfunds.credit-suisse.com/ch/de/institutional/fund/history/CH0209106761?currency=USD

What is the advantage of owning these three compared to just owning VT/VWRL?

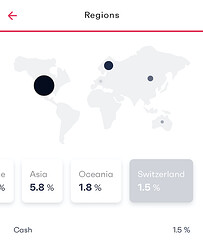

I want different regional weights.

And you could also readjust with 3rd pillar if you have different strategies within (e.g. Global defaults have too much CH).

It also has a minor impact on total TER, but doesn’t play a significant role for me.

On which day of the month have you set up your standing orders?

If I set up a standing order at UBS to be executed on the last day of the month (it executes earlier if the last day is weekend/holiday), will this be enough time for money to arrive at Finpension so that it can be invested on the first banking day of the month as they say? Or should I leave a bit more space and make a standing order on the 27th of the month for example? Hopefully I will always receive the salary by the 27th. What is your experience with standing orders?

I always receive my salary on 25th (or earlier when it’s on the weekend) so I set the date on the 25th too. Finpension only sends me an email one day later though. So, setting up on the very last day of the month might be tight. I believe if you set up yours on 28th it should be enough (except for February maybe).

Finpension now offers a referral scheme.

For each recommendation you will receive a fee credit of: CHF 25

You will benefit from every registration with finpension 3a Retirement Savings Foundation with your code if at least CHF 1’000 is paid in or transferred within the first 12 months.

People who accept your recommendation, register and pay in or transfer at least CHF 1’000 will be entered into a draw to win a maximum amount of currently CHF 6’883. The raffle will be held every 1’000 code registrations.

The main advantage of tax-sheltered investment accounts (in Switzerland - 3a) is the tax advantage. It means that not only you are not paying income and wealth taxes on investment held in 3a account, but also that you are allowed to invest in funds which do not pay withholding taxes on dividends, because they are dedicated for pension funds.

Now enter “CSIF (CH) III Equity World ex CH Blue - Pension Fund Plus ZB” (CH0429081620) available to individual investors via a finpension account.

According to the information distributed by finpension in May, this fund does not pay withholding taxes on dividends distributed by USA and Japanese companies, which made up 75% of the fund holdings. I guess there are also tax advantages for securities from other countries. “Class ZB” means that no management fees being deducted, only running costs are charged. Please ignore “Class ZBH”, these are currency-hedged. In fact, it is the only “World ex CH” fund (at finpension) that has a specific remark “This Fund is solely available for Swiss Pension Funds” and is tracking a total return version of an index (in this case “MSCI World ex Switzerland”). And doing it quite well.

Therefore, I am switching to this fund only on finpension. Regions and factor over/underperformance may come and go, but fee and tax advantages will stay.

Having said that, there is also “CSIF (CH) III Equity World ex CH ESG Blue - Pension Fund Plus ZB” (CH0337393745), which does not have that specific remark and uses a net return index as a benchmark, but the fund suspiciously consistently overperforms its benchmark. So there are probably also reduced withholding taxes on dividends.

There are also “CSIF (CH) III Equity US Blue - Pension Fund ZB” (CH0030849712) and “CSIF (CH) I Equity Japan Blue - Pension Fund” (CH0357515474), which seem to have the same level of tax advantage.

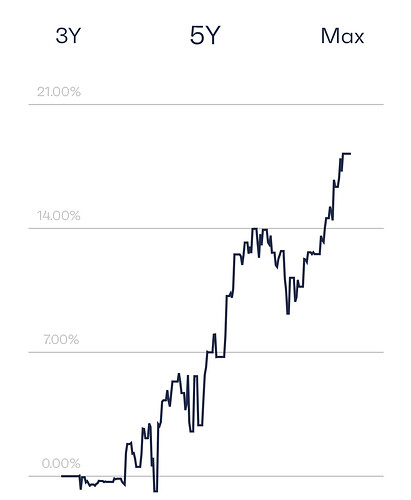

Nice performance guys

Damn I shouldn’t have gone for that EM and gold tilt in my finpension portfolio… I am at 8% YTD.

Very interesting, thank you! I am thinking about switching to Finpension from VIAC’s Global 100 (YTD performance: approx. 16%), and “CSIF (CH) III Equity World ex CH Blue - Pension Fund Plus ZB” (CH0429081620) potetially has everything I need. Can I go for 100% (or nearly 100%) of CH0429081620 only with Finpension or are there no custom strategies or limitations due to 3a regulation? VIAC also has CS institutional index funds (different selection) but unlike Finpension, they do not state that “these funds can reclaim a large part of the withholding taxes on foreign dividends and interest”.

I am thinking about changing/adjusting also because the main bulk of my investments consists of individual CH stocks (that I want to eventually complement with VWRL or VT) - and VIAC’s Global 100 has a heavy CH regional weight (same with Finpension’s Equity 100). If an individual strategy with non-CH focus is not possible, it is probably not worth leaving VIAC, or am I missing something?

It is.

On the hand, while you could go 99% all-in on Switzerland Small & Mid Cap (CH0110869143), they limit your exposure to Switzerland Large Cap Blue (CH0033782431) to a 50% maximum. I assume this is to prevent the shares of the big three (Nestlé, Roche, Novartis) individual stocks to exceed 10% of your overall portfolio (as they would otherwise).

Thanks! And if I want to go all-in (or close to that) on CSIF (CH) III Equity World ex CH Blue - Pension Fund Plus ZB” (CH0429081620), avoiding Switzerland?

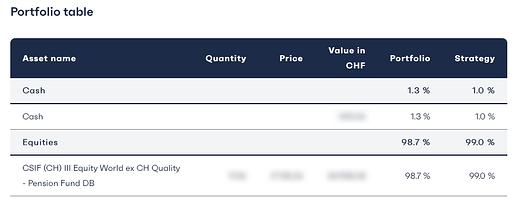

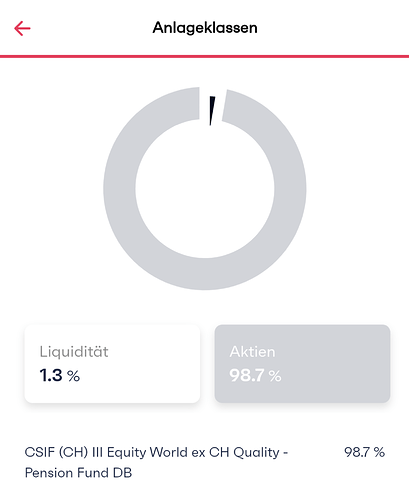

That’s actually how this pillar is setup:

Sorry for an ignorant question from me please: whats the difference between Pension Fund Plus and the previous Pension Fund ZB (CH10130458182)? The later was it seems replaced by the former. When this happens, if I was 100% invested on this fund, is the transition transparent or is there a communication on it specifically?

It happened automatically. I got a pop up message at some point when I logged in on the finpension website.

The essential difference from the old ones is no withholding tax on Japanese dividends.

Dear Mr Musk,

We are increasing the trading frequency. From 2 August 2021, we will trade weekly (always on the first day of the week). This means that your deposits or transfers to the finpension 3a Retirement Savings Foundation will be invested even faster.

Another change concerns risk profiling. In future, your risk capacity may no longer be lower than the investment risk of the selected strategy. You will be made aware of this in the application if you need to review your risk profile.

Finally, we have noticed that our foundation was sometimes used as a pass-through account in order to benefit solely from the low withholding tax of the Canton of Schwyz. For such new clients domiciled abroad who withdraw the transferred money within one year, the processing fee will therefore be increased.

The updated regulations can be found at the bottom of this page: Structure – finpension

Kind regards,

Your finpension team